eResearch | This month, Dye & Durham (TSX:DND), a Canadian LegalTech company, announced the acquisition of DoProcess for C$530 million.

DoProcess is an affiliated entity of Teranet, which is owned by OMERS Infrastructure, a global infrastructure investor and asset manager. As part of the transaction, OMERS is expected to acquire C$30 million of D&D’s common shares.

The acquisition is expected to be partially funded through a C$510 million debt financing package underwritten by The Bank of Nova Scotia (TSX:BNS), which includes a:

- C$245 million term loan.

- C$125 million term loan.

- C$140 million revolving credit facility.

In addition to the debt financing, D&D also raised C$225 million through a private placement of 6.5 million shares at a price of C$34.65 per share. The private placement included five of D&D’s existing long-term institutional shareholders.

In the press release, Matthew Proud, CEO of D&D, said,

“DoProcess is an extremely strategic acquisition for Dye & Durham, given its deeply embedded technology, market position, and advanced cloud-based software platform. This is a highly sought-after asset for us, and we have strong conviction around the prospects and opportunities that can be created by combining Dye & Durham and DoProcess under a single platform.”

Shortly after announcing the acquisition of DoProcess, D&D announced another acquisition with a majority stake investment in Courthouse Solutions, a Canadian LegalTech company.

Courthouse Solutions’ cloud-based product, Dockets, enables legal professionals to automate and optimize litigation workflows such as electronic filing, scheduling, payments, and court reporting.

D&D plans to help drive adoption for Dockets while allowing Courthouse Solutions to operate as a stand-alone business.

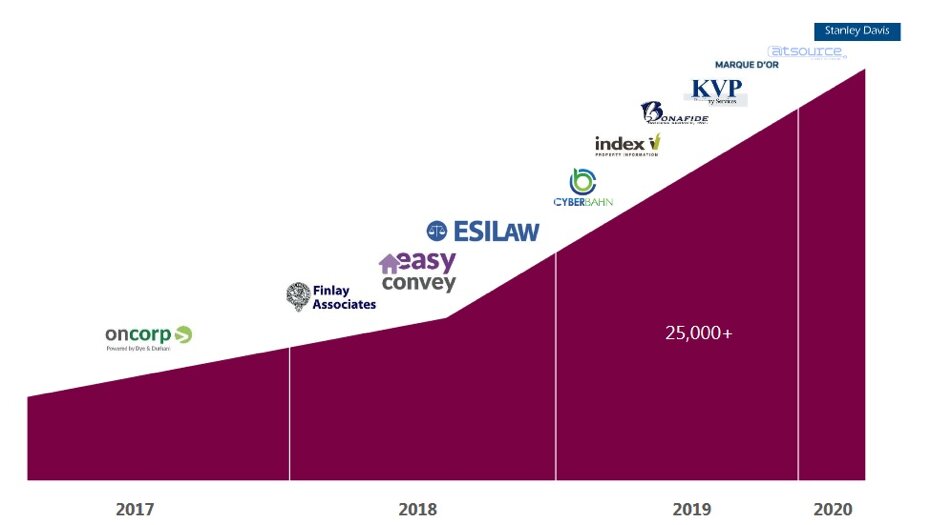

D&D is currently trading at C$50.55 per share, an 18% increase since announcing the acquisition of DoProcess, with a market capitalization of C$3.2 billion.

DoProcess

DoProcess is a Canadian LegalTech software provider focused on offering solutions that streamline processes for legal professionals. Through DoProcess’ products, legal professionals can easily connect and share information with industry service providers, other law firms, and government entities.

According to QYResearch Group, the Global Legal Practice Management Software market was $1 billion last year and is forecasted to reach $2.4 billion by 2025, growing at a CAGR of 13%.

Over 15,000 practitioners currently use DoProcess’ software products to process over 1.4 million transactions annually.

DoProcess’ product offerings include:

- Unity – a secure cloud-based conveyancing solution.

- Fast Company – a corporate data and document management solution.

- Estate-a-Base – an estate administration and accounting solution.

- Will Builder – a will and powers of attorney preparation solution.

- ProSuite – an automated mortgage processing solution.

In November, DoProcess announced the acquisition of Lex Cortex, a Canadian LegalTech company that operates an estate management platform called NoticeConnect.

Dye & Durham

D&D provides a cloud-based platform designed to improve efficiency and increase productivity for legal and business professionals. The platform expedites day-to-day workflows by automating processes such as due diligence searches, document creation, and records filing.

Customers that currently use D&D’s platform include law firms, financial services organizations, and government organizations in Canada and the United Kingdom (“UK”).

In July, D&D launched its IPO with its shares jumping 97% on the first day of trading, reported by eResearch in the article: IPO of Dye & Durham, Canadian Legal Tech Firm, Jumps 97%

D&D is currently focused on accelerating growth through a series of acquisitions, mainly targeting competitors that have synergistic benefits.

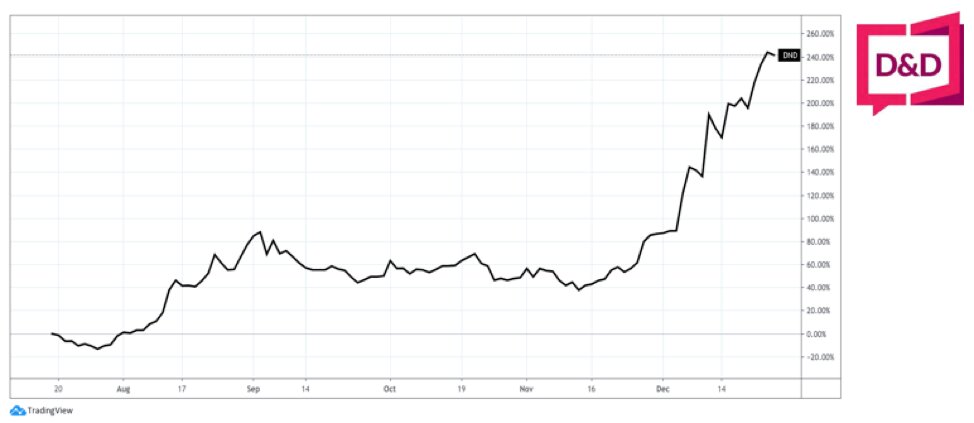

FIGURE 1: Dye & Durham Acquisition History

At the beginning of December, D&D announced plans to enter the Australian market through the acquisition of SAI Global’s Property Division for AUD 91 million (C$87 million). SAI Global’s Property Division supports conveyancers, solicitors, and financial services firms with software solutions that facilitate the transfer of property.

In September, D&D entered into an agreement to acquire Property Information Exchange for £31.0 million (C$52.9 million), previously reported by eResearch in the article: LegalTech Company Dye & Durham Acquires UK-Based PIE and Raises C$50M

InsurTech Disrupts Legal Industry

The traditionally conservative legal industry is currently being disrupted by InsurTech companies that are creating software solutions to improve legal services.

D&D could become a global leader in InsurTech as it integrates the operations of its various acquisitions while scaling to new markets such as Australia.

FIGURE 2: Dye & Durham Stock Performance Since IPO