eResearch | On March 23, mCloud Technologies Corp., (TSXV:MCLD | OTCQB: MCLDF), released its 2020 annual financial statements with annual revenue growth of 47% and then last week, announced a $14.5 million capital raise as it grows its business in Alberta, the Middle East and Southeast Asia.

mCloud is a provider of asset management solutions combining the Internet-of-Things (IoT), cloud computing, artificial intelligence (AI), and analytics. The Company, a CleanTech leader, helps businesses reduce energy waste, maximize energy production, and get the most out of critical energy infrastructure.

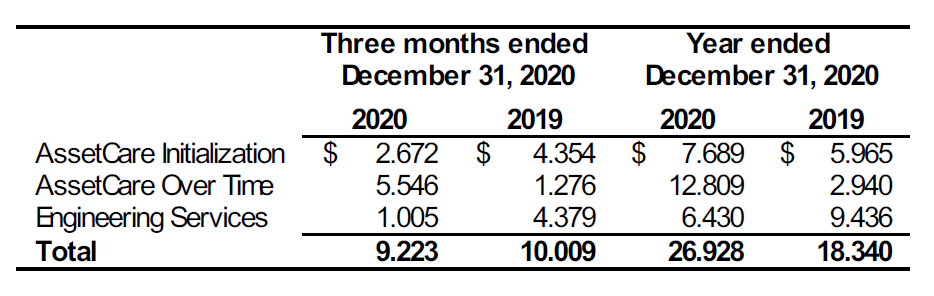

2020 Financial Results

mCloud reported 2020 revenues of C$26.9 million representing a 47% growth compared with C$18.3 million reported in 2019. The increase in revenues was due to a 45% increase in Connected Assets to 59,462 at year-end and the acquisitions of Construction Systems Associates, AirFusion, and kanepi Group.

Gross Margins for 2020 increased slightly to 62% compared to Gross Margins of 59% in 2019, driven by higher-margin AssetCare solutions and reduced technical project services revenue, which are lower margin.

AssetCare revenues were C$20.5 million in 2020, up 130% year-over-year, compared to C$8.9 million in 2019. Total recurring AssetCare Over Time revenues were up 335% in the year to C$12.8 million from C$2.9 million in 2019.

Adjusted EBITDA in 2020 was a loss of C$6.0 million compared with an Adjusted EBITDA loss of C$5.7 million in 2019 even with the increases in Operating Expenses caused by the transaction costs, acquisition consulting fees, legal and professional fees caused by the acquisitions and the fees associated with uplisting to the NASDAQ stock exchange.

In Q4/2020, revenue was C$9.2 million, slightly below the record revenue in Q4/2019 of C$10.0 million but was up 51% quarter-over-quarter from C$6.1 million in Q3/2020. AssetCare revenue contributed C$8.2 million or almost 90% of the revenue in the quarter compared to C$5.6 million in the previous quarter.

Even with COVID-19 related travel restrictions, connected assets increased by 4,692 in Q4/2020, a 9% rise quarter-over-quarter.

Russ McMeekin, mCloud President and CEO stated,

“Our fourth quarter results illustrate the solid growth trajectory and gross margins we are creating via recurring AssetCare subscriptions and our international growth.”

FIGURE 1: Full Year 2020 and Q4 2020 Revenue Highlights

Air Quality Solutions for Return to Work

mCloud’s Research and Development efforts continued in 2020 and, in response to the COVID-19 global health crisis, included expanding its AI-powered HVAC optimization capabilities to include indoor air quality optimization capabilities to meet new health and safety regulations regarding better indoor air safety.

On the March 23 Analyst Call, Russ McMeekin commented,

“We have significant demand in AssetCare indoor air quality.”

With companies gearing up for employees returning to office, mCloud offers a solution for monitoring and improving particulate levels in buildings using AI, 24/7 monitoring and hospital-grade air purification. We expect future client-sale announcements as property managers address company and employee health concerns.

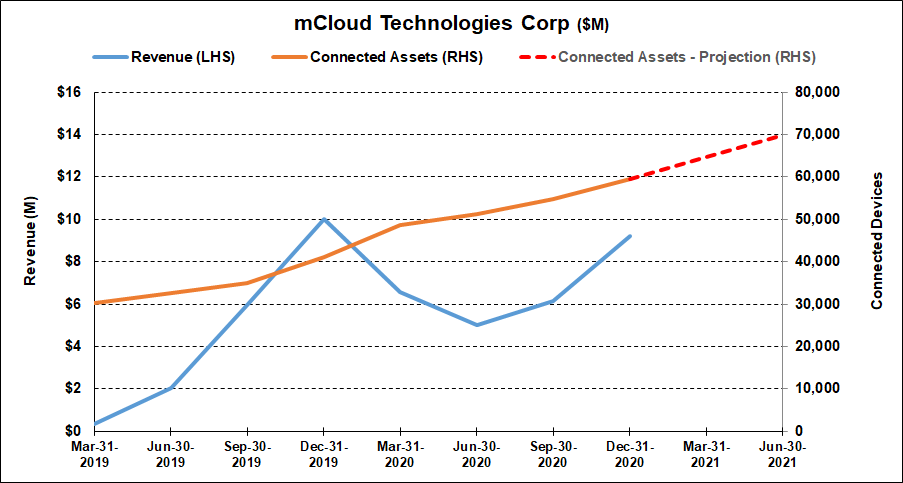

Guidance for 2021

Results in 2021 should be driven by growth in AssetCare solutions as the Company has experienced a major uptick in the demand for the remote connectivity that AssetCare provides. According to mCloud, many heavy industry sites, Oil & Gas companies and process companies are looking for ways to continue operations when they cannot get people on the ground.

Due to COVID-19 issues, the Company has a substantial backlog of new AssetCare implementations that it expects to monetize as travel restrictions ease. The Company estimated that it has C$175 million of a combination of pipeline and backlog, mostly contracted over a 3-year period and divided primarily between building solutions (40%) and oil & gas solutions (40%).

With this backlog and a strong sales pipeline, mCloud expects to double AssetCare revenues in 2021, which comprised 76% of revenue in 2020, and could raise its total revenue to at least C$45 million in 2021.

mCloud anticipates reaching 70,000 connected devices by mid-year and thus hitting a cash flow positive milestone for the Company.

FIGURE 2: mCloud Quarterly Revenue and Connected Assets

mCloud Closes $14.5M Financing

This week, mCloud announced a $14.5 million capital raise as it grows its business in Alberta, the Middle East and Southeast Asia. Each unit will be valued at C$2.10 and will consist of one common share and one common share purchase warrant, exercisable at a price of C$2.85 for 3 years.

The Company explained the net proceeds of the Offering would be used to advance its Alberta-led Environmental, Social, and Corporate Governance (ESG) digital initiatives and oil and gas decarbonization solutions, including the commercialization of its new AssetCare fugitive gas and leak detection solution, as well as to grow its business in the Middle East and Southeast Asia.

Russ McMeekin commented,

“We are very pleased with the interest we have received in this financing, with most of the participation coming from new institutional investors. Our ESG agenda in Alberta, in collaboration with a variety of organizations across the province, has accelerated greatly since we first announced our engagement with Invest Alberta Corporation in February, due in part to the positive reception our new mobile fugitive gas emissions solution is experiencing among oil and gas customers and ESG stakeholders across the province.”

Uplisting to the NASDAQ and TSX

The Company also reported that it has been working hard to uplist to the TSX and to the NASDAQ.

In January, mCloud announced that it retained American Trust Investment Services to serve as a key strategic partner in securing long-term capital and will also play an active role in helping mCloud list on the NASDAQ.

mCloud closed yesterday at C$1.80 with a Market Cap of C$62 million.

To learn more about, mCloud, read our other articles about the Company:

- Adelaide Capital’s CleanTech conference where mCloud presented – Canadian CleanTech Companies Speak about the Current Market.

- mCloud Released 2019 & Q1/2020 Financial Results with a 922% Revenue Gain in 2019

Notes: All numbers in USD unless otherwise stated. The author of this report, and employees, consultants, and family of eResearch may own stock positions in companies mentioned in this article and may have been paid by a company mentioned in the article or research report. eResearch offers no representations or warranties that any of the information contained in this article is accurate or complete. Articles on eresearch.com are provided for general informational purposes only and do not constitute financial, investment, tax, legal, or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this information should consult with a financial advisor. The article may contain “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements are based on the opinions and assumptions of the Company’s management as of the date made. They are inherently susceptible to uncertainty and other factors that could cause actual events/results to differ materially from these forward-looking statements. Additional risks and uncertainties, including those that the Company does not know about now or that it currently deems immaterial, may also adversely affect the Company’s business or any investment therein. Any projections given are principally intended for use as objectives and are not intended, and should not be taken, as assurances that the projected results will be obtained by the Company. The assumptions used may not prove to be accurate and a potential decline in the Company’s financial condition or results of operations may negatively impact the value of its securities. Please read eResearch’s full disclaimer.