eResearch | No change for Canada. It is on an official eResearch Count-Down to a possible Economic Recession occurring between November 2020 and April 2021.

In the USA, yields for all maturities across the entire spectrum declined this past week, more so at the long-end. The one-month maturity joined the Overnight Bank Funding Rate in exhibiting significant volatility. Spreads narrowed across the board with the 10-year/1-year yield curve ratio re-inverting. There are now 15 yield curve ratio Spreads that are inverted out of the 24 that we follow.

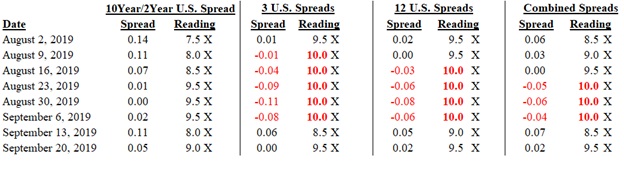

Our most important yield curve metric is the 10-year/2-year Spread which, after rising to 0.11x declined to a low of 0.03x this past week before ending the week at 0.05x.

Our “3 Spreads” metric, comprising 20-year/10-year, 10-year/3-month, and 5-year/2-year, was negative, or “inverted”, for five straight weeks before going decidedly positive two weeks ago. However, it narrowed this past week to end at 0.00x, right on the Inversionary cusp.

Our “12 Spreads” reading also was negative/inverted until two weeks ago, and it, too, narrowed this past week.

After three negative/inverted weeks, the Combined Spread went positive two weeks ago, but retreated along with our other metrics in this latest week. This has resulted in a higher Recession Barometer reading of 9.5X at the close last week.

In order to initiate our recession Count-Down, all four of the metrics must be inverted and the 10-year/2-year ratio must be inverted for ten consecutive business days.

You can read our entire 12-page report by clicking the following link: Recession Barometer – September 21, 2019