eResearch | Last month, Upstart Holdings (NASDAQ:UPST), a U.S. lending platform driven by artificial intelligence (“AI”), launched its initial public offering (“IPO”). On the first day of trading, Upstart’s stock increased by 47% from the IPO price to $29.47 per share.

Upstart priced its IPO at $20.00 per share at an approximate valuation of $1.5 billion, which was at the lower end of its initially announced pricing range of $20.00 to $22.00 per share.

Upstart priced its IPO at $20.00 per share at an approximate valuation of $1.5 billion, which was at the lower end of its initially announced pricing range of $20.00 to $22.00 per share.

The IPO raised $216 million, including the full exercise of the underwriters’ option to purchase additional shares.

Upstart’s stock is currently trading at $52.73 per share, an 80% increase since listing publicly, with a market capitalization of $2.8 billion and an EV/Revenue of 17x based on last year’s annual revenue.

Upstart Holdings

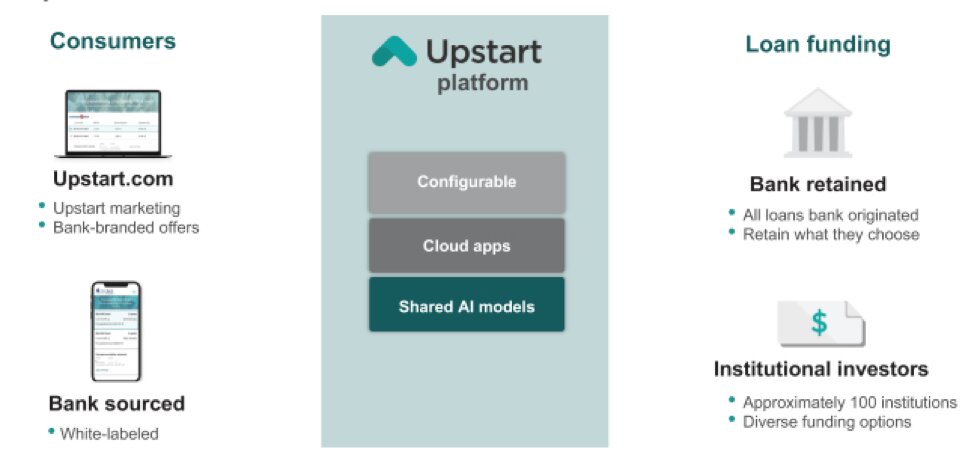

Upstart operates a cloud-based lending platform driven by AI, providing partnered banks with a consumer-facing application that facilitates end-to-end loan origination processes.

The platform provides higher approval rates and lower interest rates for consumers while lowering loss rates and improving credit processes for banks.

Upstart launched in 2012 by Dave Girouard, the former President of Google’s Enterprise division. Since its inception, Upstart has facilitated over 600,000 loans with $7.8 billion in cumulative transactions and more than 9 million repayments events.

According to Allied Market Research, the Global Digital Lending Platform Market was $6 billion in 2019 and is forecasted to reach $20 billion by 2027, growing at a CAGR of 17%.

Upstart’s platform allows banks to integrate existing systems, in addition to providing configurability for determining risk parameters and defining credit policies.

The platform can be accessed through Upstart’s website or through white-labeled products on the partnered banks’ websites.

Through an initial partnership with Cross River Bank, a U.S. commercial bank, Upstart developed the platform’s models and processes.

Upstart has now expanded partnerships to 10 banks, including Customers Bank, FinWise Bank, First Federal Bank of Kansas City, First National Bank of Omaha, KEMBA Financial Credit Union, TCF Bank, Apple Bank for Savings, and Ridgewood Savings Bank.

Although Upstart increased its number of bank partnerships, Cross River Bank currently originates almost 3/4 of the loans on the platform, accounting for 65% of Upstart’s total revenue.

In the most recent quarter, Upstart funded its loans through:

- Institutional investors – 76% of loans.

- Originating bank partners – 22% of loans.

- Upstart’s balance sheet – 2% of loans.

The majority of Upstart’s funds are raised from a network of approximately 100 institutions, including Goldman Sachs Group (NYSE:GS), PIMCO, and funds managed by Morgan Stanley (NYSE:MS).

FIGURE 1: Upstart’s Platform Ecosystem

AI-Driven Lending Process

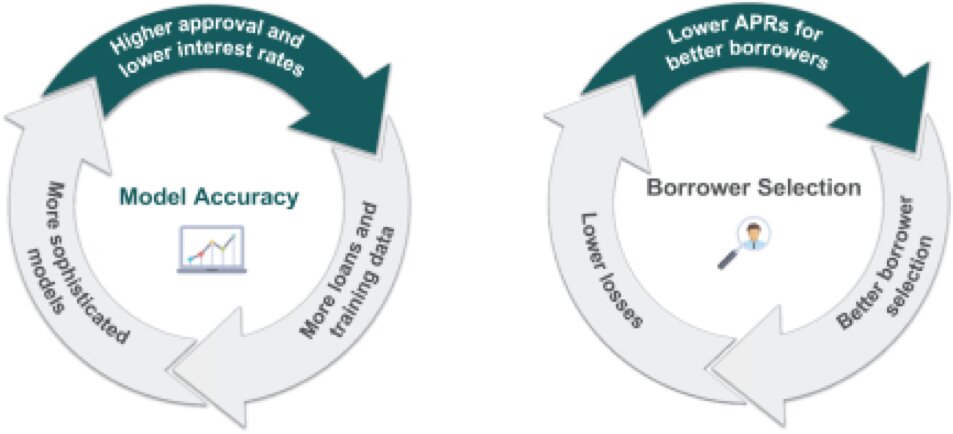

AI makes sense for disrupting traditional lending processes as lending involves a large number of data points for credit analysis.

Upstart leverages 15 billion data points in its AI models, which include model input variables and training data such as payment events. In the most recent quarter, approximately 70% of Upstart’s loans were entirely automated.

Machine learning algorithms allow Upstart to constantly improve lending models over time as more data is collected, increasing the accuracy and efficiency of loan processes.

FIGURE 2: Upstart’s AI Flywheel for Continuous Improvements

Several studies support Upstart’s AI-driven lending processes:

- An internal study done by Upstart found that its models approved 2.7x more borrowers than several large banks at the same loss rate.

- The Consumer Financial Protection Bureau reported that Upstart’s models approved 27% more borrowers than traditional models, with a 16% lower annual percentage rate (“APR”) for approved loans.

- An internal study by Upstart reported that its realized loss rate for securitized loans was half the amount predicted by Kroll, a credit rating agency owned by Duff & Phelps.

Financials

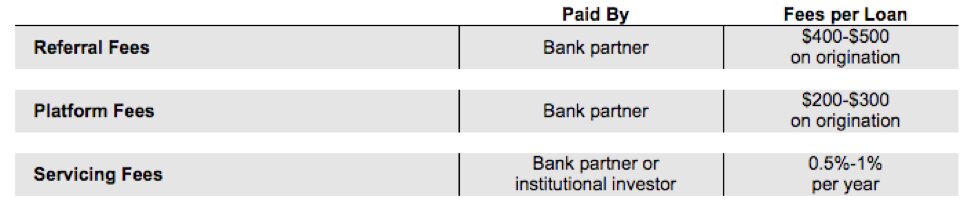

Upstart generates revenue through referral and platform fees that are charged to banks for each loan facilitated through its platform. In addition, Upstart charges the holder of the loan a servicing fee for the outstanding principal over the lifetime of the loan.

FIGURE 3: Upstart’s Revenue Model for an Averaged-Sized Loan

For the nine months ended September 30, 2020, Upstart reported revenue of $147 million, a 44% increase from the same period last year, and a net income of $4.5 million compared with a net loss of $10 million last year.

In 2019, Upstart reported revenue of $164 million, a 65% increase year-over-year, and a net loss of $5 million compared with a net loss of $11 million in the prior year.

Upstart’s strong revenue growth was supported by an increase in the number of loans facilitated on its platform with 215,122 loans in 2019, an 88% increase year-over-year. For the nine months ended September 30, 2020, Upstart processed 176,983 loans, a 30% increase from the same period last year.

In Q2/2020, Upstart’s operations were significantly impacted by the COVID-19 pandemic due to banks pausing originations, resulting in a 71% decrease in the number of loans transacted and a 47% decrease in revenue compared with the same period last year.

In Q3/2020, Upstart saw some recovery as the number of loans transacted increased by 26% from the same period last year.

Digital Lending Platforms

Digital lending platforms are disrupting the traditional lending industry as banks adopt technology to improve credit analysis and origination processes.

Another company with an AI-driven lending platform is Peak Fintech Group (CSE:PKK | OTCQX:PKKFF), a technology company that operates in China’s commercial lending industry.

eResearch published an updated Equity Research Report on Peak Fintech in December: Peak Fintech – Quarterly Revenue Doubles Again as Fintech Platform Gains Traction

As digital lending platforms continuously improve their models through AI, we could see a significant increase in banks adopting lending technologies.