eResearch | Last month, Real Luck Group (TSXV:LUCK), the parent company of LuckBox, an eSports betting platform, listed publicly on the TSX Venture Exchange and opened at C$0.80 per share. The public listing was facilitated through a merger with Elephant Hill Capital (TSXV:EH.P), a capital pool company.

As part of the transaction, LuckBox raised total gross proceeds of C$4.6 million from an oversubscribed private placement. In addition, LuckBox raised C$1.5 million from the sale of convertible notes to ExpoWorld, a private Canadian investment firm.

As part of the transaction, LuckBox raised total gross proceeds of C$4.6 million from an oversubscribed private placement. In addition, LuckBox raised C$1.5 million from the sale of convertible notes to ExpoWorld, a private Canadian investment firm.

LuckBox is currently trading at C$0.68 per share, a 15% decrease since listing publicly, with a market capitalization of C$34 million.

LuckBox

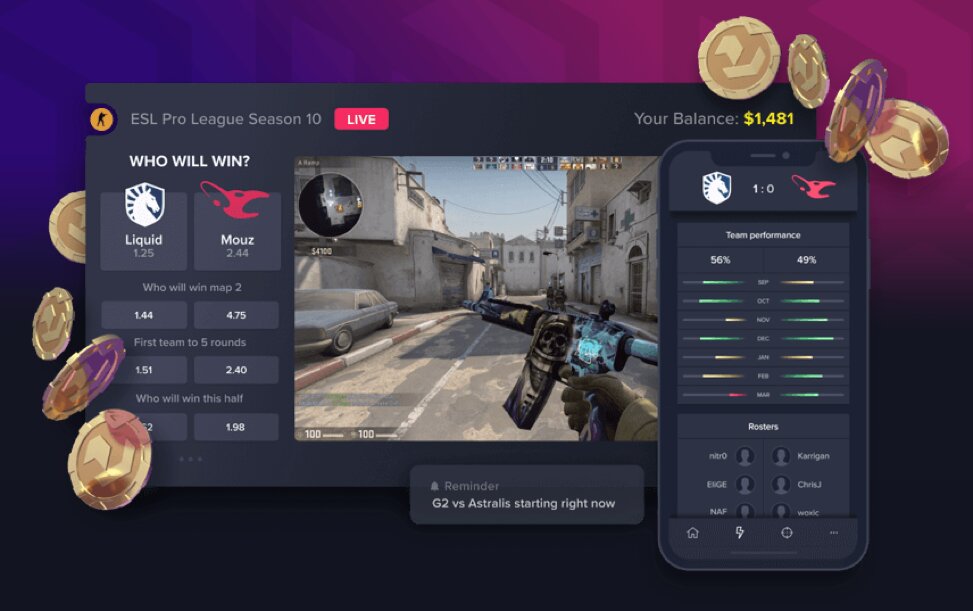

Headquartered in the Isle of Man, LuckBox is a pure-play eSports betting company that launched a legal, real-money betting platform in 2019. LuckBox enables users to view live streams and statistics of eSports matches on either desktop or mobile while making bets on various outcomes with fixed odds.

LuckBox’s proprietary betting platform currently includes the whole value chain for betting services except odds creation, which is the only function operated through third-party companies.

According to QYResearch Group, the Global eSports Betting Market was $8 billion in 2019 and is forecasted to reach $18 billion by 2026, growing at a CAGR of 14% between 2021 and 2026.

FIGURE 1: LuckBox Betting Platform

LuckBox is fully licensed under the Online Gambling Regulation Act, issued by the Isle of Man Gaming Supervision Commission. The license allows LuckBox to operate betting services globally while providing access to favourable payment processors.

The management team at LuckBox brings past leadership experiences from companies such as The Stars Group (TSX:TSGI), 888 Holdings (LON:888), Walt Disney (NYSE:DIS), Zynga (NASDAQ:ZNGA), and the British Broadcasting Corporation.

In 2019, LuckBox’s platform was offered in more than 80 territories with over C$3 million in bets made across 13 eSports titles, including CS:GO, DOTA 2, and League of Legends. Users on the platform made bets on over 1,800 tournaments, 22,000 pre-match matches, and 11,000 in-play matches.

In H2/2020, LuckBox experienced a 500% increase in bets placed on its platform, year-over-year, as traditional sports calendars shut down due to the COVID-19 pandemic.

This year, LuckBox expects to focus heavily on marketing to expand its user base with plans to invest C$2 million into content marketing, affiliates, partnerships, influencers, and direct media.

LuckBox is also currently seeking acquisition opportunities that support the vertical integration of its platform and expands its user base.

Financials

LuckBox generates revenue from bets placed by users on its platform after paying out winnings to the users who made correct bets.

For the nine months ended September 30, 2020, LuckBox had $1.6 million in bets placed on its platform compared with $0.1 million in the same period last year. Gross margins after distributing winnings for the bets increased to 3.6% compared with 2.8% last year.

From the $1.6 million in bets placed on its platform, LuckBox reported revenue of C$58,457 compared with C$2,700 in the same period last year, with a net loss of C$3.1 million compared with a net loss of C$3.5 million last year.

Although LuckBox is experiencing high growth in bets wagered on its platform, gross margins are tight due to costs in paying back winning bets. In addition, LuckBox’s profits are currently pressured due to high costs from administrative, research, marketing, and legal expenses.

eSports Betting Market

When the COVID-19 health crisis shut down live sporting events, bookmakers scrambled to fill the void and sportsbooks began offering lines on eSports events.

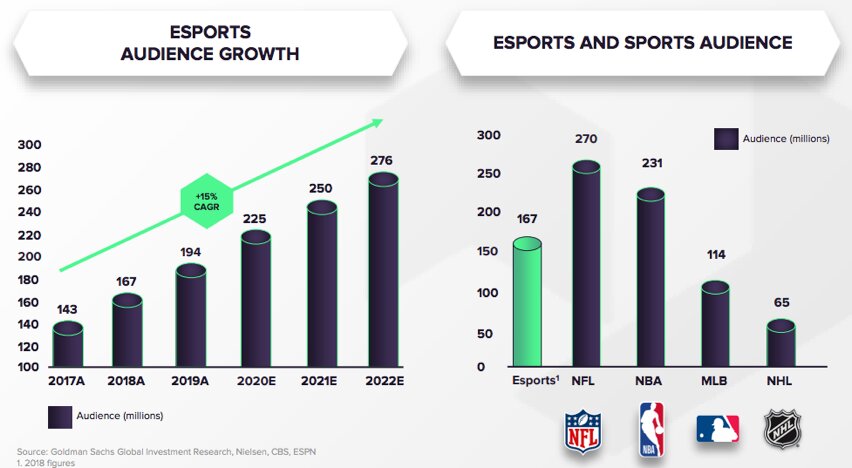

As eSports becomes more mainstream globally, the audience for eSports is expected to exceed traditional sports such as the National Football League (“NFL”).

In 2019, the NFL’s main Super Bowl event had 98 million viewers compared with the League of Legends World Championship eSports event, which had 137 million viewers.

FIGURE 2: eSports Audience Growth

Other public companies that operate eSports betting platforms include FansUnite Entertainment (CSE:FANS), Fandom Sports Media Corp. (CSE:FDM), and Esports Entertainment Group (NASDAQ:GMBL).

The market for eSports betting may continue to see high demand as the number of viewers grows and the number of platforms offering eSports betting increases.