eResearch | Dye & Durham Limited (TSX: DND) announced today that it has entered into an agreement to acquire Property Information Exchange Ltd. (“PIE”) for £31.0 million (approximately C$52.9 million), in an all-cash deal.

eResearch | Dye & Durham Limited (TSX: DND) announced today that it has entered into an agreement to acquire Property Information Exchange Ltd. (“PIE”) for £31.0 million (approximately C$52.9 million), in an all-cash deal.

Concurrent with the acquisition and to fund the transaction, the Company entered into a bought deal private placement of 2.4 million shares at a price of C$21 per share for gross proceeds of C$50.0 million.

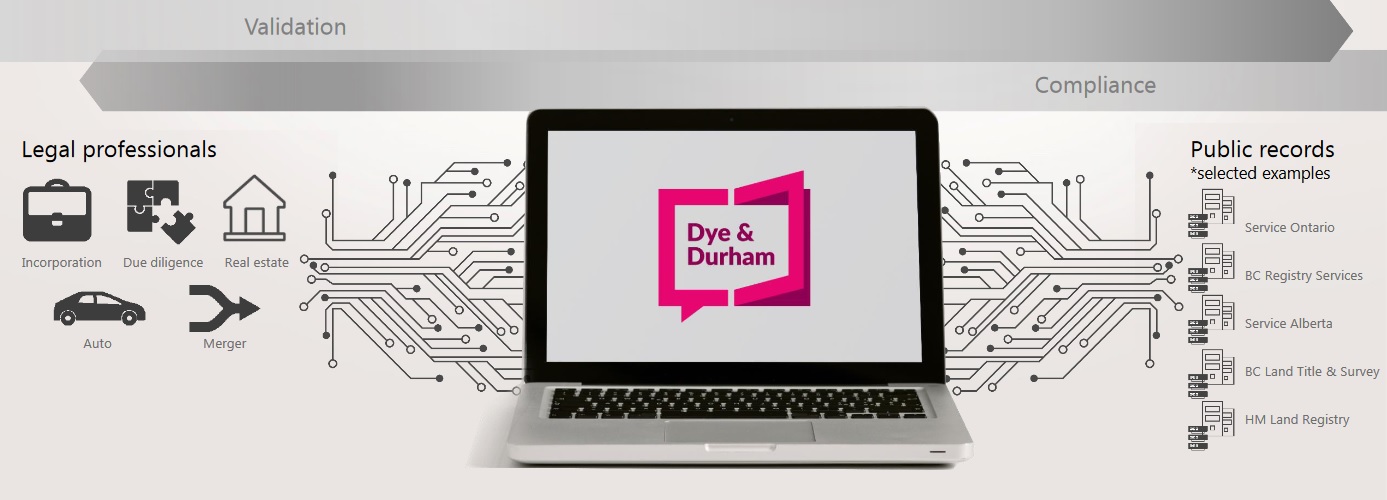

Dye & Durham is a provider of cloud-based software and technology solutions designed to improve efficiency and increase productivity for legal and business professionals. The Company has operations in Canada and the United Kingdom (“UK”), and customers include law firms, financial service institutions, and government organizations.

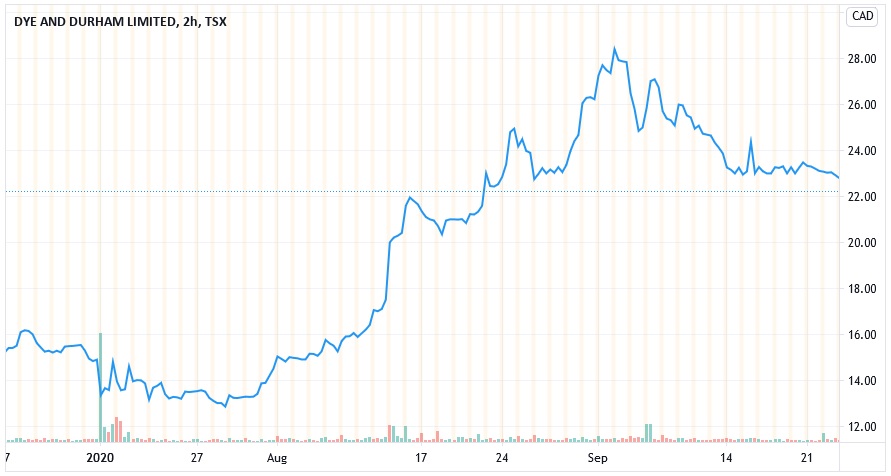

Dye & Durham launched its IPO on July 17, 2020, with the shares jumping 97% on the first day of trading.

PIE is a UK-based competitor and offers cloud-based real estate due diligence products in the UK that would expand Dye & Durham’s footprint.

PIE is a UK-based competitor and offers cloud-based real estate due diligence products in the UK that would expand Dye & Durham’s footprint.

Matt Proud, CEO of Dye & Durham, said,

“We expect that the acquisition of PIE will support Dye & Durham’s industry growth, as we continue to execute on our strategy of acquiring, integrating and operating core technology businesses in order to build on our expanding online platform.”

DIAGRAM 1: Dye & Durham Service Offerings

The acquisition of a direct in-market competitor is expected to accretive to shareholders on an Adjusted EBITDA basis once the two business operations in the UK are integrated and synergies are realized.

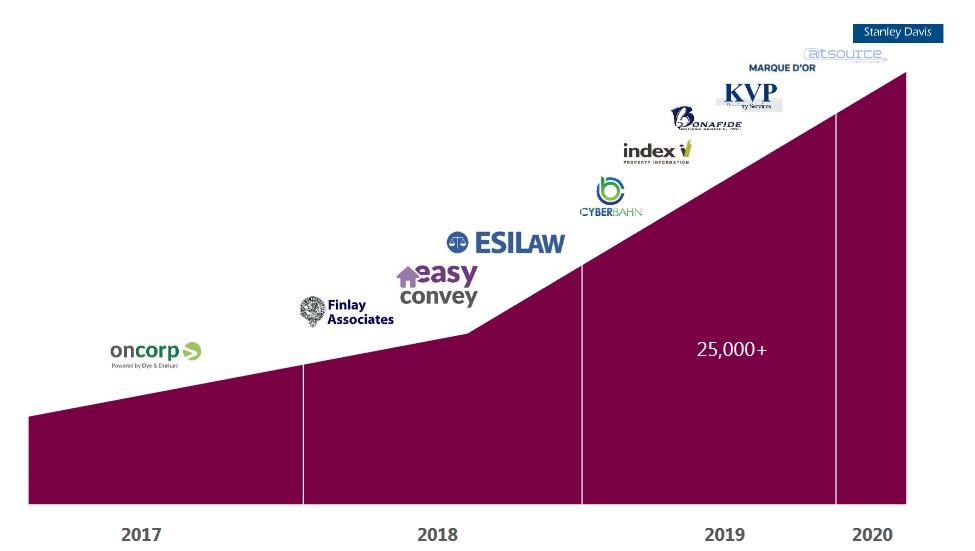

According to Dye & Durham, the acquisition of PIE is consistent with the Company’s strategy of “acquiring, integrating and operating core cloud-based technology businesses” in the legal industry that has strong customer bases.

The Company has completed 14 acquisitions since 2013 and current cash flows fuel their platform consolidation strategy.

DIAGRAM 2: Dye & Durham Acquisitions Since 2017 Resulting in 25,000 Customers

Year-End Financial Results

Also today, Dye & Durham announced financial results for FQ4/2020 and F2020, for the year ended June 30, 2020.

Revenue in FQ4/2020 was C$14.2 million, down 6% from C$15.1 million in FQ4/2019 with a Net Loss of C$3.8 million, compared to Net Income of C$1.7 million in the same quarter last year. Adjusted EBITDA in FQ4/2019 was C$8.8 million, up 3% from C$8.5 million in the FQ4/2019.

Revenue was down year-over-year due to less economic activity resulting from the COVID-19 pandemic and the temporary closure of many courthouses in Canada which reduced the usage of the Company’s litigation solutions product line.

In response to COVID-19, management reduced costs through permanent and temporary measures that resulted in approximately C$4.1 million of cost reductions in FQ4/2020 compared to the previous quarter.

For F2020, Revenue was C$65.5 million, up 49% from C$43.8 million in F2019 with a Net Loss of C$11.2 million compared to a Net Income of C$0.7 million in F2019. For the fiscal year, Adjusted EBITDA was C$36.7million, up 39% from $26.4 million in fiscal 2019.

Financial Outlook FQ1/2021

Dye & Durham provided financial guidance for its FQ1/2021 financial results, ending September 30:

- FQ1/2021 Revenue to be in the range of C$20.0 to $21.0 million; and

- FQ1/2021 Adjusted EBITDA of C$12.0 to C$12.5 million.

The stock closed the day at C$22.93 with a market cap of over C$1.0 billion and trades at an EV/Revenue of 17.7x and an EV/EBITDA of 39.5x.

Another recent eResearch article on Dye & Durham:

CHART 1: Dye & Durham Stock Chart Since IPO on July 17, 2020