eResearch | Last month American Well (NYSE: AMWL) and GoodRx Holdings (NASDAQ: GDRX), two telehealth-focused companies, listed publicly through initial public offerings (“IPO”). The two IPOs had high investor demand with both companies experiencing a double-digit percentage increase in stock price.

As the pandemic pushes the adoption of remote healthcare services, healthcare companies are developing and providing more telehealth technologies and innovations. Telehealth leverages digital information and communication technologies to better manage and improve patient treatments.

Telehealth-focused companies CB2 Insights (CSE: CBII; OTC: CBIIF) and CloudMD Software & Services (TSXV: DOC; OTC; DOCRF) were highlighted in eResearch’s recent article: HealthTech Quarterly Update – Acquisitions Continue as Companies Focus on Remote Care and U.S. Expansion

Amwell

Last month, Amwell, a U.S. telehealth company, started trading on the New York Stock Exchange at $25.51 per share, after initially pricing its IPO at $18 per share.

Last month, Amwell, a U.S. telehealth company, started trading on the New York Stock Exchange at $25.51 per share, after initially pricing its IPO at $18 per share.

The IPO raised $922 million, which included a concurrent private placement of $100 million from Google, a subsidiary of Alphabet (NASDAQ: GOOGL). Amwell plans to integrate some of its services onto Google’s cloud network.

Amwell provides a comprehensive platform that enables health organizations to integrate telehealth capabilities through web and mobile applications. In addition, Amwell white-labels its technology for clients to create telehealth applications branded under their own name.

Since launch, Amwell’s platform has powered over 5.6 million telehealth visits, which enabled digital care in a variety of clinical, retail, school, and home settings.

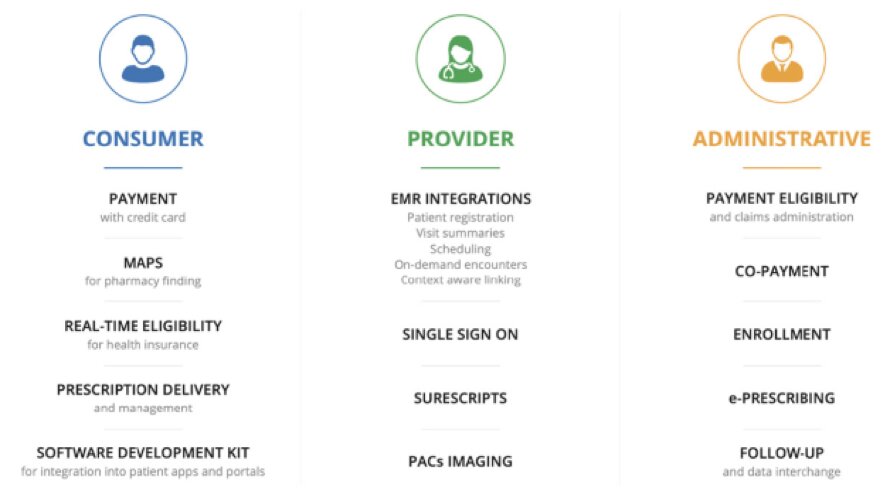

Amwell’s platform currently includes:

- 80 million members with Amwell as a covered benefit.

- 50+ health plan partners, including Blue Cross, United Healthcare, and Cigna (NYSE: CI).

- 2000+ hospitals and health system partners, including Cleveland Clinic, Avera Health, Northwell Health, and UNC Health.

- 40,000+ client providers using Amwell.

FIGURE 1: Amwell Platform

The open architecture of Amwell’s platform allows clients to seamlessly connect existing systems and electronic health records with Amwell’s telehealth solutions.

Amwell’s Software Development Kits (“SDK”) provide access to various application programming interfaces (“API”), which enable quick telehealth implementations.

Amwell also developed a full range of hardware devices integrated with telehealth capabilities to be used in clinical settings. Amwell’s proprietary kiosk and cart provides secure digital communication, and connects to diagnostic and examination tools.

FIGURE 2: Amwell Telehealth Solutions

The majority of Amwell’s revenue is generated through subscription services, with recurring revenue streams accounting for 84% of total sales in 2019.

In H1/2020, Amwell reported revenue of $122 million, a 77% increase year-over-year, which is already on track to beat last year’s annual revenue of $149 million. In the past twelve months, Amwell generated revenue of $202 million.

However, in H2/2020, Amwell’s net loss widened to $114 million versus $42 million in the prior year’s comparable period, mainly due to $66 million in stock-based compensations.

Amwell’s stock is currently trading at $33.81 per share, an 88% increase from the listing price, with a market capitalization of $7.8 billion and an EV/Revenue of 41x.

GoodRx

At the end of last month, GoodRx, a heath technology company, started trading on the NASDAQ exchange at $50.50 per share, after initially pricing its IPO at $33.

At the end of last month, GoodRx, a heath technology company, started trading on the NASDAQ exchange at $50.50 per share, after initially pricing its IPO at $33.

GoodRx raised $1.3 billion in the IPO, in addition to another $100 million raised in a private placement with entities affiliated with Silver Lake, an existing shareholder.

GoodRx provides a platform for comparing prescription medicines, while also providing a free list of discount codes and coupons. The platform aggregates over 150 billion prescription pricing data points, which are accepted at over 70,000 pharmacies in the U.S.

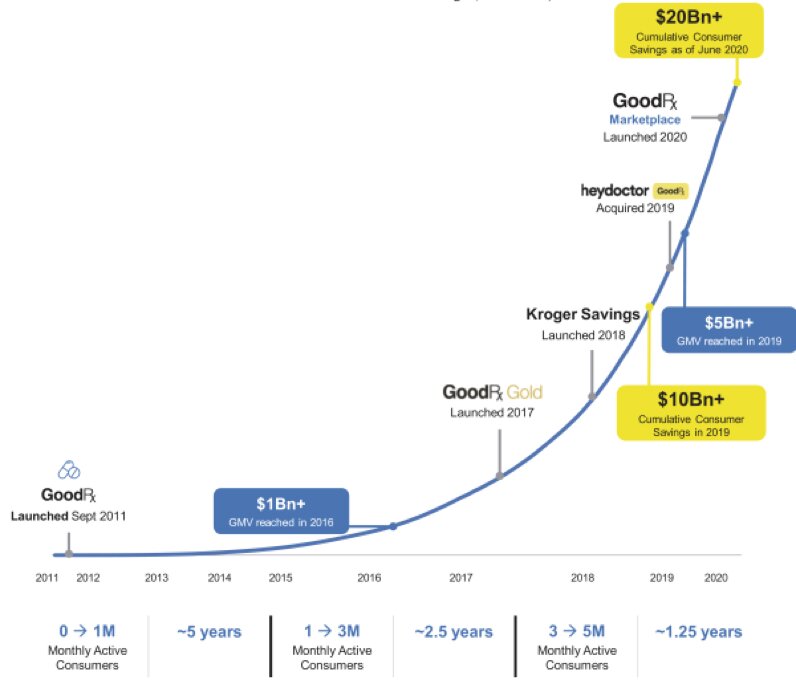

The prescription comparison platform is the #1 most downloaded medical app on the Apple and the Google Play store, with 4.9 million monthly active users. Since launch, consumers have saved more $20 billion from comparing various medications on GoodRx’s platform.

PHOTO 3: GoodRx Cumulative Consumer Savings (2011-2020)

GoodRx generates 91% of its revenue from partnered pharmacies that pay a fee when consumers use a discount code on its platform. Over 80% of transactions on GoodRx’s platform is recurring, due to the typical long-term nature of most prescriptions.

Earlier this year, GoodRx launched the GoodRx Telehealth Marketplace, a platform that identifies high-quality telehealth providers for users to compare. Last year, GoodRx also acquired HeyDoctor, a platform that connects patients to virtual doctors.

Since 2016, GoodRx grew revenue at a CAGR of 57% to $388 million in 2019. GoodRx generated revenue of $257 million in the last six months and $433 million in the last twelve months.

GoodRx also consistently generates profits, with a net income of $66 million last year. GoodRx reported a net income of $55 million in the last six months and $90 million in the last twelve months.

GoodRx’s stock is currently trading at $51.26 per share, a 55% increase from the listing price, with a market capitalization of $20 billion and an EV/Revenue of 49x.

Telehealth Market

As the COVID-19 pandemic enters a second wave in multiple countries, health providers and patients are seeking ways to connect remotely through telehealth innovations. In addition, digital services allow for more timely and efficient patient care when the healthcare system is oversaturated.

According to Fortune Business Insights, the telehealth market was $61 billion last year and is expected to potentially reach $560 billion by 2027, growing at a CAGR of 25%.