eResearch is pleased to publish a 40-page Initiation Report on Terreno Resources (TSXV:TNO.H).

eResearch is pleased to publish a 40-page Initiation Report on Terreno Resources (TSXV:TNO.H).

We are Initiating Coverage with a Speculative Buy rating and a one-year price target of $0.14.

You can download our 40-page Equity Research Report that covers an in-depth analysis of the company and a detailed overview of the geology and exploration projects in Mexico, by clicking on the following link: eR-Terreno-TNO-IR-2022-01-31_FINAL

Company Description:

Terreno is a Canadian-based gold & silver exploration and development company that is currently focusing on Las Cucharas Gold and Silver Project in Nayarit, Mexico.

Las Cucharas Project is a district-scale exploration project covering over 4,445 hectares and exploration work has identified precious and base metal mineralized zones over an area that is six kilometres long.

The project area has documented historical gold & silver production through several small mines that highlight the potential for large-scale exploration and commercial exploitation.

Investment Thesis and Upcoming Catalysts:

- District-scale Exploration Potential: The project holds 17 mining concessions covering over 4,445 hectares, with 17 gold-silver and gold-silver-copper-lead-zinc mineralized zones over an area that is 6km long.

- Solid Geological Conditions: The project sits at the southern side of the Sierra Madre Occidental (SMO) metallogenic province, a large mid-tertiary volcanic field that is one of the world’s largest epithermal precious metal terranes and hosts several world-class, multi-million-ounce gold & silver mines and deposits.

- Historical Production Highlights Future Potential: The area has documented historical gold & silver production through several small mines that highlight the potential for large-scale exploration and commercial exploitation.

- Funding for 2022: In November 2021, Terreno reported that it closed the second tranche of an up to $1.0M financing. Once fully closed, the Company will be fully financed to execute on its 2022 exploration plan.

- Upcoming Catalysts:

- Exploration Results: Exploration results from upcoming fieldwork programs and proposed diamond drilling plan.

- Graduating to the TSX Venture Exchange: Terreno is currently in the process of graduating to the TSX Venture Exchange from the NEX board and believes the transfer will be complete in the first quarter of 2022.

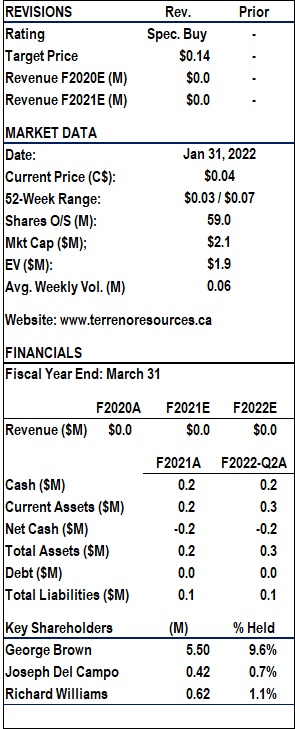

Financial Analysis & Valuation:

- We valued Terreno using a comparable company analysis to other companies with exploration projects in Mexico.

- From this calculation, we estimated Terreno’s Enterprise Value to be $16.8 million and its One-Year Forward Target Price would be $0.14.

We are Initiating Coverage with a Speculative Buy rating and a one-year price target of $0.14.

You can download our 40-page Equity Research Report, by clicking on the following link: eR-Terreno-TNO-IR-2022-01-31_FINAL

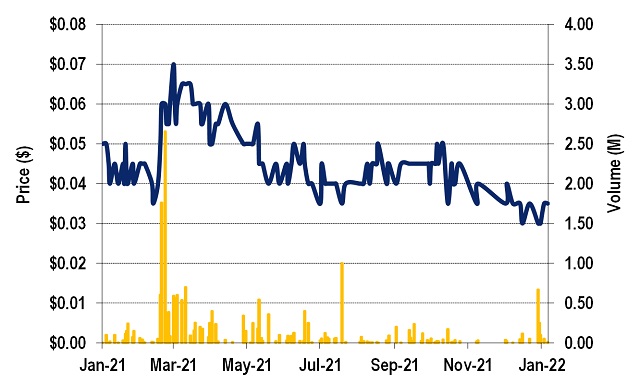

FIGURE 1: Terreno – 1 Year Stock Chart

Other related articles on eResearch:

- Is Now a Suitable Entry Point to Buy Gold or a Gold Stock?

- Recent Mining Deals Score Big as M&A and Pre-Production Raise Required Cash

Notes: All numbers in CAD unless otherwise stated. The author of this report, and employees, consultants, and family of eResearch may own stock positions in companies mentioned in this article and may have been paid by a company mentioned in the article or research report. eResearch offers no representations or warranties that any of the information contained in this article is accurate or complete. Articles on eresearch.com are provided for general informational purposes only and do not constitute financial, investment, tax, legal, or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this information should consult with a financial advisor. The article may contain “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements are based on the opinions and assumptions of the Company’s management as of the date made. They are inherently susceptible to uncertainty and other factors that could cause actual events/results to differ materially from these forward-looking statements. Additional risks and uncertainties, including those that the Company does not know about now or that it currently deems immaterial, may also adversely affect the Company’s business or any investment therein. Any projections given are principally intended for use as objectives and are not intended, and should not be taken, as assurances that the projected results will be obtained by the Company. The assumptions used may not prove to be accurate and a potential decline in the Company’s financial condition or results of operations may negatively impact the value of its securities. Please read eResearch’s full disclaimer.