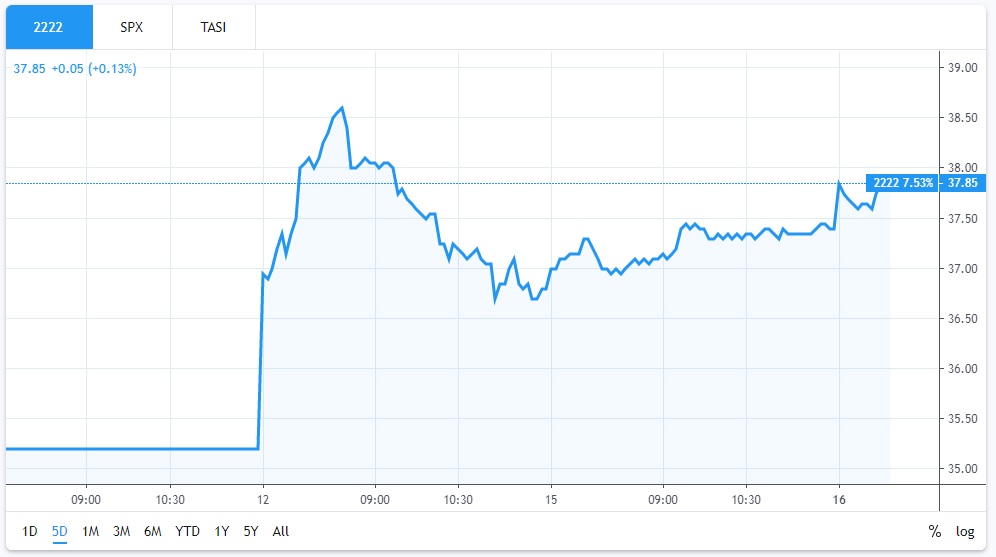

eResearch | Shares of Saudi Arabian Oil Company (“ARAMCO”) started trading on the Riyadh stock exchange this week and rose in price to SAR37.40, with the market cap hitting US$2 trillion.

The Company decided to list the stock only on the Tadawul exchange in Saudi Arabia, forgoing any of the Western exchanges.

ARAMCO sold only 1.6% of the equity in the company, mostly to Saudi nationals or Saudi-based institutional investors.

According to S&P Capital IQ, there are three analysts covering the Company with a mean price target of SAR30.23 and a median price target of SAR26.00

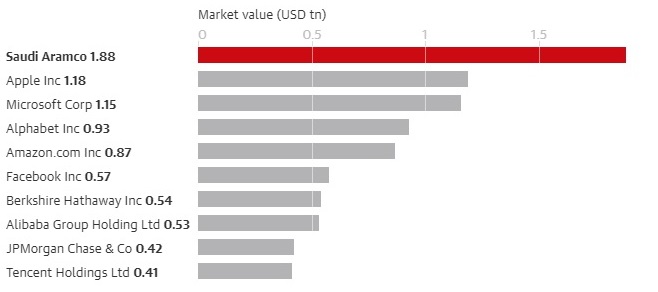

Saudi Aramco Becomes the World’s Largest Listed Company

Aramco’s share price values the market cap of the company as the most valuable listed company, at almost seven times Exxon Mobil Corp and ahead of Apple’s $1.2 trillion price tag. Aramco’s dividend is approximately 4% and Exxon’s dividend at 5%.

Figure 1: Saudi ARAMCO’s Market Value vs Other Large Companies

Saudi Arabia wanted to sell a part of the company to raise funds to help modernise the Saudi economy to attract new investment in their economy,

Additional Demand

Major index providers such as FTSE Russell, MSCI and S&P Dow Jones have all indicated that they will include Aramco shares in their index funds, which would mean any ETF and asset manager tracking the indices would be forced to buy shares, thereby creating further demands on the stock.

Key Risk:

As the Kingdom of Saudi Arabia will own the balance of shares, corporate governance has been identified as a key risk for investors.

//

Saudi Arabian Oil Company (ARAMCO) (SASE:2222)

- saudiaramco.com

- Headquartered in Dhahran, Saudi Arabia, Saudi Arabian Oil Company (ARAMCO) operates as an integrated oil and gas company in the Kingdom of Saudi Arabia and internationally. The company operates through both Upstream and Downstream segments: the Upstream segment explores, develops, produces, and sells crude oil, condensate, natural gas, and natural gas liquids; the Downstream segment engages in the production of various chemicals, including olefins ethylene, ethylene glycol, ethylene oxide, and methanol.

- Saudi Arabian Oil Company (ARAMCO) is currently trading at SAR37.40 with a market cap of SAR7,480,000 million, approximately US$2 trillion.