eResearch | On May 7, 2020, Cresco Labs (CSE: CL) announced completion of the expansion project at its cultivation and manufacturing facility in Brookville, Pennsylvania.

The expansion upgrades the size of its facility by 66,000 sq. ft to a total of 88,000 sq. ft of indoor and greenhouse space. As part of the expansion, CL also increased its manufacturing efforts, increasing butane and ethanol capacity by 300% and 90%, respectively.

The expansion upgrades the size of its facility by 66,000 sq. ft to a total of 88,000 sq. ft of indoor and greenhouse space. As part of the expansion, CL also increased its manufacturing efforts, increasing butane and ethanol capacity by 300% and 90%, respectively.

Pennsylvania is a market that is often overlooked by investors. Nevertheless as of last month the limited license market has already reached 284,000 medical patients with 80 dispensaries. This equates to ~3% of the adult population within the State.

PHOTO 1: Cresco Labs Brookville, Pennsylvania Facility

CL entered Pennsylvania in 2018 and currently has 3 dispensaries open with another 3 expected to open in the future in the Philadelphia area.

While the new facility comes online in several phases, we can estimate how much this facility may be producing when it has fully ramped up in 2021. We believe the impact of this facility would be material, as we estimate it could represent approximately $88 million in wholesale flower revenue and this does not include revenue from manufacturing. This new revenue bodes well as the company is currently operating at a run rate of approximately $160 million/year.

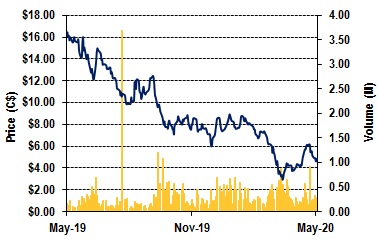

Cresco currently trades at a discount to peers, 1.2x 2021 sales and 4.5x 2021 EBITDA, compared to other major U.S. peers (>$500M in Market Cap), which trade at an average of 2.1x sales and 7.6x EBITDA.

CL is also oversold compared to peers, down 45% year-to-date, compared to the average down 25%.

//

| Company | Cresco Labs |

| Ticker | CSE:CL |

| Close | $4.87 |

| 52 Week Range | $2.81 / $16.26 |

| Shares O/S (M) | 212.2 |

| Market Cap (M) | $1,033.6 |

| Ent. Value (M) | $1,269.5 |

| Dividend | $0.00 |

| Dividend Yield | 0.0% |

| Revenue (2019) (M) | $124.19 |

| EBITDA (2019) (M) | -$22.61 |

| Website | www.crescolabs.com |

| As of May 08, 2020 |