Thoughts On Market Crashes

Scott Grannis, the Calafia Beach Pundit, weighs in with advice on how investors should react to a significant market down-draft. [more]

Scott Grannis, the Calafia Beach Pundit, weighs in with advice on how investors should react to a significant market down-draft. [more]

The Energy Sector fared a little better over the last two weeks. However, our Model Oil Portfolio dropped 0.9% and is now down 5.7% since inception on June 2, 2019 while, for 2020, it is off 14.6%. Many of the benchmarks we use are also struggling. The fear is that the coronavirus could spread globally and instigate a significant slow-down in a variety of economic areas. [more]

The specter of a coronavirus epidemic gripped the markets in the last few days with a broad sell-off occurring across almost all indexes. We are on the cusp of this health threat, and we could know soon whether it will proliferate or be contained. [more]

With a lessening of tensions in the Middle East, the Energy Sector retrenched last week. Although the price of crude oil rebounded in the latter part of the week, it was still down 0.9% and dragged many oil stocks down with it. [more]

We close out the year on a high note. Our Model Oil Portfolio stands at an all-time high. We hope to continue this positive performance in 2020. [more]

The outlook for the energy sector has improved during December with positive catalysts including the OPEC+ cartel agreeing to cut production in Q1/2020, the successful IPO of Saudi Aramco, and crude oil price gains. [more]

Shares of Saudi Arabian Oil Company (“ARAMCO”) started trading on the Riyadh stock exchange this week and rose in price with the market cap hitting US$2 trillion. [more]

The outlook for the energy sector, and particularly for the oil component, was given a boost on Friday as the OPEC+ cartel agreed to cut oil production in Q1/2020. Our Portfolio continues to perform relatively well but is still struggling to gain much traction in positive territory. [more]

October was not a kind month to the Energy sector, perhaps highlighted by the surprising, if not shocking, abandonment of Canada by Encana Corp. [more]

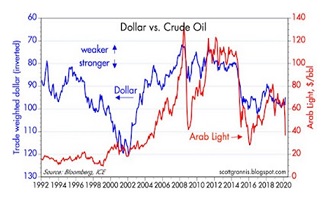

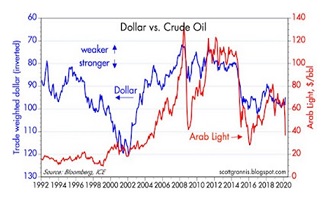

eResearch is pleased to provide the latest McClellan Chart-In-Focus report from McClellan Financial Publications. McClellan shows an uncanny relationship between the movement in the price of crude oil and the corresponding movement in the value of the DJIA, but with a twist. [more]

Copyright © 2026 | MH Magazine WordPress Theme by MH Themes