eResearch | This week, Altice USA (NYSE: ATUS), a U.S. cable company, proposed a hostile bid to acquire telecommunication company Cogeco (TSX: CGO) and its subsidiary, Cogeco Communications (TSX: CCA), for C$10.3 billion in an all-cash deal. The acquisition offers a 36% premium for Cogeco’s shareholders and a 37% premium for Cogeco Communications’ shareholders.

However, the Audet family (www.audet.org), who owns controlling interests in the two companies, quickly rejected Altice’s offer on the same day of the proposal. Gestion Audem, the holding company of the Audet family, owns 69% of the voting shares in Cogeco and 83% of the voting shares in Cogeco Communications, providing sufficient control to block hostile bids.

Altice plans on only keeping Cogeco’s U.S. assets, which include Atlantic Broadband, a cable company servicing 11 U.S. states. The deal includes a side arrangement with Rogers Communications (TSX: RCI.B), who is expected to buy Cogeco’s Canadian assets for C$4.9 billion from Altice.

Altice and Rogers are expected to continue pursuing this acquisition, as it responded to the rejected proposal in a press release stating,

“We strongly believe that we presented a very attractive offer – one that would reward all Cogeco shareholders with a significant premium – and we stand by that offer. We remain committed to pursuing this transaction and are open to engaging with shareholders and the boards in a constructive dialogue.”

Cogeco

Cogeco is a Canadian telecommunication and media company who has been under the Audet family’s control in Quebec since its inception in 1957. Quebec is known to have high levels of protectionist tendencies, which deters local companies from transferring any operations over to locations outside of Quebec.

Cogeco is a Canadian telecommunication and media company who has been under the Audet family’s control in Quebec since its inception in 1957. Quebec is known to have high levels of protectionist tendencies, which deters local companies from transferring any operations over to locations outside of Quebec.

The hostile bid prompted backlash from the Quebec government. In an interview with Quebec City radio station, FM93 (CJFM), Quebec Premier Françoise Legault said,

“It is out of the question to let this Quebec company move its head office to Ontario.”

In addition, Quebec-based cable companies, such as Quebecor (TSX: QBR.B), are expected to react when companies from outside of Quebec, such as Rogers, attempt to acquire cable assets in Quebec.

Altice

Altice is one of the largest broadband operators in the U.S., providing communication, content, and advertising services to over 4.9 million residential and business customers across 21 states through its two brands, Optimum and Suddenlink.

Altice is one of the largest broadband operators in the U.S., providing communication, content, and advertising services to over 4.9 million residential and business customers across 21 states through its two brands, Optimum and Suddenlink.

In the past five years, Altice has made three acquisitions to expand its footprint in the U.S., including acquiring Cequel Corporation, who operates the Suddenlink brand, Cablevision Systems Corporation, who operates the Optimum brand, and Service Electric Cable T.V., who was acquired this past quarter.

Altice’s acquisition of Atlantic Broadband, Cogeco’s U.S. asset, would scale Altice’s telecommunication services in the east coast of the U.S., in states including Connecticut, Delaware, Florida, Maine, Maryland, New Hampshire, New York, Pennsylvania, South Carolina, Virginia, and West Virginia.

Rogers Communications

Rogers, a leading telecommunication company in Canada, recently confirmed its agreement with Altice to purchase all of the Canadian assets of Cogeco, upon approval and completion of the transaction. Rogers is Cogeco’s largest long-term shareholder, as Rogers owns 41% of the voting shares for Cogeco and 33% of the voting shares for Cogeco Communications.

Rogers, a leading telecommunication company in Canada, recently confirmed its agreement with Altice to purchase all of the Canadian assets of Cogeco, upon approval and completion of the transaction. Rogers is Cogeco’s largest long-term shareholder, as Rogers owns 41% of the voting shares for Cogeco and 33% of the voting shares for Cogeco Communications.

Rogers stands to benefit significantly if the deal follows through, as Rogers does not currently have a cable footprint in the Quebec region. Rogers would also be able to bundle its various wireless and data offerings into new packages for Cogeco’s cable customers.

On Friday, Rogers attempted to reassure the Quebec province over its attempt to buy the Canadian assets of Cogeco, with a recent press release stating,

“Upon successful completion of the Cogeco transaction, Rogers would ensure that Cogeco’s headquarters and management team remains in the province, including the operations of the company’s Quebec-based media assets”.

Joe Natale, CEO of Rogers, spoke on its acquisition of Fido in 2004, who’s headquarters remain in downtown Montreal, providing proof of Rogers’ commitment to Quebec.

Stock Price Impacts

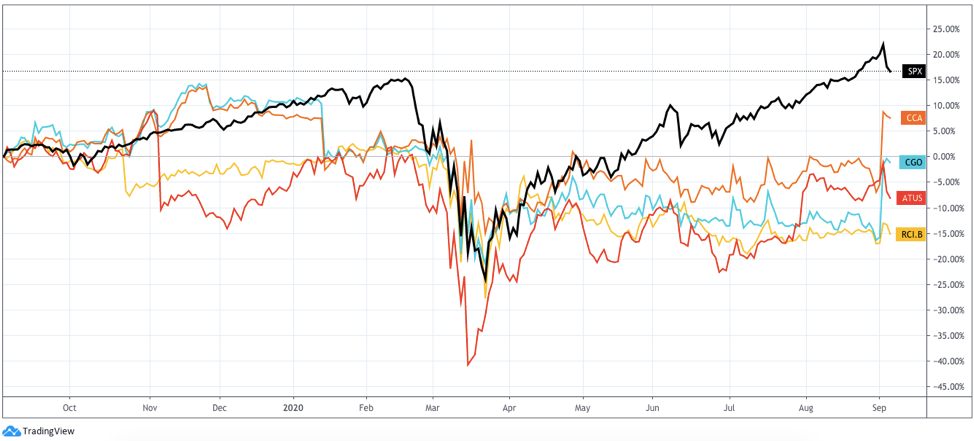

Altice’s stock price is currently trading at $26.65 per share, a 4% decrease since the bid offer and a 9% decrease in the past year.

Cogeco’s stock price is currently trading at C$92.60 per share, a 17% increase since the bid offer and a 2% decrease in the past year.

Cogeco Communications’ stock price is currently trading at C$113 per share, a 14% increase since the bid offer and a 9% increase in the past year.

Rogers’ stock price is currently trading at C$55.52 per share, a 2% increase since the bid offer and a 15% decrease in the past year.

As Altice and Rogers attempts to persuade Cogeco’s board and shareholders, it is possible that the bid could be increased to a much more attractive offer. Only time will tell if the offer will close.

CHART 1: S&P 500 (black) vs ATUS (red), CCA (orange), CGO (blue), and RCI.B (yellow) – Past Year Stock Performance