eResearch | The Top Ten Portfolio is almost keeping pace with S&P/TSX Composite Index and essentially marked time these last two weeks, declining an insignificant 0.5%. However, the S&P/TSX Composite Index rose 0.6% so the Portfolio under-performed on a comparative basis.

19.9% Gain YTD

Our initial investment was $500,000 so, at $599,601, the Portfolio is ahead by 19.9%, which includes dividends received and trading profits.

Cash

The Portfolio’s cash component stands at 15%. Given our increasing nervousness for a near-term correction, which might be now underway, we are looking for opportunities to raise the amount of cash on hand. If we are right, and the market sells off a bit, the additional cash will come in handy to take advantage of stocks that have fallen to attractive levels.

Market Decline

While we believe that an imminent market pull-back could be in the cards, we also believe that any decline will be shallow and short-lived. A pull-back of 5%-7% would be welcome if it opens up attractive buying opportunities.

Worst and Best Performers

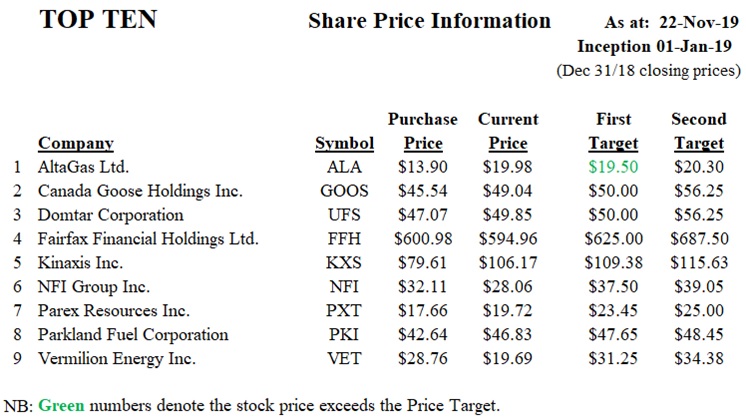

Currently, there are 3 of 9 stocks in the Portfolio that are “under water”. These are Fairfax Financial Holdings, NFI Group, and Vermilion Energy. The best performers continue to be AltaGas and Kinaxis. We raised the Price Targets for both Kinaxis and Parkland Fuel as they have risen markedly over the past two months.

The current portfolio is presented below:

You can read our entire report here: TopTen_112219

///