eResearch | The seasonality strength of thirteen indexes/sectors expire in April, with many occurring at the end of the month. This certainly gives credence to the time-worn stock market adage: sell in May and go away. If you accept this theory, then it might be prudent to sell all or part of profitable positions over this coming month. This advice is supported by the fact that April traditionally is a good month for investors, and it is always good to book a profit when you can.

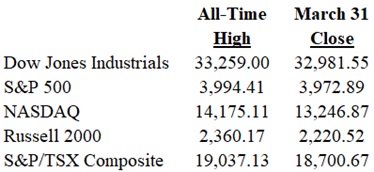

As April dawns, many of the key indexes are near or at all-time highs.

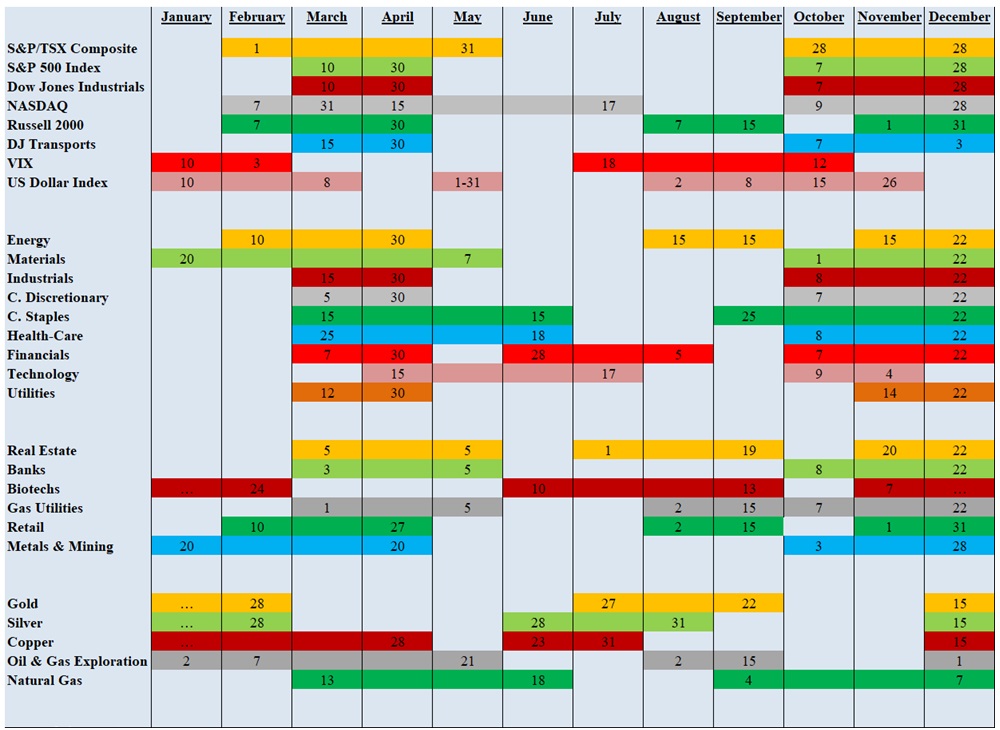

CHART 1: Indices Update

Over the last three months, only the NASDAQ has not churned consistently higher.

The market is always forward-looking and, in the current circumstances, the market is anticipating success with the global vaccine program and a return of consumers with their pent-up savings to galvanize the general economy. This is giving impetus to stocks but also sets up a selling scenario for stocks if the expectations do not match reality.

Changes for April

There is just one addition, Technology, to seasonality strength in April, but there are thirteen indexes/sectors that see their seasonality strength come to an end this month.

Seasonal Trends for the Market Segments in April

The following table shows which indexes and sectors come into seasonal strength during the month of March. There is 1 addition this month, shown in GREEN under FROM, and 13 expiries this month, shown in RED under UNTIL

NOTE: A full seasonality list of indexes and sectors is provided at the end of this report.

CHART 2: Current Seasonal Changes for the Market Segments

Importance of Seasonality Trends

Seasonality refers to particular time-frames when stocks/sectors/indexes are subjected to and influenced by recurring tendencies that produce patterns that are apparent in the investment valuation process. A seasonality study preferably uses at least 10 years of data.

Seasonality Trends Chart

The Seasonality Trends chart below was updated in December 2020. The chart shows the periods of seasonal strength for 28 market segments (sectors/indexes). Each bar indicates a buy and a sell date based upon the optimal holding period for each market sector/index.

The Seasonality trends chart is an ever-changing 14-year average of the indexes and sub-indexes that we track. The information in the chart is courtesy of www.equityclock.com.

CHART 3: Seasonality Trends Chart