eResearch | In our latest video, Chris Thompson from eResearch delves into the Canadian Information and Communications Technology (ICT) sector’s mergers and acquisitions (M&A) strategies, with a special focus on the effectiveness of roll-up strategies.

This 22-page report titled, “Roll-Up Strategies in the Canadian ICT Industry,” offers a thorough overview of the sector’s M&A activities, highlighting the strategic moves of key players and the overall impact on the industry’s growth.

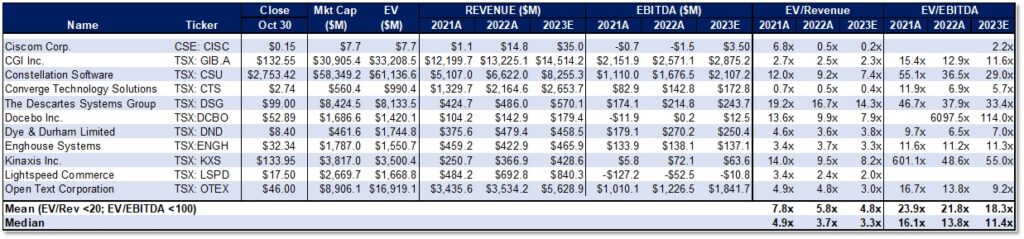

The report examines how companies like Constellation Software (TSX: CSU) and Ciscom Corp. (CSE: CISC) are at the forefront of employing roll-up strategies to consolidate their market positions, enhance their service offerings, and achieve economies of scale.

The 22-page report can be downloaded here: eR-Industry_Report-ICT-M&A-2023-10-30-FINAL

Report Highlights:

Our concise yet comprehensive document navigates through the Canadian ICT sector’s M&A landscape, shedding light on:

- The fundamentals of roll-up strategies and their significance in the ICT sector.

- An overview of Canadian companies making waves through strategic acquisitions, with a spotlight on Constellation Software’s and Ciscom Corp.’s aggressive expansion tactics.

- The driving forces behind the surge in M&A activities within the Canadian ICT industry, including technological demands, demographic shifts among entrepreneurs, and the post-pandemic economic recovery.

- Insights into the potential for future growth and investment opportunities in the sector.

Four Key Takeaways for Investors Considering the Canadian ICT M&A Space:

- Strategic Growth: Understanding how roll-up strategies are being utilized to foster growth and competitiveness in the ICT sector.

- Sector Dynamics: Insights into the ICT sector’s evolving landscape and how companies are positioning themselves through acquisitions.

- Investment Opportunities: Identifying potential investment gems in the Canadian ICT sector poised for significant growth.

- Market Trends: Grasping the factors driving M&A activities, including technological advancements and demographic changes.

Company Spotlight – Ciscom Corp. (CSE: CISC):

- The report highlights Ciscom which recently went public and focuses on acquisitions in the ICT sector.

- Ciscom plans to acquire Small and Medium-sized Enterprises (SMEs) with strong growth potential and proven historical profitability.

- It typically targets independent ICT businesses with revenue ranging from $10 million to $30 million per year (excluding COVID-19 impacts) and a history of positive cash flow.

- Ciscom employs a blend of cash and shares for its acquisition strategy. This approach provides sellers with a favorable exit opportunity at a fair valuation, and some immediate liquidity with the cash component but also offers the potential for long-term value growth through ownership in the combined entity.

- Ciscom completed its first two acquisitions in 2022 and is expected to book at least $35 million of revenue in 2023, up from $14.8 million in 2022.

Companies Mentioned in this Report include:

- Ciscom Corp. (CSE: CISC)

- CGI Inc. (TSX: GIB.A | NYSE: GIB | LSE: 0A18 | FSE: CJ5A)

- Constellation Software Inc. (TSX: CSU | OTC: CNSWF | FSE: W9C)

- Converge Technology Solutions Corp. (TSX: CTS | OTC: CTSDF | FSE: 0ZB)

- Descartes Systems Group Inc. (TSX: DSG | NASDAQ: DSGX | FSE: DC2)

- Docebo Inc. (TSX: DCBO | NASDAQ: DCBO)

- Dye & Durham Ltd. (TSX: DND | OTC: DYNDF)

- Enghouse Systems Ltd. (TSX: ENGH | FSE:3E4 | OTC: EGHSF)

- Kinaxis Inc. (TSX: KXS | FSE: 9KX | OTC: KSXCF)

- Lightspeed Commerce Inc. (TSX: LSPD | NYSE: LSPD)

- Open Text Corp. (TSX: OTEX | NASDAQ: OTEX | FSE: OTX)

The 22-page report can be downloaded here: eR-Industry_Report-ICT-M&A-2023-10-30-FINAL

FIGURE 2: Publicly-Traded Comps

Notes: All numbers in CAD unless otherwise stated. The author of this report, and employees, consultants, and family of eResearch may own stock positions in companies mentioned in this article and may have been paid by a company mentioned in the article or research report. eResearch offers no representations or warranties that any of the information contained in this article is accurate or complete. Articles on eresearch.com are provided for general informational purposes only and do not constitute financial, investment, tax, legal, or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this information should consult with a financial advisor. The article may contain “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements are based on the opinions and assumptions of the Company’s management as of the date made. They are inherently susceptible to uncertainty and other factors that could cause actual events/results to differ materially from these forward-looking statements. Additional risks and uncertainties, including those that the Company does not know about now or that it currently deems immaterial, may also adversely affect the Company’s business or any investment therein. Any projections given are principally intended for use as objectives and are not intended, and should not be taken, as assurances that the projected results will be obtained by the Company. The assumptions used may not prove to be accurate and a potential decline in the Company’s financial condition or results of operations may negatively impact the value of its securities. Please read eResearch’s full disclaimer.