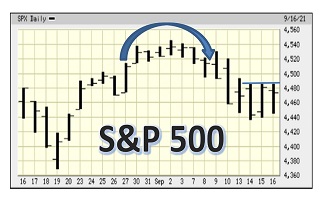

Most developed equity markets in the world reached an intermediate peak on or about May 1st. Last week they continued moving slightly lower.

Technical action by individual S&P 500 stocks remained bearish last week. Number of stocks breaking intermediate resistance totaled 17 while number of stocks breaking support totaled 37 (including eight energy stocks) The Up/Down ratio dropped last week for the fourth consecutive week to (248/157=) 1.58 from 1.86.

Medium term technical indicators for U.S. equity markets (e.g. Percent of stocks trading above their 50 day moving average, Bullish Percent Index) continued to move lower last week. They are intermediate neutral and trending down. See charts near the end of this report. Medium term technical indicators in Canada also moved slightly lower last week. They remain intermediate neutral. See charts near the end of this report.

Short term technical indicators for U.S. markets and sectors (20 day moving averages, short term momentum) moved lower again last week. Short term technical indicators for Canadian markets and sectors also moved lower last week.

Short term political concerns in the U.S. remain elevated. Issues include tariff wars between the U.S. and China and anti-Trump hearings initiated by the Democrat controlled House of Representatives. Release of the Mueller report continues to elevate political rhetoric.

You can access the latest report from Tech Talk here: TechTalk_052719Mo