eResearch is pleased to publish an Update Equity Research Report on DATA Communications Management Corp. (TSX: DCM | OTC: DCMDF).

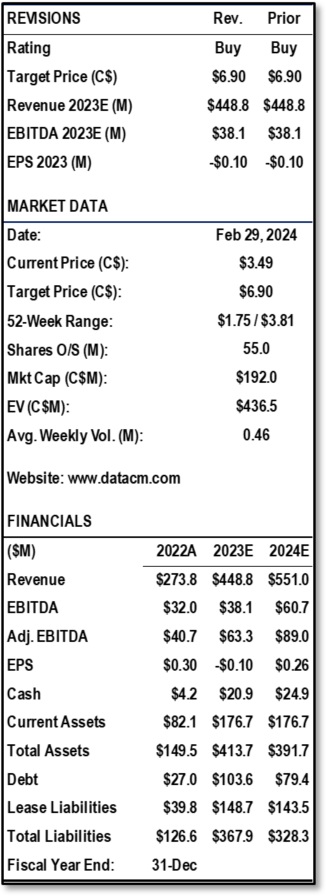

We are maintaining a Buy rating and a one-year price target of $6.90.

You can download our FULL 12-page Equity Research Report by clicking on the following link: eR-DCM-2024_02_29_UR_FINAL

Company Overview

DCM is a Canadian-based provider of marketing and business communication solutions to companies in North America. Its technology-enabled content and workflow management capabilities solve the complex branding, communications, logistics, and regulatory requirements of leading enterprises so its customers can accomplish more in less time. Its services include printing, data & content management, labels & asset tracking, location-specific marketing, and multimedia campaign management.

Company & Industry Updates

Company & Industry Updates

- STG Partners’ acquisition of MediaValet Inc. for $79 million, valued the company at 5.0x Revenue, indicating a positive outlook for the valuation of other Canadian SaaS and DAM companies. DCM, with a current trading multiple of 1.0x EV/Revenue, could benefit as it advances its Print-to-Digital strategy and increases SaaS revenue. DCM continues its guidance of 5% organic revenue growth and growing its marketing technology solutions at more than 60% in 2024.

- DCM completed the sale and leaseback of its Trenton, Ontario facility for $9.0 million. The recent series of sale and leaseback transactions have collectively raised $37.8 million in net proceeds and paid down acquisition-related financing following the acquisition of Moore Canada Corporation (MCC) in April 2023.

- DCM secured a 5th place ranking in the 2024 OTCQX Best 50, reflecting its significant growth, following the acquisition of MCC. This recognition highlights DCM’s performance, enhanced market liquidity, and commitment to high financial and governance standards, positioning the company for sustained growth and long-term value creation.

Financial Analysis & Valuation

- At this time, we did not update our model. We are awaiting 2023 financials that are expected near the end of March 2024.

- We estimate an equal-weighted price target of $6.90 based on a DCF valuation ($9.31/share), a Revenue Multiple valuation ($6.17/share), and an EBITDA Multiple valuation ($5.10/share).

We are maintaining a Buy rating and a one-year price target of $6.90.

You can download our FULL 12-page Equity Research Report by clicking on the following link: eR-DCM-2024_02_29_UR_FINAL

Other DCM Research Reports:

- Update Report (November 13, 2023): Revenue & EBITDA Growth Continues to Benefit from MCC Acquisition; Deal Synergies Now Targeting up to $35M

- Update Report (August 17, 2023): DCM Acquisition Provides 75% Revenue Jump & Cash Flow Growth as Merger Synergies Drop to the Bottom Line

- Update Report (June 14, 2023): DCM and MCC Merger Closes and Leaps Forward with $26.1M Financing & $23.1M Facility Sale

- Update Report (March 10, 2023): Strategic Merger Between DCM and RRD Canada Sparks Industry Consolidation with Beneficial Synergies

- Initiation Report (August 16, 2021): Digital-First Strategy and Tactical Consolidation Drives EBITDA Growth at DCM

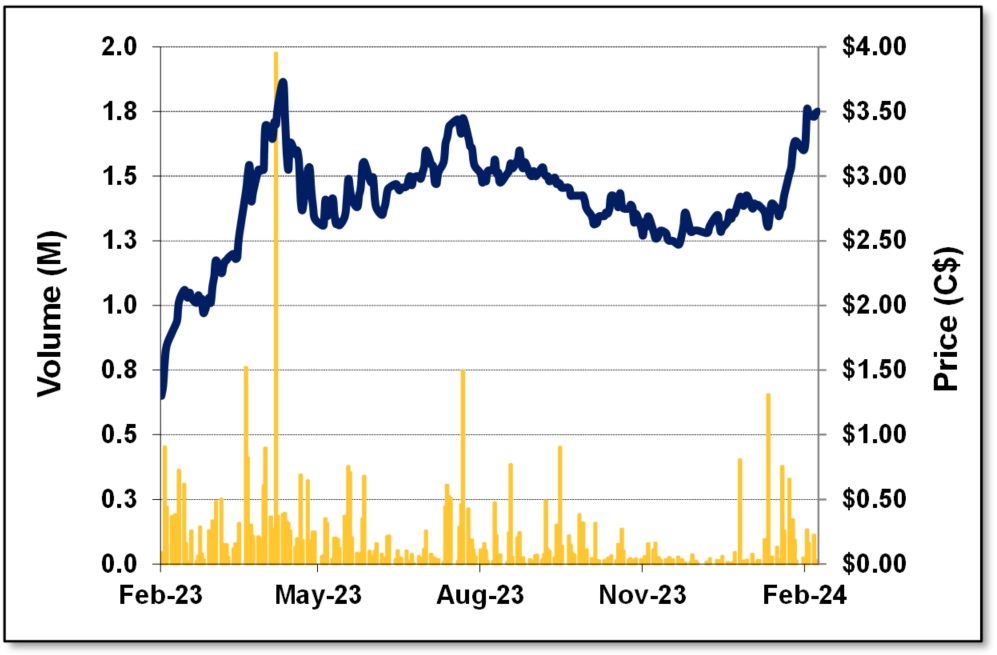

FIGURE 1: One-Year Stock Chart

Notes: All numbers in CAD unless otherwise stated. The author of this report, and employees, consultants, and family of eResearch may own stock positions in companies mentioned in this article and may have been paid by a company mentioned in the article or research report. eResearch offers no representations or warranties that any of the information contained in this article is accurate or complete. Articles on eresearch.com are provided for general informational purposes only and do not constitute financial, investment, tax, legal, or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this information should consult with a financial advisor. The article may contain “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements are based on the opinions and assumptions of the Company’s management as of the date made. They are inherently susceptible to uncertainty and other factors that could cause actual events/results to differ materially from these forward-looking statements. Additional risks and uncertainties, including those that the Company does not know about now or that it currently deems immaterial, may also adversely affect the Company’s business or any investment therein. Any projections given are principally intended for use as objectives and are not intended, and should not be taken, as assurances that the projected results will be obtained by the Company. The assumptions used may not prove to be accurate and a potential decline in the Company’s financial condition or results of operations may negatively impact the value of its securities. Please read eResearch’s full disclaimer.