eResearch | The S&P 500 Index might have reached a near-term peak. For one, it is struggling to stay above its rising trend-line. For another, it has experienced a near-perfect, albeit short, “roll-over”, as we point out in Charts 2 and 3 below.

For some time we, along with countless other market pundits, have been expecting a pull-back to consolidate the extraordinary gains that have occurred since the market melt-down in March 2020. A pull-back is going to happen, but when? The trouble is that we usually do not know we are in one until it is well underway.

What should investors do? We recommend converting to defensive positions, but not abandoning stocks altogether. We suggest that subscribers take a look at our Dividend Yield Portfolio. We update it on the last Friday of each month. Sneak Preview: Although things can certainly change over the next two weeks, right now the Portfolio is well ahead of last month’s position.

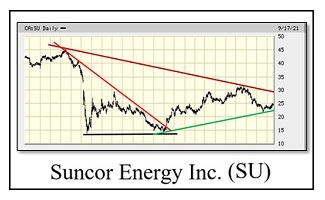

Chart 1: One-Year Chart

Observation: The one-year chart above indicates that the S&P 500 is bumping along the bottom of its channel. But let us look a little more closely at the six-month chart below.

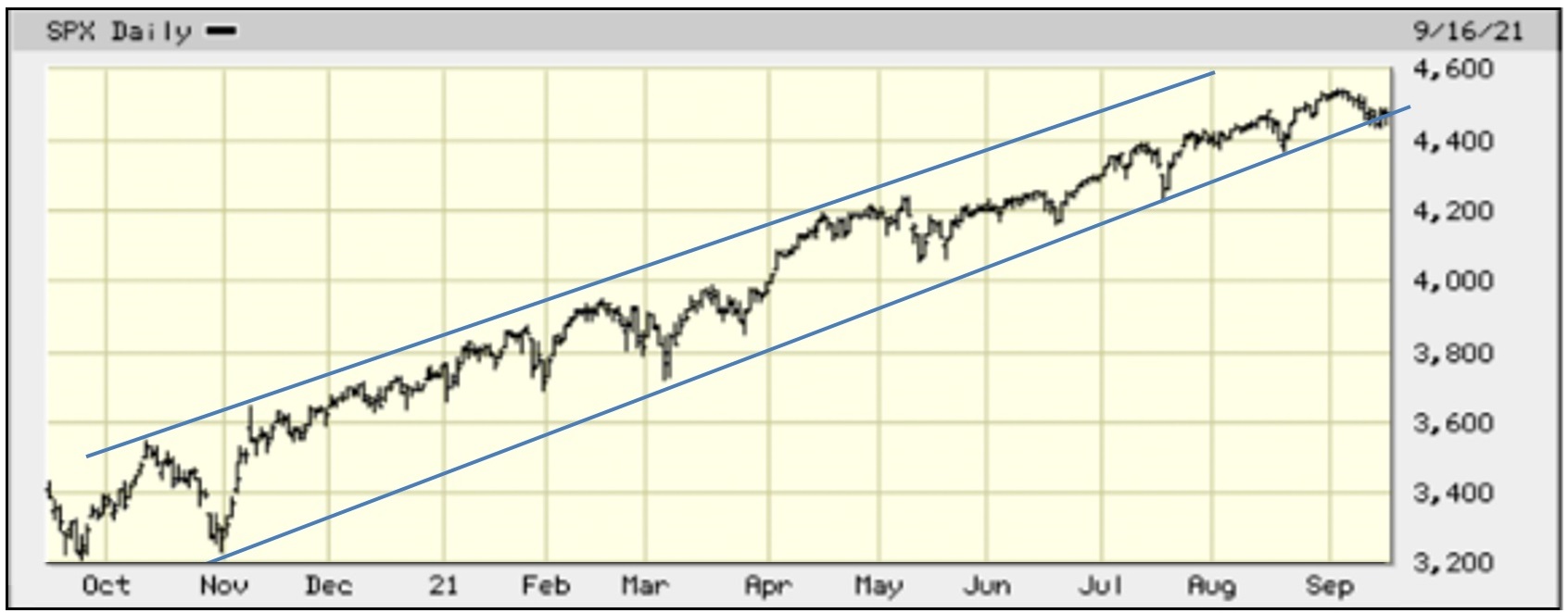

Chart 2: Six-Month Chart

Observation: The six-month chart shows that the S&P 500 is caught in a rising wedge. This is a bearish indicator. Worse, the Index is struggling to stay in the formation. There is also a perfect “roll-over” that began near the end of August and ended on September 8-9 followed by a brief consolidation to the present. Next, we will look at the one-month chart to illustrate this roll-over/consolidation.

Chart 3: One-Month Chart

Observation: The “roll-over” is very clear on the one-month chart. That was followed by a consolidation, shown by the horizontal blue line. Okay, admittedly, it is only a three-day wonder, so it cannot yet be considered significant, but it requires monitoring for whatever direction it takes next.

Notes: All numbers in CAD unless otherwise stated. The author of this report, and employees, consultants, and family of eResearch may own stock positions in companies mentioned in this article and may have been paid by a company mentioned in the article or research report. eResearch offers no representations or warranties that any of the information contained in this article is accurate or complete. Articles on eresearch.com are provided for general informational purposes only and do not constitute financial, investment, tax, legal, or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this information should consult with a financial advisor. The article may contain “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements are based on the opinions and assumptions of the Company’s management as of the date made. They are inherently susceptible to uncertainty and other factors that could cause actual events/results to differ materially from these forward-looking statements. Additional risks and uncertainties, including those that the Company does not know about now or that it currently deems immaterial, may also adversely affect the Company’s business or any investment therein. Any projections given are principally intended for use as objectives and are not intended, and should not be taken, as assurances that the projected results will be obtained by the Company. The assumptions used may not prove to be accurate and a potential decline in the Company’s financial condition or results of operations may negatively impact the value of its securities. Please read eResearch’s full disclaimer.