eResearch | We are taking advantage of the surge in the share prices of the oil stocks today to update our Oil Portfolio. Finally, we are in positive territory, which actually happened last Thursday and the first time since the Portfolio was begun at the beginning of June. We expect that oil shares will likely retreat a little before consolidating.

Much is being made in the media of the increased geopolitical risk now attached to the price of oil. However, the fact remains that oil demand is still sluggish, and the loss of Saudi oil while it repairs its facilities will most likely be made up from global stockpiles.

In Canada, our short-sighted political activists who have held up the building of pipelines have caused this country a missed golden opportunity to service Asian and other global markets with our crude. Let’s get those pipelines built.

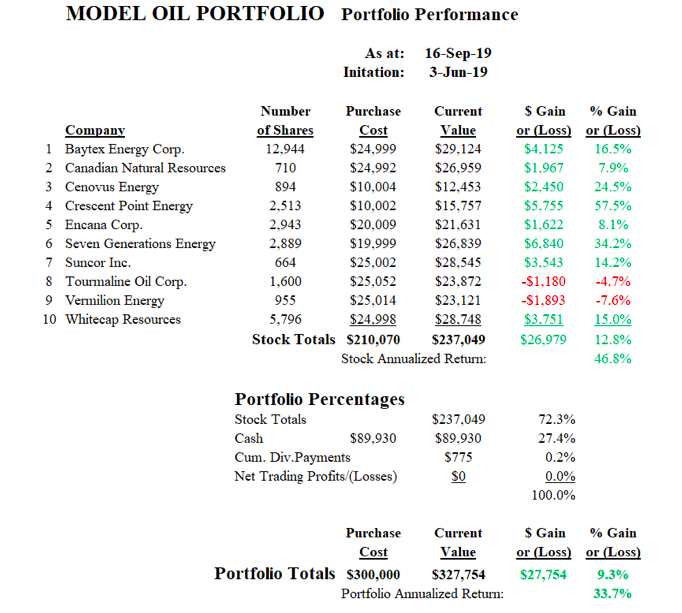

Our Portfolio of oil stocks, initiated on June 3, 2019 with a total invested value of $300,000, is focused on recovery and growth. The Energy sector has been depressed for some time, and most Energy stocks have not fared well since the Portfolio’s inception. However, the sector is now directly in the spotlight, at least temporarily, and it is likely to respond more positively looking ahead. In the meantime, the Portfolio only shows two of the ten stocks to be “under water”. There is also a sizable cash position available to take advantage of any under-performing situations if the opportunity arises.

One caveat, though, is that the positive seasonality aspect for the sector ends next week and does not return until next February. The increased geopolitical focus on the sector might just upset the usual seasonality performance.

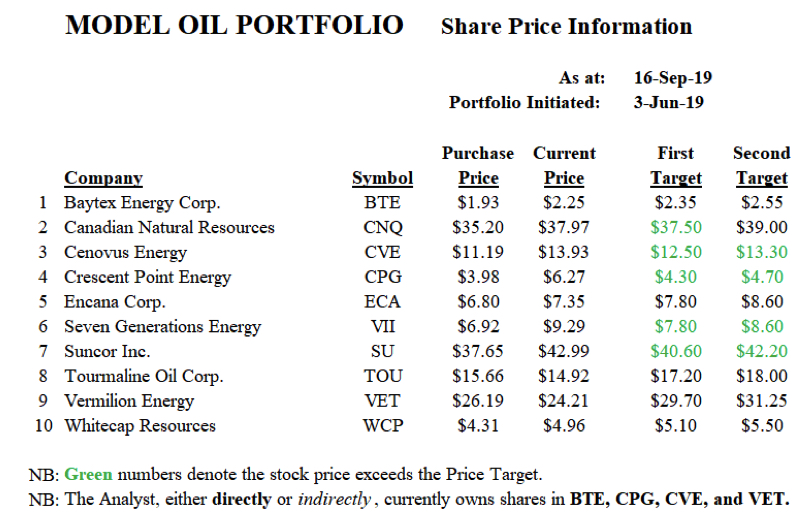

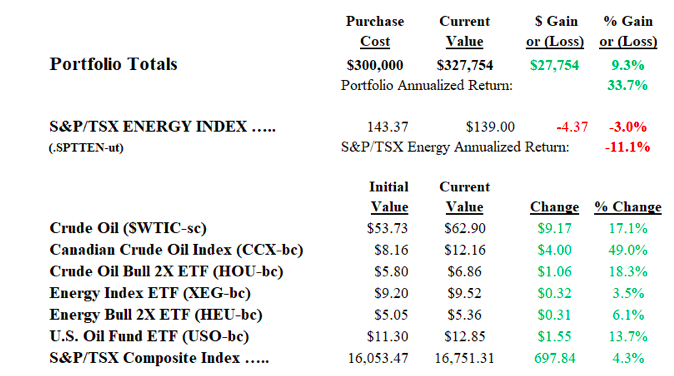

PORTFOLIO PERFORMANCE

The following table shows how the Portfolio has performed since inception on June 3, 2019.

INDUSTRY COMPARISON

Next, the return on the portfolio is compared to various energy bench-marks.

The Portfolio is up 9.3%. The S&P/TSX Energy Index is off 3.0%. The Energy Index Bull 2X ETF (HEU) is up 6.1% and the Energy Index ETF (XEG) is up 3.5%. The price of crude oil is up 17.1% and the Canadian Crude Oil Index (CCX) has risen a startlingly 49.0%.

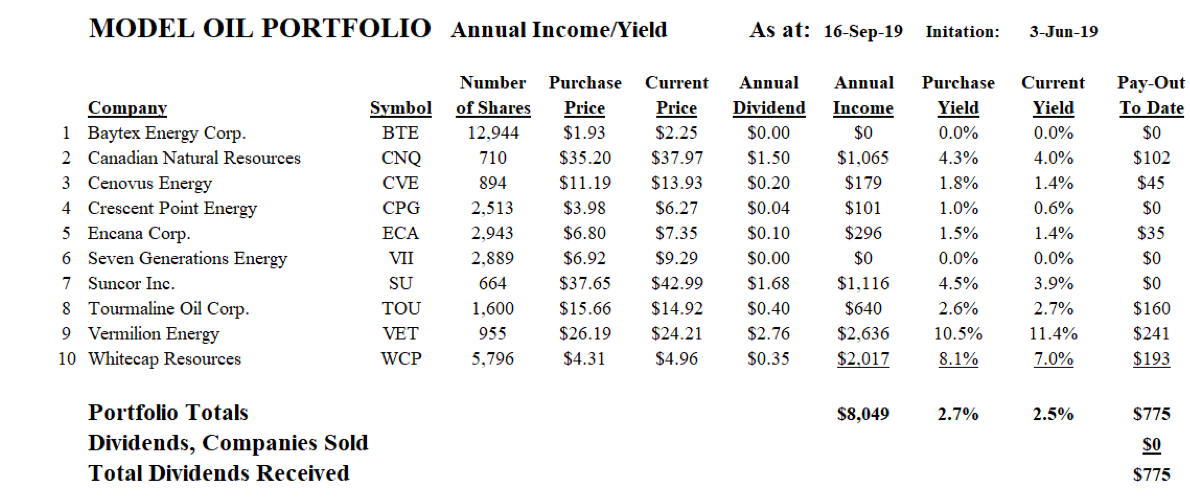

DIVIDENDS and YIELDS

The table below indicates the annual dividend and corresponding annual income and yields. This table is updated twice monthly or when a stock is bought or sold.