eResearch| Taboola (NASDAQ: TBLA), a leading content discovery and native advertising platform, recently announced that it entered into an agreement with Symphony Technology Group, a private equity firm based in California, to acquire Connexity, Inc, a performance-marketing technology company.

eResearch| Taboola (NASDAQ: TBLA), a leading content discovery and native advertising platform, recently announced that it entered into an agreement with Symphony Technology Group, a private equity firm based in California, to acquire Connexity, Inc, a performance-marketing technology company.

The total estimated consideration for the acquisition is $800 million, which includes purchase price as well as retention incentives, and values the Connexity at 4.3 times Last Twelve Months (LTM) revenue and 18.0x LTM EBITDA.

Transaction Details

Taboola plans to finance the Connexity acquisition with approximately $260 million from cash on hand, issuing approximately $240 million shares to the seller, and raising $300 million through a debt financing.

Taboola plans to finance the Connexity acquisition with approximately $260 million from cash on hand, issuing approximately $240 million shares to the seller, and raising $300 million through a debt financing.

The final number of ordinary shares Taboola will issue depends on the volume-weighted average price of its shares over the 5 business days ending 3 business days prior to the closing.

Objective of the Acquisition

The Taboola–Connexity acquisition aligns with Taboola’s “Recommend Anything” growth strategy and is expected to introduce a new type of recommendation offering for the company.

Taboola‘s advanced technology and Connexity‘s retail expertise, as well as its index of more than 750 million product offers is projected to give rise to one of the largest e-Commerce media platforms on the open web.

Taboola plans to leverage Connexity’s recommendations platform in order to provide even greater value to its over 13,000 direct advertisers, 9,000 digital property partners, and 500 million daily active users.

According to Adam Singolda, CEO and Founder of Taboola, “The rise of social commerce proves the value of commerce alongside content, and with Connexity, Taboola is primed to bring this value to the open web.”

New Opportunities for Taboola Merchants and Publishers

For Taboola direct merchants, the acquisition could open opportunities to reach new clients on the open web. For publishers, the deal would provide a new and additional way to drive meaningful revenue growth and tap into the global e-commerce market, particularly the U.S. e-Commerce media market, currently estimated at $35 billion.

According to Bill Glass, CEO of Connexity, “Connexity’s vision of helping brands easily connect with customers and helping publishers grow gets supercharged with Taboola.”

The Taboola–Connexity deal is Taboola‘s fourth acquisition since 2017 and adds over 200 people to its staff, increasing the total number of employees in the company to approximately 1,600. The companies expect the deal to close in Q3/2021, subject to regulatory approvals and customary closing conditions.

Taboola only recently began trading on the NASDAQ after it merged with a SPAC and raised $526 million.

Connexity’s Annual Financial Performance in the Recent Past

Due to the expansion of Connexity’s merchant customer base and the successful integration of Skimlinks, a company specializing in affiliate marketing solutions, Connexity has been able to achieve significant growth in the recent past.

In 2019, Connexity booked revenue of $158 million, which included $28 million of Adjusted EBITDA. The following year, Connexity’s revenue increased to $176 million and Adjusted EBITDA was $38 million.

Market Overview: Retail eCommerce

Substantial growth has been recorded in the Retail e-Commerce market over the last few years. According to Statista, the retail e-commerce market currently stands at US$4.2 trillion and it is expected to reach US$6.5 trillion in 2023, growing annually at almost 25%.

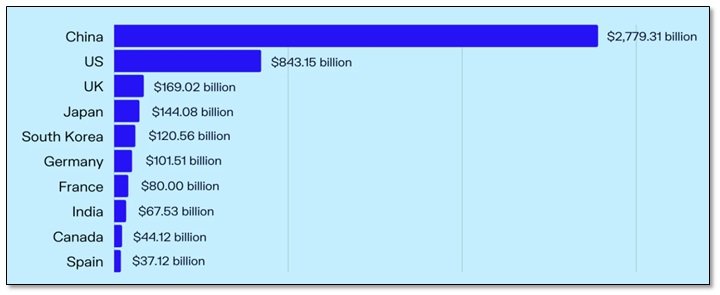

According to Oberlo, China, US, and UK are the biggest players with the highest market share along with Japan and South Korea.

FIGURE 1: Ecommerce Sales by Country (2021)

China, the world’s largest e-commerce giant, is responsible for approximately 52% percent of all online sales worldwide, which is more than the total market size of the next nine on the list of the top ten largest e-commerce markets in the world.

Some of the major driving factors that make retail e-commerce a great value proposition for investors are lower infrastructure costs, automated checkout procedures (decreasing the need for personnel), reduced marketing expenses, and the growing ability of companies to engage with a larger audience on a geographic scale.

Surprisingly enough, only 10% of retail companies in the world have their online presence, which shows great potential for high growth in the retail e-commerce space.

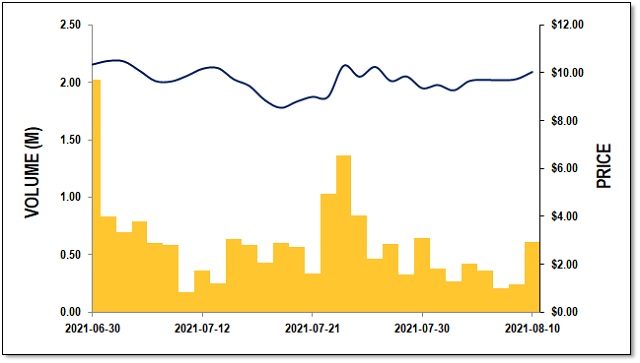

FIGURE 2: Taboola – Stock Chart Since RTO

Notes: All numbers in USD unless otherwise stated. The author of this report, and employees, consultants, and family of eResearch may own stock positions in companies mentioned in this article and may have been paid by a company mentioned in the article or research report. eResearch offers no representations or warranties that any of the information contained in this article is accurate or complete. Articles on eresearch.com are provided for general informational purposes only and do not constitute financial, investment, tax, legal, or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this information should consult with a financial advisor. The article may contain “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements are based on the opinions and assumptions of the Company’s management as of the date made. They are inherently susceptible to uncertainty and other factors that could cause actual events/results to differ materially from these forward-looking statements. Additional risks and uncertainties, including those that the Company does not know about now or that it currently deems immaterial, may also adversely affect the Company’s business or any investment therein. Any projections given are principally intended for use as objectives and are not intended, and should not be taken, as assurances that the projected results will be obtained by the Company. The assumptions used may not prove to be accurate and a potential decline in the Company’s financial condition or results of operations may negatively impact the value of its securities. Please read eResearch’s full disclaimer.