Below is an article excerpt written by Lorimer Wilson of munKNEE.com. munKNEE.com is a new affiliate of eResearch.com.

Material for the article below was sourced from the munKNEE.com archives on hyperinflation.

//

To wind up with true hyperinflation, some very bad things have to happen. The government has to completely lose control and the populace has to completely lose faith in the system – or both at the same time. Will the U.S. go down that path? Let’s review the situation.

By Lorimer Wilson, Editor of munKNEE.com

Hyperinflation: A Definition

- Historically speaking, hyperinflation is essentially always a political event. Someone loses a war, the government collapses, there is a pandemic such as the coronaviris (COVID-19) that virtually shuts down the economy causing many companies to fail and mass unemployment to occur or some huge dramatic political event happens that triggers the hyperinflation. After this huge event, the politicians in charge generally begin printing money and dishing it out many times more than existed the year before and, as inflation begins to pick up, the leaders then also generally speed up the printing.

- Professor Steve Hanke defines hyperinflation as when inflation exceeds 50% per month and lasts for at least 30 consecutive days.

- In hyperinflation the money supply is going up, the velocity of money is going up, and the real GNP is going down, all at the same time. It is a triple whammy that drives prices up really fast. Source: munKNEE.com

The Steps To Hyperinflation

- Government spending gets out of control to where the deficit is 40% or more of spending and the debt is over 80% of GNP.

- The central bank starts buying up government debt with newly made money.

- There is capital flight out of that currency.

- Bond sales fail.

- Investors move into shorter term bonds as the years pass and it becomes clear that the deficit is not going back down.

- The Government is forced to print more and more money as a result of more and more bonds coming due sooner to cover their budget.

- The velocity of money picks up.Some people notice prices going up and spend their money before prices go up more, even for things they do not need yet. This spending of money as fast as it is earned is the hallmark of hyperinflation. In other words, it is when savings of any sort become the stupid thing to do.

- Many people start using foreign currencies, or gold, as a store of value when they realize that the local currency is not a good store of value even though government may forbid it.

- A black market starts in currency exchange.

- The black market spreads to commerce as people start to use barter or a foreign currency or gold for trade.

- The government freezes bank accounts because so many people are taking money out of their bank accounts and exchanging it for a foreign currency, or gold, causing many banks to become in danger of going under.

- Wages and prices become indexed to something more stable, like a foreign currency or gold.

- Wages become paid weekly or daily, instead of monthly, and the velocity of money picks up more.

- Interest rates become very high.

- Loans become for much shorter periods, a couple of months instead of 30 years.

- The black market eventually grows larger than the legal market. People no longer worry about the government requirement to use local paper currency, as enforcement is impossible. Businesses that follow the law and sell for regulated prices in the local currency cannot buy enough new inventory and soon go out of business making the percentage of the economy that is black market go up further and further.

- People start to no longer accept the local paper money.

- Regular taxes decline because hyperinflation has devastated the economy and much of the economy is now in the “black market”. The government is losing economic power and, at this step, there is a very real risk of the government failing. Source: munKNEE.com

- Once people get spooked, their willingness to hold money will decline (the velocity of money will expand). It is this latter phenomenon that moves a country from very high inflation into hyperinflation.

- An arbitrary definition of hyperinflation might be in excess of 50% per month.

- Historically, it generally has taken two to three years before growth in the money supply has translated into a meaningful acceleration in inflation. Source: munKNEE.com

- The timing of the onset of full blown hyperinflation likely will be coincident with a broad global rejection/repudiation of the U.S. dollar. Source: munKNEE.com

- The situation will quickly devolve from a deepening depression, to an intensifying hyperinflationary great depression and, while the resulting U.S. economic difficulties will have broad global impact, the initial hyperinflation should be largely a U.S. problem, albeit with major implications for the global currency system. Source: munKNEE.com

- Bottom line:The larger the amount of outstanding debt is, the larger will be the potential increase in the money supply. The more the money supply grows, the more likely it is that there will be hyperinflation and a potential breakdown of money demand: the unfolding of a crack-up boom. Source: munKNEE.com

…to continue reading the full post of this article, please visit “An Exclusive Review of Hyperinflation Yesterday, Today (& Tomorrow?)”.

//

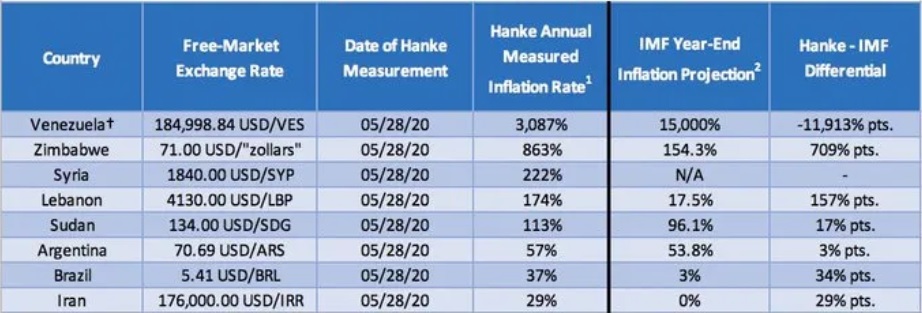

TABLE 1: The Hanke Inflation Weekly

//

munKNEE.com is a new affiliate of eResearch.com. To learn more about munKNEE.com, please visit their website and sign-up for their weekly newsletter.