eResearch | Last week, Analog Devices, Inc. (NASDAQ: ADI), a U.S. semiconductor company focused on signal processing and power management, announced a US$21 billion all-stock acquisition of Maxim Integrated Products Inc. (NASDAQ: MXIM), resulting in a new semiconductor powerhouse with a potential collective enterprise value of over US$60 billion.

The two semiconductor businesses will complement each other as Maxim’s expertise in the automotive and data centre markets will be merged with Analog Devices’ experience in industrial, communication, and healthcare markets.

The two semiconductor businesses will complement each other as Maxim’s expertise in the automotive and data centre markets will be merged with Analog Devices’ experience in industrial, communication, and healthcare markets.

Vincent Roche, CEO of Analog Devices, said “Maxim is a respected signal processing and power management franchise with a proven technology portfolio and impressive history of empowering design innovation. Together, we are well-positioned to deliver the next wave of semiconductor growth, while engineering a healthier, safer and more sustainable future for all.”

The acquisition provided Maxim shareholders 0.63 shares of Analog Devices per one Maxim share, which valued Maxim at US$78.43 per share, a 22% premium to the closing price on the prior trading day before the merger announcement. Maxim shareholders are expected to own approximately 31% of Analog Devices.

Maxim’s CEO, Tunc Doluca and one other director will join Analog Devices’ board.

Maxim’s CEO, Tunc Doluca and one other director will join Analog Devices’ board.

The merger is expected to close next summer, subject to shareholder approvals from both companies, in addition to U.S. and certain non-U.S. regulatory approvals.

Merger Benefits and Synergies

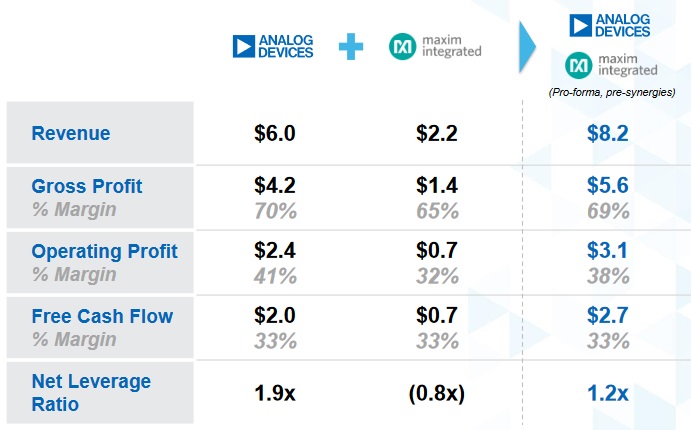

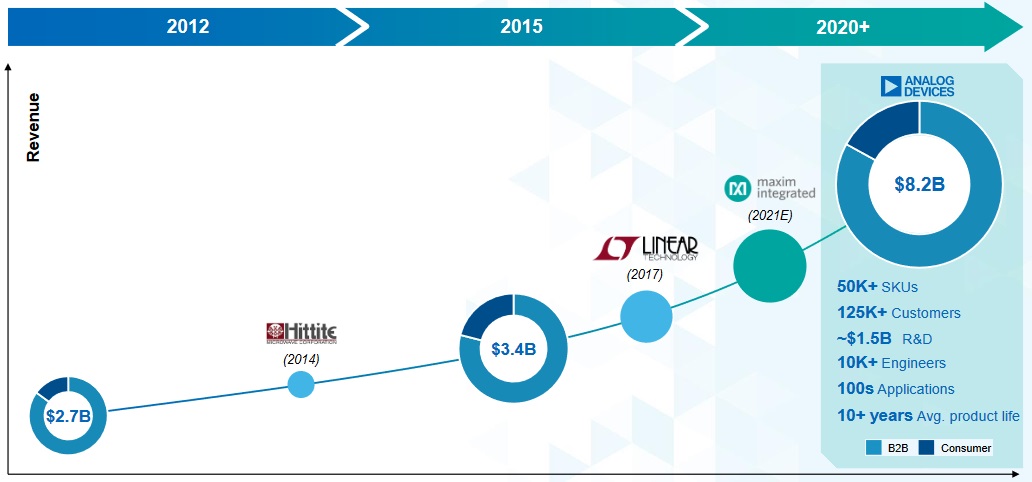

Together, Analog Devices and Maxim will have a combined expected revenue of US$8.2 billion with free cash flows of US$2.7 billion, serving more than 125,000 customers with more than 50,000 products.

Once the deal closes, by the end of year two, cost synergies are expected to reach US$275 million, attributed to overall lower operating expenses and cost of goods sold. Cost synergies from manufacturing optimization are expected to be realized by the end of year three.

CHART 1: Analog Devices + Maxim – Combined Financials

The merged companies will be able to synergize manufacturing and R&D to develop more customized semiconductor products for technologies with growing demand, such as data centres, autonomous vehicles, and 5G communication.

Analog Devices and Maxim will have a combined 10,000 engineers working with an approximately US$1.5 billion annual R&D budget.

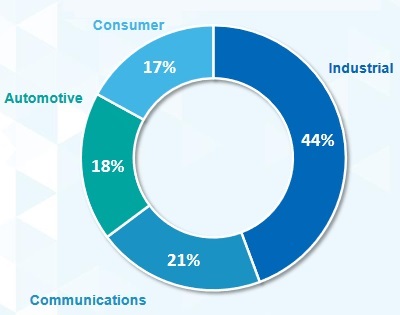

CHART 2: Analog Devices + Maxim – Market Segmentations

Analog Devices

Analog Devices is a Massachusetts-based manufacturer of semiconductors for signal processing products for both analog and digital signalling, which are used by various industries to convert, condition, and process external factors such as light, sound, and temperature into electrical signals.

Analog Devices derives more than 85% of its revenues from B2B markets including industrial, communications, automotive, and consumer markets.

Three years ago, Analog Devices acquired semiconductor manufacturer Linear Technology Corp., another U.S. based company focused on analog integrated circuits, for US$14.8 billion.

In 2014, Analog Devices completed the acquisition of Hittite Microwave Corporation, a designer and manufacturer of high performance integrated circuits, modules, subsystems and instrumentation for RF, microwave and millimeter wave applications, for US$2 billion.

From these investments, Analog Devices illustrates its track record of driving revenue growth through M&A.

CHART 3: Analog Device’s Revenue Growth through Acquisitions

On May 20, Analog Devices announced financial results for its second quarter of fiscal 2020, which ended May 2, 2020.

Analog Devices FQ2/2020 – Highlights

- Revenue of US$1.32 billion, a 14% decrease year-over-year, with Gross margins dropping to 64% from 68% the prior year.

- Operating expenses of US$503 million, a 11% decrease year-over-year, consisting of R&D costs of US$252 million, SG&A costs of US$142 million, Amortization costs of US$107 million, and Special charges costs of US$1.3 million.

- Net income of US$268 million, a 27% decrease year-over-year.

- Balance Sheet consists of Cash and cash equivalents of US$785 million, Accounts receivables of US$588 million, Goodwill of US$12.3 billion, Current liabilities of US$1.58 billion, and Long-term liabilities of US$8.18 billion.

- Cash dividend of US$0.62 per share for the quarter.

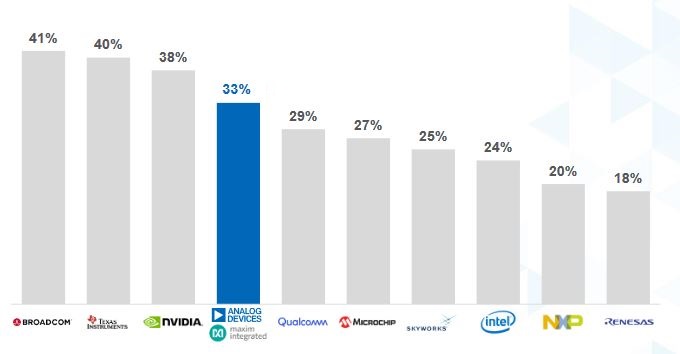

Analog Devices expects the combined company to be accretive to free cash flow at close with a Free Cash Flow margin of 33% and yield a stronger balance sheet, with a pro forma net leverage ratio of approximately 1.2x.

With the cash flow, Analog Devices plans to reinvest in the business, maintain a dividend policy of 7-15% annual growth and annual share buybacks to reduce the share count.

CHART 4: Semiconductor Industry Free Cash Flow Margins

Analog and Mixed Signal Device Industry

As technology impacts numerous industries, more companies are seeking solutions for collecting, curating, and communicating data, which is increasing demand for signal processing semiconductor products.

According to Global Info Research, the global analog and mixed signal device market reached US$56.1 billion last year, and is expected to increase to US$62.3 billion by 2025, growing at a CAGR of 2.7%.

If the merger between Analog Devices and Maxim closes, they will be a powerhouse in the semiconductor analog and mixed signalling industry.

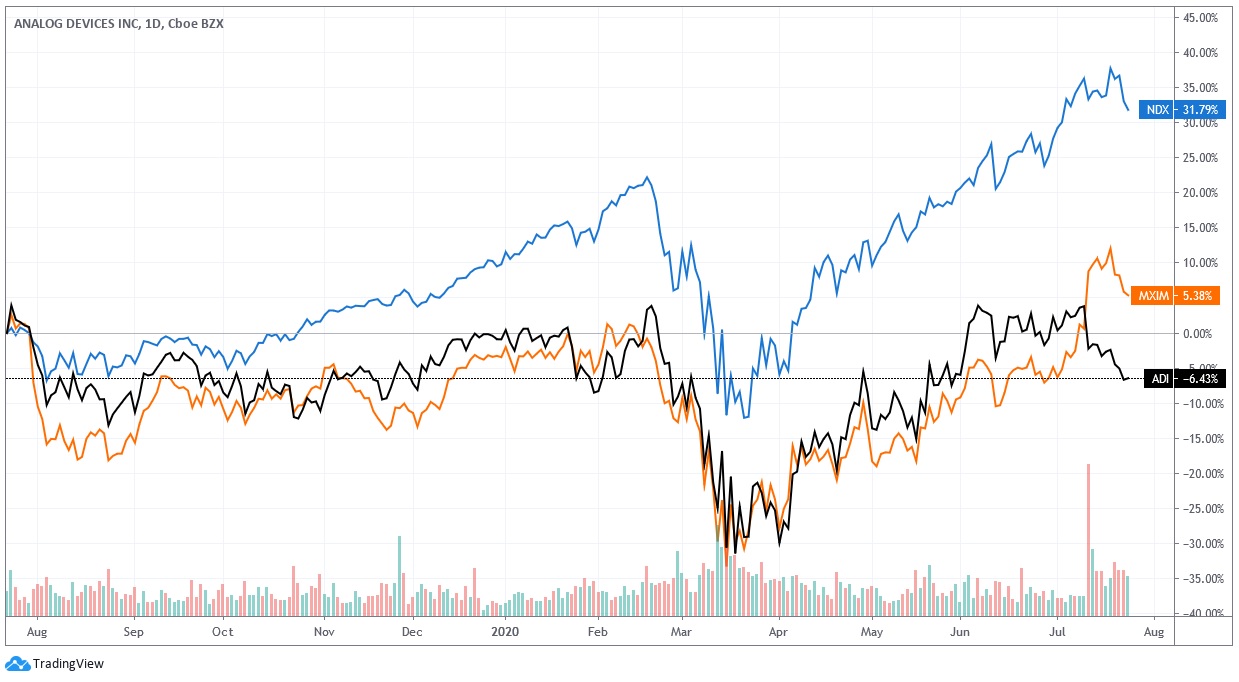

CHART 5: 1-Year Comparison Chart – ADI (black line, down 6.4%), MXIM (orange line, down 5.4%) and NASDAQ 100 (blue line, up 31.8%)