eResearch | On April 15, Xebec Adsorption Inc., (TSXV: XBC), released its Q4/2019 and 2019 annual results with a 144% gain in annual revenue and Adjusted EBITDA of $6.3 million.

Xebec is a global provider of gas generation, purification and filtration solutions for the industrial, energy and renewables marketplace. The Company has seen an uptick in sales from their CleanTech solutions, including systems to produce Renewable Natural Gas (RNG) from animal manure and food waste, and provided 2020 revenue growth guidance in the 60%-80% range.

Xebec is a global provider of gas generation, purification and filtration solutions for the industrial, energy and renewables marketplace. The Company has seen an uptick in sales from their CleanTech solutions, including systems to produce Renewable Natural Gas (RNG) from animal manure and food waste, and provided 2020 revenue growth guidance in the 60%-80% range.

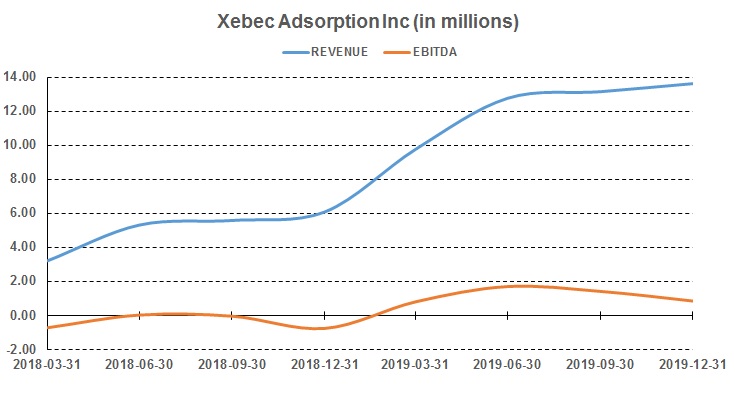

2019 Financial Results

Xebec posted revenue of $13.6 million in Q4/2019 versus $6.1 million in Q4/2018, a 123.7% increase, and a record for quarterly revenue. The Q4/2019 Adjusted EBITDA was $1.9 million, up from a loss of $760 thousand, a year ago.

Xebec recorded record annual revenue of $49.3 million, primarily by the high volume of major CleanTech contracts and the consolidation of revenue from the Compressed Air International (“CAI”) acquisition in January 2019.

EBITDA was down year-over-year and was negatively impacted by selling and administrative expenses that were higher primarily due to an organizational scale-up of employees and associated costs to support the increased level of sales and order backlog.

As the Company completed two equity financings in Q3 & Q4/2019 totaling $35.2 million, working capital increased substantially from $5.3 million to $36.9 million, positively affecting the company’s liquidity ratios. Current and quick ratios went up from 1.58 to 3.2 and from 1.01 to 2.77, respectively.

The gross margin presented a gain of 5%, from 25% to 30%, on a quarterly basis, explained by increased sales from the higher margin CleanTech segment.

2020 Management Guidance

For 2020, management guided to revenue in the range $80 to $90 million, EBITDA margins in between 11% to 13%, and net margins within the 7% to 9% range. Guidance is supported by an increasing order backlog, now at $99.3 million as reported by the Company.

COVID-19 Impact

Xebec expects a moderate impact from COVID-19 on the first quarter results due to a temporary shutdown of their operations in Shanghai. The facility now is fully operating, and the negative impact should not last throughout the year. As for the operations in Italy and North America, they have noticed delays from suppliers based in Northern Italy because of the transportation shutdown and operations in North America are operating almost at full capacity.

“We have been dealing with the novel coronavirus since its first outbreak in China 12 weeks ago,” said Kurt Sorschak, Xebec’s president and CEO, in the press release. “This has led Xebec to prepare for a similar situation in North America and we are in the fortunate situation to have all necessary protocols in place to continue operating in this challenging environment.”

Xebec Announces $10M Unsecured Loan Facility

On May 6, 2020, Xebec announced that it has entered into a 5-year, $10 million loan agreement with the Fonds de solidarité FTQ (the “Fonds”). The debt will be used for working capital and general corporate purposes but the main reason is to fund Xebec’s organic and inorganic growth as well as to keep investing in renewable gas infrastructure projects.

“We are pleased to offer Xebec this loan after following the company’s developments closely for more than a year. I am impressed with the results they have achieved. This loan will help them continue their mission of decarbonizing the gas grid. I believe that we are in the early stages of the renewable gas transition and Xebec will be a key player in the industry. This is a positive first step in building our relationship with the company and we look forward to the years ahead.”

– Dany Pelletier, Vice President, Fonds de solidarité FTQ”

M&A Activity

Xebec continues to pursue M&A opportunities and believes acquisitions are a critical component in supporting their growth by enabling service and support throughout North America.

In December 2019, they announced their second acquisition as part of this strategy, when they acquired CDA Systems LLC (“CDA”). CDA is a leading distributor and service provider of oil-free air compressors, air dryers, and filtration systems in the San Francisco Bay area.

Xebec expects to make another two to three acquisitions in 2020.

//

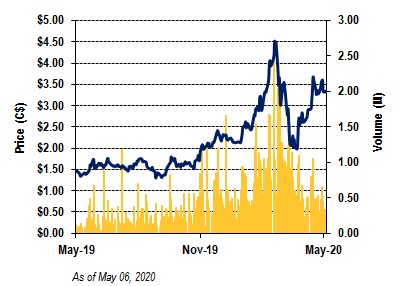

| COMPANY | XEBEC |

| Ticker | TSXV:XBC |

| Close | $3.36 |

| 52 Week Range | $1.23 / $4.67 |

| Shares O/S (M) | 87.2 |

| Market Cap (M) | $292.9 |

| Ent. Value (M) | $268.8 |

| Dividend | $0.00 |

| Dividend Yield | 0.0% |

| Revenue (2019) (M) | $49.32 |

| EBITDA (2019) (M) | $4.65 |

| Website | www.xebecinc.com |

| Analyst 1-Year Target Price Estimates | |

| Average | $4.81 |

| Low/High | $4.00 / $5.00 |

| Number of Analysts | 9 |

| As of May 06, 2020 | |