eResearch | GreenPower Motor Company Inc. (NASDAQ: GP, CVE: GVP), released its FQ1/2021 results.

Founded in 2010 and headquartered in Vancouver, Canada, GreenPower manufactures a range of zero gas emission electric buses such as transit and school buses, shuttles, and cargo vans. Key suppliers, such as Siemens (ETR: SIE), TM4 (NYSE: DAN), Knorr (ETR: KBX), ZF, and Parker (NYSE: PH), provide the OEM platform for components and maintenance.

Founded in 2010 and headquartered in Vancouver, Canada, GreenPower manufactures a range of zero gas emission electric buses such as transit and school buses, shuttles, and cargo vans. Key suppliers, such as Siemens (ETR: SIE), TM4 (NYSE: DAN), Knorr (ETR: KBX), ZF, and Parker (NYSE: PH), provide the OEM platform for components and maintenance.

FQ1/2021 Financial Results

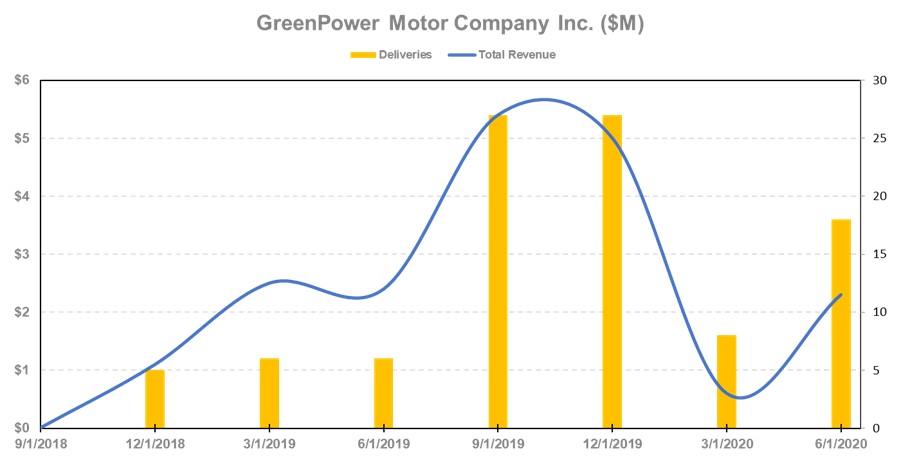

GreenPower Motor Company reported revenues of $2.3 million in FQ1/2021 ended on June 30, 2020. Gross profit came in $0.6 million, yielding a gross margin of 27.2%. Adjusted EBITDA was reported at a negative $0.55 million.

Revenue was primarily attributed to the sale of 18 Electric Vehicle (“EV”) Stars, a zero-emissions mini-bus capable of a range of up to 150 miles.

Comparatively, on a quarter-over-quarter basis to the same period last year, the Company recorded revenue of $2.4 million and gross profit of $0.7 million, representing a 30% gross margin. Revenue in this period was mainly due to the sale of one EV 350 and 5 EV Stars.

PHOTO 1: GreenPower’s EV Star

Operating Highlights

Amid the COVID-19 pandemic, the Company managed to complete the Federal Transit Authority’s (“FTA”) Altoona testing for the EV Star, and launch the EV Star Cab and Chassis product. In addition to these achievements, GreenPower also delivered 18 EV Stars.

Altoona Test

The FTA Altoona test is rigorous and focuses on how well a vehicle will withstand transit duty. Potential buyers look at the Altoona test results when making a purchase decision.

In April 2020, the EV Star passed with the highest score in the medium and/or heavy-duty vehicle category, with a score of 92.2. The Company stated that the EV Star is the only all-electric Class 4 vehicle to have passed the Altoona test.

Only vehicles that are built to “Buy America” compliant standards and have passed the Altoona test are eligible for FTA funding of up to 80% of the cost of a new vehicle.

EV Star CC model

In May 2020, Greenpower launched the EV Star CC model. The 25-foot EV Star CC chassis is a battery-electric, multi-utility cab and has a carrying capacity of up to 6,000 lbs.

Delivery of 18 EV Stars

In June 2020, the Company finalized the delivery of 18 EV Stars to Green Commuter. In its remaining order for 52 Greenpower EV Stars, Green Commuter approved California HVIP (Hybrid Zero-Emission Truck and Bus Voucher Incentive Project) vouchers totaling $4.5 million.

In June 2020, the Company finalized the delivery of 18 EV Stars to Green Commuter. In its remaining order for 52 Greenpower EV Stars, Green Commuter approved California HVIP (Hybrid Zero-Emission Truck and Bus Voucher Incentive Project) vouchers totaling $4.5 million.

COVID-19

Since the beginning of March 2020, Greenpower adhered to government health regulations to protect staff and other stakeholders and also maintained production, although at reduced levels.

To mitigate the financial impacts of the pandemic, the Company successfully secured government grants in Canada and in the U.S. Moreover, Greenpower was able to get $0.36 million in financial support under the U.S. Small Business Administration’s Paycheck Protection Program.

To further conserve cash, the Company reduced expenses from the CEO and Chairman taking a 30% salary reduction and from a salary reduction of some staff working from home.

CHART 1: GreenPower – Total Revenue and Deliveries

Other Highlights

Current Greenpower “Buy America” compliant domestic production capacity consists of:

- 15 EV Stars per month, which is expected to increase to 30 by the end of 2020,

- Manufacturing partners of 50 additional EV Stars per month, which is expected to increase to 100 by the end of 2020.

Inventories June 30, 2020

- 3 EV350’s, 2 EV Stars, and ancillary equipment totaling approximately $0.75 million

- Finished goods inventory consisted of 9 EV Stars, 2 EV Star Cab and Chassis, 2 Synapse school buses, 1 EV350 and charging stations totaling approximately $2.9 million

- Work in process Inventory consisted of 14 EV Stars, 10 EV Star Plus, 5 EV 250s, deposits for the 100 EV Star project, and parts inventory totaling $3.2 million

U.S. NASDAQ Listing

On September 1, Greenpower announced the closing of a U.S. Initial Public Offering of 1.86 million post-consolidation common shares at $20 per share for gross proceeds of $37.2 million. In connection with the offering, the Company completed a seven-to-one consolidation of shares.

Fraser Atkinson, CEO of GreenPower said,

“We’re excited that this provides us access to a broader market and will increase the exposure to GreenPower and its suite of products.”

The company intends to use the proceeds from the offering for EV production, product development, and geographic expansion.

GreenPower’s stock closed the week at C$18.54 and has a market cap of C$339 million with the EV/Revenue multiple of 20x.

PHOTO 2: GreenPower’s Fleet

Notes: All numbers in USD unless otherwise stated. The author of this report, and employees, consultants, and family of eResearch may own stock positions in companies mentioned in this article.