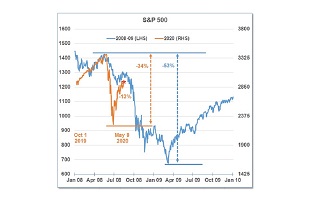

S&P 500 Index: Short-term head-and-shoulders topping pattern projects downside potential towards 2650, should the neckline to the bearish setup break around 2800.

Stocks closed marginally higher on Friday as investors squared away their positions ahead the three-day weekend in the US. The S&P 500 Index posted a gain of just over one tenth of one percent, remaining below the open gap charted in the previous session. The pivot point at 2853 is now in a position of resistance. The benchmark has pegged resistance at the 20-day moving average, which is about to chart a bearish crossover with the 50-day moving average. A short-term head-and-shoulders pattern is apparent on the chart based on the trading activity since the middle of March. The neckline of the bearish setup is around 2800, a break of which would project downside potential towards 2650, which approximately matches the lows charted in October and November. Risk sentiment remains weak, but we are just one tweet away from the next move higher or lower.

You can access Monday’s report from Equity Clock here: EquityClock_052719Mo