eResearch is pleased to publish an Update Equity Research Report on DATA Communications Management Corp. (TSX:DCM | OTC: DCMDF).

We are maintaining a Buy rating and increasing the one-year price target to $4.50 from $4.20

You can download our 18-page Equity Research Report by clicking on the following link: eR-DCM-2022_11_11_UR-2022-Q3_FINAL

Company Overview

DCM is a Canadian-based provider of marketing and business communication solutions to companies in North America. Its technology-enabled content and workflow management capabilities solve the complex branding, communications, logistics, and regulatory requirements of leading enterprises, so its customers can accomplish more in less time. Its services include printing, data & content management, labels & asset tracking, location-specific marketing, and multimedia campaign management.

Quarterly Update:

- Revenue in the Quarter Up 11.4% Year-over-Year:

- DCM reported Revenue of $63.4 million in Q3/2022, up 11.4% from $56.9 million in Q3/2021, and higher than our estimate of $57.2 million.

- The Company commented that revenue growth was driven by a combination of additional revenue from existing clients and new business wins.

- DCM also reported that it received more than $30 million in new business year-to-date and its tech-enabled service pipeline remained strong.

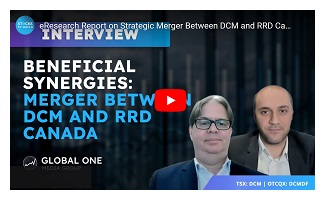

- Revenue per employee over the past year reached $287,800, up more than 40% over the last five years.

Figure 1: Revenue Per Employee

- Gross Profit:

- The Company reported Gross Profit of $19.9 million in Q3/2022, up $2.7 million (15.8%) from $17.2 million in the same quarter last year.

- Gross Margin was 31.4% in the third quarter, up 1.2% from 30.2% in Q3/2021, and slightly higher than our estimate of 30.0%.

- Selling, General, and Administrative (SG&A):

- SG&A expenses were $14.9 million in Q3/2022, up 31.5% from $11.3 million in Q3/2021, and up from $13.8 million in the previous quarter.

- In Q3/2022, SG&A expenses represented 23.4% of Total Revenue, up 3.6% from 19.9% in the same quarter last year.

- The increase in SG&A expenses was attributable to wage inflation and increased commissions due to higher sales year-over-year.

- Net Income:

- The Company reported Net Income of $2.8 million in Q3/2022, an increase of 175.8% from $1.0 million in Q3/2021.

- Basic and Diluted EPS in the quarter was $0.06 compared to $0.02 in the same quarter last year.

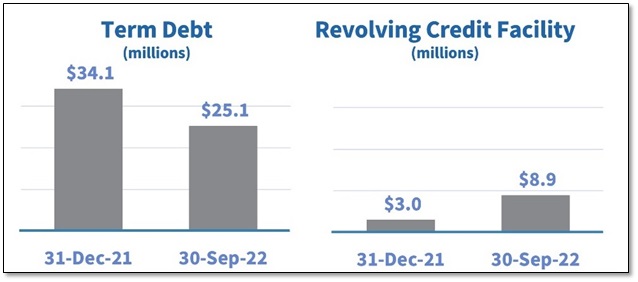

- Company Continues to Reduce Debt:

- As of September 30, 2022, DCM had $1.9 million in cash but continues to maintain a low cash balance to reduce the borrowing charges under its Bank Credit Facility.

- DCM continued to pay down the higher cost fixed term debt that is now at $25.1 million, down from $34.1 million at the end of 2021.

- The Company reported that due to supply-side issues, it continued to maintain a higher inventory level than normal to ensure that it could meet client demands. DCM continues to expect working capital improvements as the raw material market normalizes.

Figure 2: DCM Continued to Pay Down Higher Cost Fixed-Term Debt

- Valuation Multiples Still Trading Below Peers.

- DCM is currently trading at 0.5x 2022 EV/Rev compared with Printer comps trading at 1.0x EV/Rev, and well below the Digital Asset Management & Tech-Enabled Workflow providers trading at 3.5x and 1.9x EV/Rev, respectively.

Financial Analysis & Valuation:

- We are raising our 2022 Revenue estimate to $265.3 million from $259.1 million based on the higher revenue in Q3/2022. We are maintaining our revenue multiple at 0.8x and our EBITDA multiple at 7.0x, but increased the WACC to 14% from 10%.

- We estimate an equal-weighted price target of $4.44 based on a DCF valuation ($6.96/share), a Revenue Multiple valuation ($3.45/share), and an EBITDA Multiple valuation ($2.90/share).

We are maintaining a Buy rating and increasing the one-year price target to $4.50 from $4.20.

You can download the full 18-page report by clicking here: eR-DCM-2022_11_11_UR-2022-Q3_FINAL

Other DCM Research Reports:

- Update Report (August 23, 2022): Strong Business Momentum Continues with Y/Y Revenue Growth of Over 23% in Q2/2022

- Update Report (July 29, 2022): DCM Corporate Strategy Drives Business Transformation with Q1/2022 Producing Largest Revenue Growth in 4 Years

- Update Report (April 29, 2022): DCM’s Quarterly (Q4/2021) Revenue Improves Y/Y as a Sign of COVID Impacts Easing

- Update Report (November 24, 2021): DCM Q3 Financials In-line as Consolidation Improves Cash Flow

- Initiation Report (August 16, 2021): Digital-First Strategy and Tactical Consolidation Drives EBITDA Growth at DCM

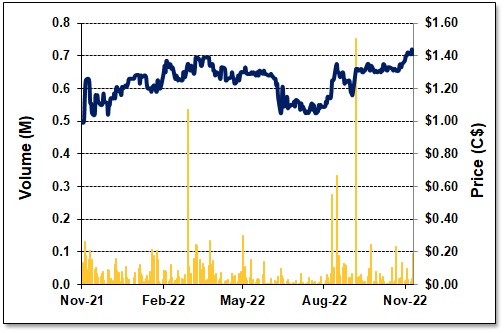

FIGURE 3: One-Year Stock Chart

Notes: All numbers in CAD unless otherwise stated. The author of this report, and employees, consultants, and family of eResearch may own stock positions in companies mentioned in this article and may have been paid by a company mentioned in the article or research report. eResearch offers no representations or warranties that any of the information contained in this article is accurate or complete. Articles on eresearch.com are provided for general informational purposes only and do not constitute financial, investment, tax, legal, or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this information should consult with a financial advisor. The article may contain “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements are based on the opinions and assumptions of the Company’s management as of the date made. They are inherently susceptible to uncertainty and other factors that could cause actual events/results to differ materially from these forward-looking statements. Additional risks and uncertainties, including those that the Company does not know about now or that it currently deems immaterial, may also adversely affect the Company’s business or any investment therein. Any projections given are principally intended for use as objectives and are not intended, and should not be taken, as assurances that the projected results will be obtained by the Company. The assumptions used may not prove to be accurate and a potential decline in the Company’s financial condition or results of operations may negatively impact the value of its securities. Please read eResearch’s full disclaimer.