eResearch is pleased to publish an update Equity Research Report on EQ Inc. (TSXV: EQ; OTC: CYPXF) pertaining to EQ’s recent release of its Q3/2020 financial statements.

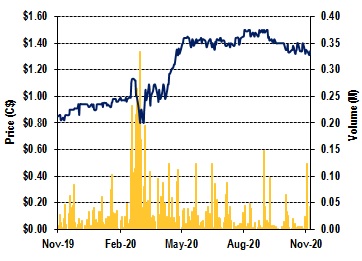

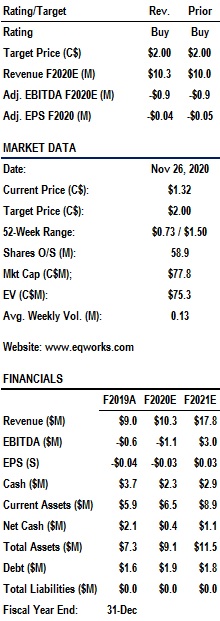

We are maintaining a Buy rating with a (blended) one-year price target of $2.00.

You can download our 12-page Update Report by clicking on the following link: eR-EQ-UR-2020_11_25-FINAL

//

EQ enables businesses to understand, predict, and influence customer behaviour. Using unique and third-party data sets, advanced analytics, artificial intelligence, and machine learning, EQ creates actionable intelligence for businesses to attract, retain, and grow customers. The Company’s proprietary SaaS platform mines insights from location and geospatial data, enabling businesses to close the loop between digital and real-world consumer actions.

QUARTERLY HIGHLIGHTS:

Q3/2020 Revenue Recovers from COVID-19 Impact

- Advertising revenue recovered in the quarter as many customers renewed previously paused campaigns and started to spend on new campaigns.

- Q3/2020 revenue was $2.85 million, an increase of 15%, compared to $2.48 million in Q3/2019, and slightly higher than our estimate of $2.60 million.

- Even during the current health crisis, EQ added 33 new clients during the first nine months of 2020.

- We are maintaining our revenue estimate of $3.5 million for Q4/2020.

Data Revenue Surges by 81% and Continues to be a Main Focus of the Company

- Data solutions revenue increased 81% year-over-year to $0.7 million in Q3/2020 and now accounts for 25% of the overall quarterly revenue.

- We expect this trend to continue and to grow substantially next year. With the restart of the economy post-COVID-19, EQ offers a unique value proposition in the market as it gives its customers the ability to understand what consumers are looking for and then present them with the most relevant content and advertising.

U.S. Publisher Deal Shows Potential for More Growth into the U.S. Market

- In Q3/2020, the U.S. still only accounted for 7% of revenue but is the largest ad market in the world. We await news of more U.S. deal signings.

Strong Balance Sheet is Maintained During the Quarter

- At the end of Q3/2020, EQ had a cash balance of $4.75 million.

FINANCIAL ANALYSIS & VALUATION:

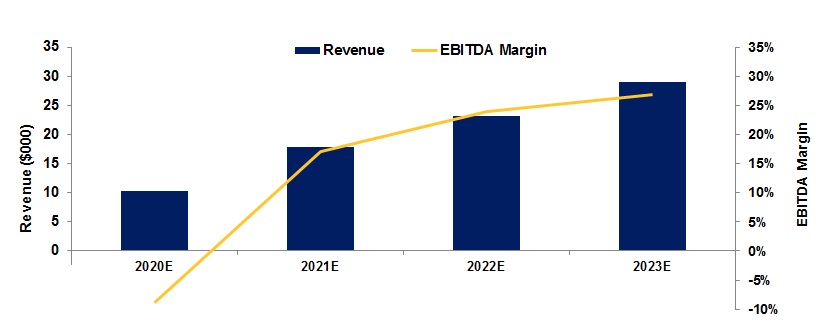

Our Revenue Estimates Remained Virtually Unchanged

- 2020E: Revenue $10.3 million; EBITDA -$1.1 million;

- 2021E: Revenue $17.8 million; EBITDA $3.0 million;

- 2022E: Revenue $23.2 million; EBITDA $5.6 million.

We estimate an equal-weighted price target of $2.00 based on a DCF valuation ($2.24/share) and a Revenue Multiple valuation ($1.82/share).

We are maintaining a Buy rating with a (blended) one-year price target of $2.00.

//

You can download our 12-page Update Report by clicking on the following link: eR-EQ-UR-2020_11_25-FINAL

CHART 1: Revenue and EBITDA Margins Estimates – 2020-2023