eResearch | GURU Organic Energy Corp. (TSX:GURU ; OTC:GUROF) is a Montreal-based beverage company that pioneered the world’s first natural plant-based energy drink back in 1999.

GURU started when Joseph Zakher and a few friends decided to launch a ready-to-drink version of their plant-based “smart drinks” they sold in their electronic dance music venue SONA in Montreal, Canada.

GURU started when Joseph Zakher and a few friends decided to launch a ready-to-drink version of their plant-based “smart drinks” they sold in their electronic dance music venue SONA in Montreal, Canada.

A few years later, they launched the world’s first natural energy drink and currently markets Gura in Canada and the U.S. with a distribution network of more than 15,000 points of sale as well as an online presence at Guru.com and Amazon.com.

RTO Financing

Are part of GURU’s going public transaction by way of a reverse takeover (“RTO”), the Company closed a C$34.5 million financing at C$5.45 per share. The stock closed today at C$14.00, up over 150% since the RTO.

GURU intends to use the proceeds to expand its presence across North America by adding major U.S. grocery and retail stores and expanding into Western Canada.

Energy Drink Market

According to Chicago-based Information Resources, the U.S. energy drink industry sales were over $12.8 billion in the past year (as of May 17), a 9.3% increase year-over-year.

In a report by Mintel, U.S. sales of energy drinks are estimated to reach $19.4 billion by 2024, an 8.1% compound annual growth.

In April, PepsiCo, Inc. (NASDAQ:PEP) closed a deal to acquire Rockstar Energy Beverages for $3.85 billion.

The Coca-Cola Company (NYSE:KO) entered the energy drink market when it acquired a 16.7% share in Monster Beverage (NASDAQ:MNST) for $2.15 billion in 2014.

GURU Product Line

GURU’s products include:

- Guru Original: Contains 80 calories (250 ml) or 115 calories (355 ml).

- Guru Lite: A similar energy drink but sweetened with extracts of monk fruit and contains 20 calories (250 ml) or 25 calories (355 ml).

- Guru Energy Water: Contains zero calories, zero sugar and is different from the Guru energy drinks.

- Guru Matcha: Launched in 2020, and, similar to Guru Lite, it contains 20 calories (250 ml) or 25 calories (355 ml).

In the first quarter of 2020, Guru Original sales represented 53% of GURU’s gross sales, Guru Lite represented 30%, Guru Matcha represented 13%, and Guru Energy Water was 4%.

Currently, the majority of GURU’s sales come from Quebec and California, and generated in convenience stores (57%), Canadian groceries and drug marts (19%), American groceries and drug marts (16%), online on platforms such as Amazon (5%), and other channels (3%).

GURU has more products in development with Guru Yerba Mate launching Quebec this quarter.

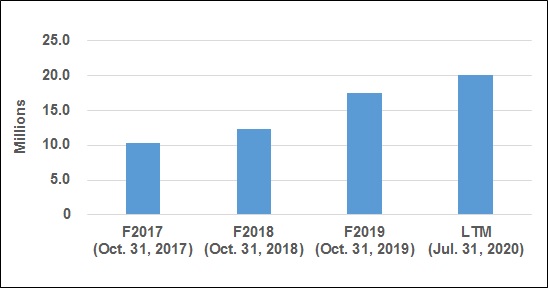

FIGURE 1: GURU’s Revenue

Millennials and Gen Z are Key Demographic

According to the Company, Millennials and Gen Z account for 70% of consumption in the energy drink market, but they are also leading health and wellness trends.

The market is shifting with many consumers focusing on buying products they consider natural or healthier.

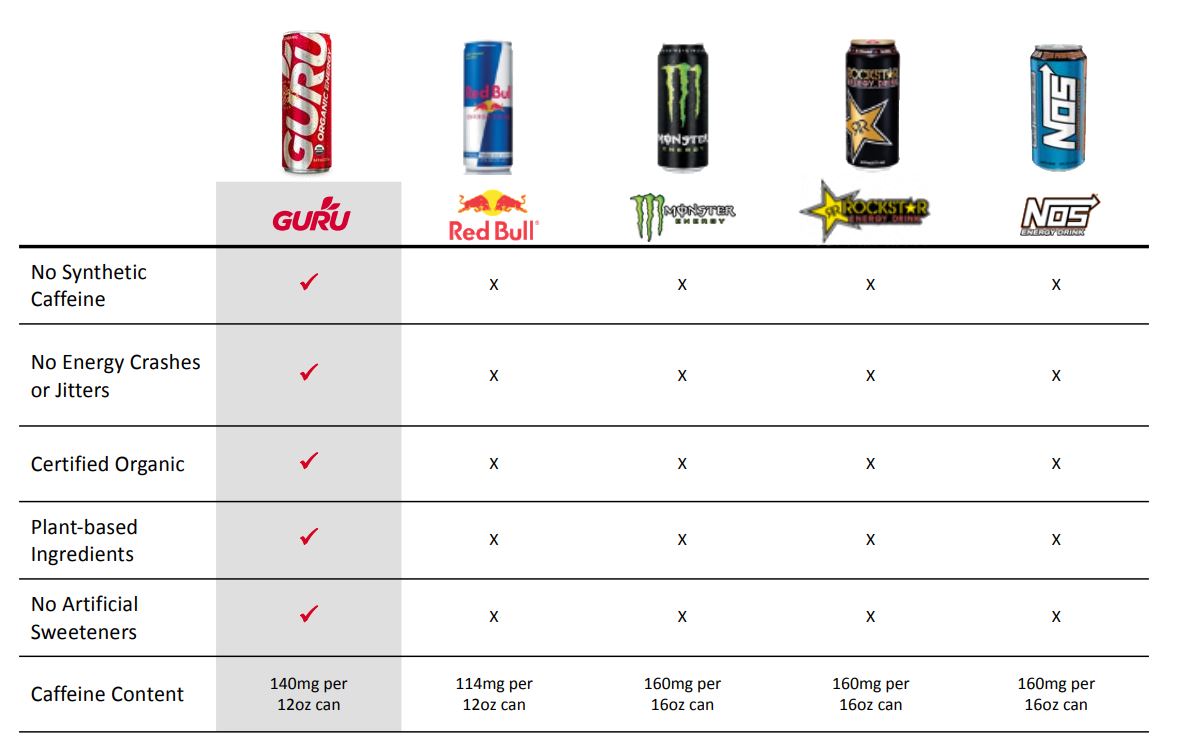

The North American energy drink market is currently dominated by two legacy brands that control 75% but GURU has started to take market share by providing products containing organic plant-based ingredients, without artificial sweeteners or synthetic caffeine.

As the Company stated, “The brand connects with consumers who understand that getting closer to nature is the best way to connect to your own true nature.”

FIGURE 2: GURU’s Versus Legacy Incumbents