eResearch| Lightning eMotors (NYSE: ZEV) recently signed an $850 million partnership agreement with Forest River, a Berkshire Hathaway (NYSE:BRK.A)-backed company, with a plan to come up with 7,500 zero-emission shuttle buses by 2025.

As soon as the news of the partnership came out, the shares of the electric vehicle manufacturer, Lightning eMotors shot up by 89% and closed the day at $11.60, the highest ever since the company went public. However, the Company’s share price has quickly returned to previous levels, closing today below $7.50.

As soon as the news of the partnership came out, the shares of the electric vehicle manufacturer, Lightning eMotors shot up by 89% and closed the day at $11.60, the highest ever since the company went public. However, the Company’s share price has quickly returned to previous levels, closing today below $7.50.

In the last 12 months, Lightning eMotors has booked revenue of $18.0 million but has lost more than $100 million. Currently, it is trading at an Enterprise Value to last-12-month’s revenue (EV/LTM Revenue) of 23.7x.

The Company first started trading in May after its merger with a special purpose acquisition company (SPAC) and closed its first day of trading at $8.64.

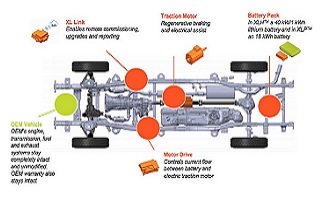

FIGURE 1: Lightning eMotors Electric Coach

Formerly known as Lightning Hybrids, Lightning eMotors is a company that specializes in commercial electric vehicles (ECV). It buys vehicle chassis from a variety of reputable brands including Ford Motor Co., and assembles electric versions at its Loveland facility.

In addition to zero-emission shuttle buses, Lightning eMotors and Forest River’s planned projects include fully electric powertrains, charging devices, and related services.

Forest River is a shuttle bus manufacturer that sells its vehicles under various brands including Starcraft, Glaval and Champion brands. It dominates the Class 4 to Class 6 shuttle-bus space, selling over 10,000 units per year. Forest River has 8 manufacturing facilities and more than 500,000 square feet of production space spread across North America.

Forest River will dedicate 100,000 square feet of space for the factory installation of Lightning eMotors’ powertrains. The Elkhart-based company plans to market the battery-powered vehicles across its wide network of more than 100 dealerships in the U.S. and Canada. According to the companies’ joint statement, Forest River expects to start supplying the new shuttle buses to its dealerships by the end of 2021.

Forest River will dedicate 100,000 square feet of space for the factory installation of Lightning eMotors’ powertrains. The Elkhart-based company plans to market the battery-powered vehicles across its wide network of more than 100 dealerships in the U.S. and Canada. According to the companies’ joint statement, Forest River expects to start supplying the new shuttle buses to its dealerships by the end of 2021.

The zero-emission vehicle (ZEV) powertrain systems will be manufactured in Lightning eMotors’ 2.5 million square foot facility in Loveland, Colorado before being sent for final assembly to Forest River‘s factory in Goshen, Indiana.

The buses will be designed for improved energy efficiencies as they will contain batteries that can support ranges between 80 miles and 160 miles on a single charge. Experts at Forest River believe the move will greatly improve the availability of premium-quality, cost-effective electric buses.

Key Takeaways from the Lightning eMotors-Forest River Deal

Lightning eMotors’ deal with a company linked to the billionaire Warren Buffett’s firm can be considered a strategic move. With Lightning eMotors being at the forefront of fleet electrification, the contract has the potential to be the one of the largest electric shuttle bus deals. Also, it can turn out to be a catalyst for other OEMs and fleets to speed up the adoption of commercial electric vehicles.

Global ECV Market Size to Reach more than 2 Million Units by 2028

The rise in demand for zero-emission vehicles and governments’ increased focus on electrification of public transport fleet have given a real push to the ECV industry.

According to Markets and Markets, the global ECV market size, which was estimated at 0.12 million units in 2020, is expected to reach more than 2 million units by 2028, growing at a compound annual growth rate (CAGR) of 41.1%. This growth potential of the market presents a great opportunity for automotive original equipment manufacturers (OEMs) to expand their business and geographical presence.

OEMs Catering to the Rising Demand for Fuel-Efficient and Eco-Friendly Vehicles

Increase in air pollution and environmental hazards, strict government regulations, and tough competition from other companies, such as AxleTech, TransPower, and Efficient Drivetrains, are some of the major factors that have forced automotive OEMs to find ways to come up with more vehicles that can meet the fuel efficiency and emission standards. Logistics companies, in particular, are looking to electrify their trucks in order to cut down operating costs and eliminate fuel expenses caused by covering long distances on conventional vehicles.

North America Projected to Experience High Growth during the Forecasted Period

Though the COVID-19 pandemic has impacted the growth of the ECV market, the industry is expected to recover soon and witness growth in 2022. According to a Market and Market’s report, North America will register the fastest growth in the market during the forecasted period due to the high adoption rate of electric vans in the logistics sector and stringent emission norms in the region. The Asia Pacific region is expected to grow steadily owing to the rising demand for electric buses in public transport fleets.

Notes: All numbers in USD unless otherwise stated. The author of this report, and employees, consultants, and family of eResearch may own stock positions in companies mentioned in this article and may have been paid by a company mentioned in the article or research report. eResearch offers no representations or warranties that any of the information contained in this article is accurate or complete. Articles on eresearch.com are provided for general informational purposes only and do not constitute financial, investment, tax, legal, or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this information should consult with a financial advisor. The article may contain “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements are based on the opinions and assumptions of the Company’s management as of the date made. They are inherently susceptible to uncertainty and other factors that could cause actual events/results to differ materially from these forward-looking statements. Additional risks and uncertainties, including those that the Company does not know about now or that it currently deems immaterial, may also adversely affect the Company’s business or any investment therein. Any projections given are principally intended for use as objectives and are not intended, and should not be taken, as assurances that the projected results will be obtained by the Company. The assumptions used may not prove to be accurate and a potential decline in the Company’s financial condition or results of operations may negatively impact the value of its securities. Please read eResearch’s full disclaimer.