eResearch is pleased to publish a 19-page Update Report on Datable Technology Corporation (TSXV:DAC | OTCQB: TTMZF).

eResearch is pleased to publish a 19-page Update Report on Datable Technology Corporation (TSXV:DAC | OTCQB: TTMZF).

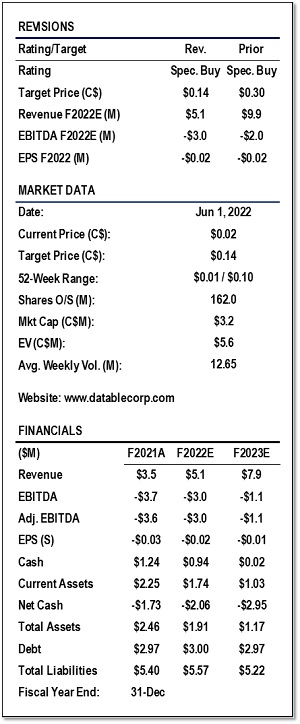

We are decreasing our one-year price target to $0.14/share from $0.30/share but maintaining our Speculative Buy rating.

You can download our 19-page Update Report by clicking on the following link: eR-Datable-2022_05_31_UR-FINAL

Company Description:

Datable Technology Corporation is a Canadian-based software development and technology company operating in the consumer online advertising and marketing sectors. Datable offers a software as a service (“SaaS”)-based Consumer Lifecycle and Data Management Platform called PLATFORM³ that enables consumer packaged goods (“CPG”) companies and consumer brands to build and launch promotions, special offers, and loyalty programs on mobile phones, websites, and microsites. Datable focuses on the collection and data mining of first-party data, information collected directly from consumers, and allows companies to communicate & build relationships directly with the consumers.

Investment Highlights:

Strong Organic Revenue Growth Continues.

Strong Organic Revenue Growth Continues. - Datable’s revenue increased by 90% Y/Y in Q4/2021 and 79% Y/Y for 2021. Q1/2022 revenue increased by 28% Y/Y and the Company already has nearly $3.3 million in revenue under contract for 2022.

- For 2021, revenue sharply rose due to an overall increase in average contract value, project deliveries, and transactional orders. In addition, during 2021, Datable signed 39 new agreements to provide PLATFORM³ to leading brands, which increased the total contracted revenue for 2021 to over $5.8 million compared to approximately $5.0 million in 2020.

- In 2021, US-based revenue increased to $3.1 million or 87.0% compared to $1.6 million or 81.5% of revenue in 2021. In the first quarter of 2022, US-based revenue increased to $0.8 million or 90% compared to $0.6 million or 94% of revenue in Q1/2021.

- SaaS Platform Focuses on Consumer First-party Data for Fortune 500 Companies.

- As governments update privacy laws and browser “cookies” are set to disappear, first-party data (opt-in) solutions become key for engaging with online consumers.

- Datable is currently working with 25 large CPG companies and 50 of the world’s “top brands”. In 2022, the Company expects to launch its consumer portal and data marketplace.

- Low Valuation Multiple Compared to SaaS Peers.

- Datable is currently trading at 1.1x our 2022E revenue estimate of $5.1 million and well below Canadian comparable companies.

- Datable’s low revenue multiple highlights the potential for its share appreciation.

Recent Developments & 2022 Guidance

- On March 3, 2022, Datable announced that it elected not to proceed with the acquisition of Adjoy Inc. operating under Dabbl. Datable believed that to achieve meaningful milestones with the combined company, more than $2.5 million in funding would be required, and a larger new financing would overly dilute the current Datable shareholders.

- In 2021, Datable started building the next generation of PLATFORM³ 6.0. This version was designed to incorporate new infrastructure, and back-end and front-end technologies that automate the integration, delivery, and testing of the Company’s services. The objective of building this new version was to significantly reduce the Company’s time to deploy new solutions for its clients.

- In 2022, Datable expects to launch its own consumer portal and data marketplace. The first version would leverage foundational technology from the Company’s proprietary SaaS platform – PLATFORM³.

- The Company announced that up until April 29, 2022, it had signed 12 new agreements (3 more than the same period in 2021), which, paired with license agreements signed in prior periods, amount to nearly $3.3 million in revenue under contract for 2022 and over $3.0 million is expected to be recognized as revenue in 2022.

- In 2022, Datable anticipates Gross Margin to be 40% to 50%, depending on product mix and expected improvements in operational efficiency. In our model, we estimate that Gross Margin is 45% in 2022.

- Datable expects its R&D expenses to increase as the Company seeks to expand and develop PLATFORM³, as well as to invest in creating new technology and products to generate additional revenues.

Financial Analysis & Valuation:

- We estimate Datable’s revenue as follows:

- 2022E Revenue: $5.1 million;

- 2023E Revenue: $7.9 million.

- Because of the current market conditions, we are now solely basing our Target Price on the Revenue Valuation as opposed to the equal-weighted price per share (Revenue Valuation and DCF) used in our previous report.

- We estimate a price target of $0.14 based on a Revenue Multiple valuation of 5.0x and a One-Year Forward Revenue Estimate of $6.7 million.

- We are decreasing our one-year price target to $0.14 from $0.30 but maintaining our Speculative Buy rating.

To understand more about the Company valuation and assumptions, you can download our 19-page Update Report by clicking on the following link: eR-Datable-2022_05_31_UR-FINAL

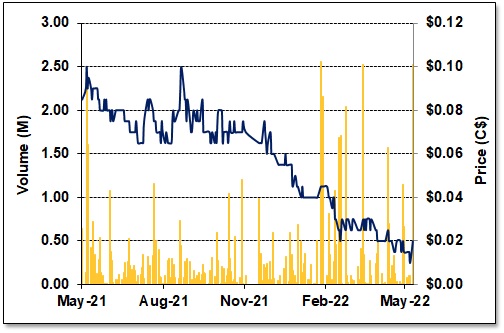

FIGURE 1: DAC 1-Year Stock Chart

Notes: All numbers in CAD unless otherwise stated. The author of this report, and employees, consultants, and family of eResearch may own stock positions in companies mentioned in this article and may have been paid by a company mentioned in the article or research report. eResearch offers no representations or warranties that any of the information contained in this article is accurate or complete. Articles on eresearch.com are provided for general informational purposes only and do not constitute financial, investment, tax, legal, or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this information should consult with a financial advisor. The article may contain “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements are based on the opinions and assumptions of the Company’s management as of the date made. They are inherently susceptible to uncertainty and other factors that could cause actual events/results to differ materially from these forward-looking statements. Additional risks and uncertainties, including those that the Company does not know about now or that it currently deems immaterial, may also adversely affect the Company’s business or any investment therein. Any projections given are principally intended for use as objectives and are not intended, and should not be taken, as assurances that the projected results will be obtained by the Company. The assumptions used may not prove to be accurate and a potential decline in the Company’s financial condition or results of operations may negatively impact the value of its securities. Please read eResearch’s full disclaimer.

Strong Organic Revenue Growth Continues.

Strong Organic Revenue Growth Continues.