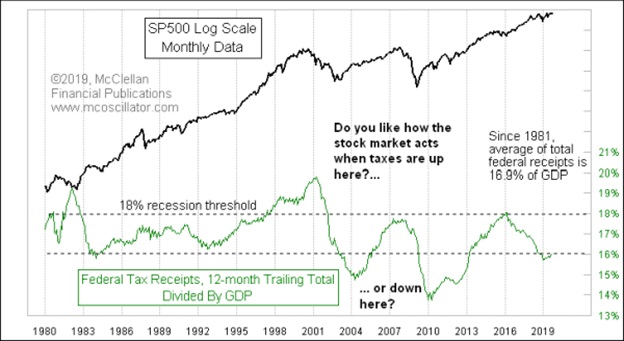

eResearch | For the 12 months ending September 30, 2019, U.S. federal tax receipts amounted to 16% of GDP. Tom McClellan states that, whenever the government raises taxes too high, recessions and bear markets duly follow which, in turn, leads to lower employment and thus lower federal tax income. It becomes a vicious cycle and akin to killing the goose that lays the golden eggs.

18% Is Danger Level

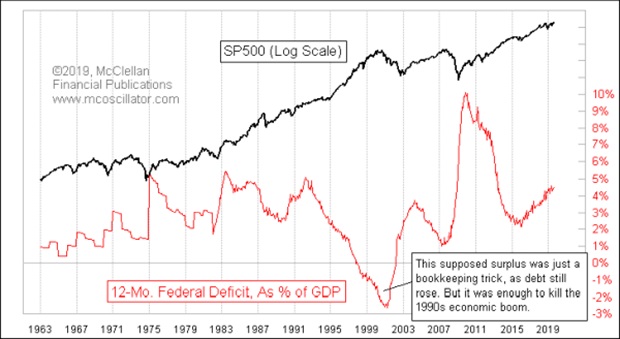

Historically, when the tax receipt percentage of GDP reaches 18%, economic pain results. In fact, 16% is the start of trouble. Over the last 40 years, the average percentage has been 16.9%. As the following graph shows, in the case of stock market performance, lower is better.

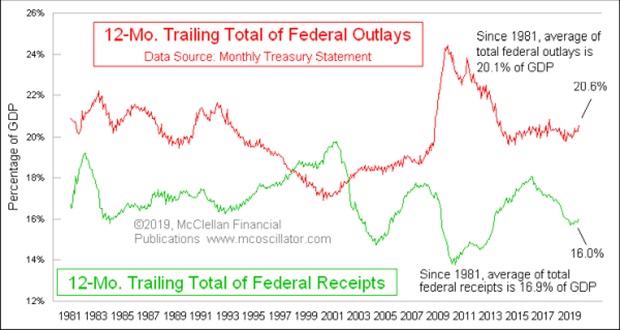

Federal Receipts Versus Federal Outlays

Even with higher percentages of federal tax receipts to GDP, U.S. government spending has been even higher. Higher spending relative to less tax receipts means the U.S. government is not paying its bills. If you or I did that to the federal government, they would be all over us to pay up or incur a penalty, or both. But the government just runs ever-increasing deficits.

The following chart shows that, relative to GDP, the 40-year average of federal tax receipts of 16.9% is far below the equivalent federal spending rate of 20.9%. Governments are never one for austerity when votes count.

Spending Problem

For the latest fiscal year, which ended September 30, U.S. total receipts rose 4.4%, but total expenditures increased 8.2%. The elected representatives in Washington cannot help themselves: it is so easy to spend money when it is not YOUR money. But, wait a minute, it is OUR money. Thus it is a spending problem that is only likely to get worse. The percentage of people entering their retirement years over the next decade and drawing their retirement benefits will increasingly outpace the percentage of people dying.

As the following chart shows, out-of-control deficits result in financial stimulus and that has been very positive for the stock market. But, ultimately, you cannot have your cake and eat it, too.

//