eResearch | Last week, Snowflake (NYSE: SNOW), a U.S. company focused on providing cloud-driven data query and analytics services, started trading on the New York Stock Exchange (“NYSE”) at $245 per share, after pricing its Initial Public Offering (“IPO”) at $120 per share. The IPO price was already raised from an expected range of $75 to $85 per share earlier this month.

eResearch | Last week, Snowflake (NYSE: SNOW), a U.S. company focused on providing cloud-driven data query and analytics services, started trading on the New York Stock Exchange (“NYSE”) at $245 per share, after pricing its Initial Public Offering (“IPO”) at $120 per share. The IPO price was already raised from an expected range of $75 to $85 per share earlier this month.

Snowflake issued 32.2 million shares for total proceeds of $3.9 billion, making it the largest public raise from a software company in history.

In the S-1 Prospectus filing, Snowflake revealed that Salesforce (NYSE: CRM), a leading enterprise SaaS platform, and Berkshire Hathaway (NYSE: BRK.A), an investment fund led by Warren Buffett, both agreed to purchase $250 million of stock at the IPO price in a private placement. Berkshire also agreed to buy an additional 4 million shares from a current Snowflake shareholder in a secondary transaction.

Berkshire recently made significant changes to its portfolio, including adding more tech stocks, as reported by eResearch on August 2020: Guru Watch – Berkshire Hathaway, Paulson & Co., and Pershing Square File 13F Reports with Major Changes in Portfolio Holdings

Snowflake’s stock is currently trading at $228.85 per share, a 91% increase since launching its IPO, with a market capitalization of $63 billion and trades at an EV/Revenue of over 150x.

Snowflake

Snowflake, previously known as Snowflake Computing, supports organizations adopt cloud strategies and enhance data capabilities through its Data Cloud Platform, which operates on three major public clouds (Amazon’s AWS, Google Cloud, and Microsoft’s Azure) across 22 regions around the world.

Frank Slootman, CEO of Snowflake, is an experienced enterprise tech executive, who has already launched two successful IPOs. In 2007, Mr. Slootman launched the IPO of Data Domain, a disaster recovery and backup hardware company that was taken private last year in a billion dollar deal. Five years later, in 2012, he led the IPO of ServiceNow (NYSE: NOW), a cloud computing platform.

In Snowflake’s S-1 Prospectus filing, it stated:

“Our platform solves the decades-old problem of data silos and data governance. Leveraging the elasticity and performance of the public cloud, our platform enables customers to unify and query data to support a wide variety of use cases. It also provides frictionless and governed data access so users can securely share data inside and outside of their organizations, generally without copying or moving the underlying data. As a result, customers can blend existing data with new data for broader context, augment data science efforts, or create new monetization streams. Delivered as a service, our platform requires near-zero maintenance, enabling customers to focus on deriving value from their data rather than managing infrastructure.”

Snowflake Cloud Data Platform

Snowflake’s Cloud Data Platform offers various data query and storage solutions, including:

- Data Engineering, which enables analytics teams to build and manage data pipelines using SQL.

- Data Lake, which serves as a central data repository or augments existing data lakes, with enhanced performance, scalability, and security. A Data Lake is a central data storage area that contains structured and unstructured data in its raw form.

- Data Warehouse, which provides business intelligence capabilities to generate comprehensive data insights.

- Data Science, which supports the transforming of massive amounts of raw data sets at scale.

- Data Applications, which develops new data-driven applications while integrating existing applications.

- Data Exchange, which enables the acquisition, sharing, and monetization of live data sets.

IMAGE 1: Snowflake’s Cloud Data Platform – Use Cases

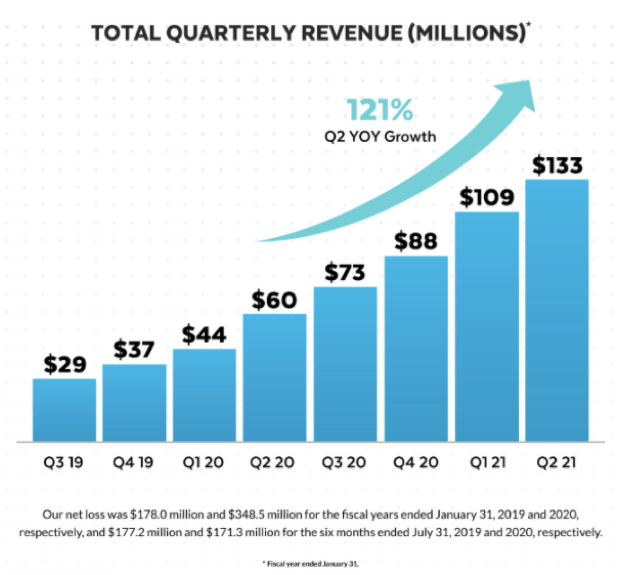

Snowflake Financials

Snowflake generates a majority of its revenue by charging a fee based on the amount of resources customers use for storing, computing, and transferring data. Customers can either contract for data capacity with a typical one-year term or pay through on-demand arrangements.

Other sources of revenue for Snowflake include professional services such as consulting, on-site technical services, and training.

For the fiscal year ended January 30, 2020, Snowflake reported Revenue of $265 million, a 174% increase year-over-year, with a Net Loss of $349 million compared with $178 million the prior year. In the last 12 months, revenue was over $400 million, growing at over 130% per year.

CHART 1: Snowflake Total Quarterly Revenue History

Snowflake Customers

![]() This year, FactSet Research Systems (NYSE: FDS), a financial data and software company, integrated select data sets onto Snowflake’s Cloud Data Platform. This integration allowed mutual customers to access and share FactSet’s content without having to manage complex processes or operate their own infrastructure.

This year, FactSet Research Systems (NYSE: FDS), a financial data and software company, integrated select data sets onto Snowflake’s Cloud Data Platform. This integration allowed mutual customers to access and share FactSet’s content without having to manage complex processes or operate their own infrastructure.

The Cloud Data Platform now includes FactSet’s fundamental, consensus estimates, geographic revenue, and supply chain data sets.

In 2017, Capital One Financial (NYSE: COF), a U.S. bank holding company, migrated its analytics workloads to Snowflake’s Cloud Data Platform, to increase data capacity and the number of concurrent user queries.

In 2017, Capital One Financial (NYSE: COF), a U.S. bank holding company, migrated its analytics workloads to Snowflake’s Cloud Data Platform, to increase data capacity and the number of concurrent user queries.

The Cloud Data Platform allowed Capital One to target and deliver personalized marketing campaigns, by integrating data at nearly real-time.

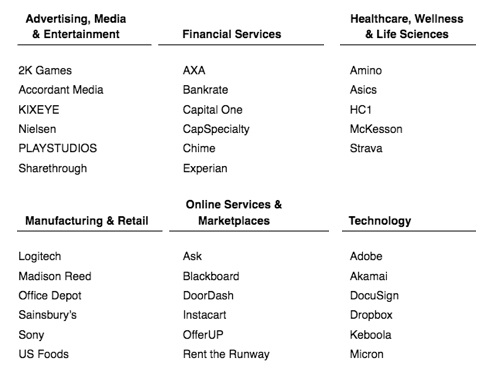

CHART 2: Snowflake’s Key Customers by Industry

Snowflake currently serves 3,117 customers, which includes 56 customers with greater than $1 million in annual revenue. Snowflake’s customers include seven companies from the Fortune 10 list and 146 companies from the Fortune 500 list, which together account for 30% of total revenues.

Global Cloud Analytics Industry

The cloud analytics market is quickly growing as businesses across various industries seek more efficient capabilities for storing, analyzing, and sharing data with multiple partners and customers in a secure manner.

According to MarketsandMarkets Research, the global cloud analytics industry was valued at $23 billion this year and is expected to reach $65 billion by 2025, growing at a CAGR of 23%.

Other recent eResearch articles related to the cloud industry:

- August 2020: Quarterly Cloud Update – Alibaba, Alphabet, Amazon, IBM, Microsoft, and Oracle

- May 2020: mCloud Released 2019 & Q1/2020 Financial Results with a 922% Revenue Gain in 2019

- May 2020: First Quarter Cloud Update – AMZN, MSFT, and GOOGL

- Feb 2020: Look to the Cloud to Diversify Your Technology Investments