eResearch | This past quarter, the HealthTech industry experienced a significant boost in activity and growth as the pandemic stimulated the digitization of various healthcare services. However, companies working directly with patients for physical appointments experienced various complications due to procedures being postponed.

As the pandemic pushes the adoption of remote healthcare services, HealthTech companies are developing and providing more telehealth technologies and innovations. Telehealth leverages digital information and communication technologies to better manage and improve patient treatments.

CB2 Insights

In Q2/2020, for the three months ended June 30, 2020, CB2 Insights (CSE: CBII; OTC:CBIIF), a telehealth services and technology company focused on alternative treatments and medicine, reported Revenue of C$3.7 million, a 16% increase year-over-year, as patient visits and registrations improved following an initial slowdown last quarter due to the pandemic.

In Q2/2020, for the three months ended June 30, 2020, CB2 Insights (CSE: CBII; OTC:CBIIF), a telehealth services and technology company focused on alternative treatments and medicine, reported Revenue of C$3.7 million, a 16% increase year-over-year, as patient visits and registrations improved following an initial slowdown last quarter due to the pandemic.

CB2 Insights provides treatments for over 100,000 patients across 12 states, leveraging its proprietary data analytics platforms to assess treatments for safety, efficacy, and effectiveness, while also utilizing virtual communications.

CB2 Insights recently announced a non-brokered private placement of up to 20 million units at a price of C$0.15 per unit, for gross proceeds of up to C$3 million. Merida Capital Partners (www.meridacap.com), a cornerstone investor of CB2 Insights, provided a C$2 million definitive lead order for the offering.

CloudMD

In Q2/2020, for the three months ended June 30, 2020, CloudMD Software & Services (TSXV: DOC; OTC: DOCRF), a telehealth company focused on digitizing the delivery of healthcare services, reported Revenue of C$2.8 million, a 163% increase year-over-year, driven by multiple acquisitions.

In Q2/2020, for the three months ended June 30, 2020, CloudMD Software & Services (TSXV: DOC; OTC: DOCRF), a telehealth company focused on digitizing the delivery of healthcare services, reported Revenue of C$2.8 million, a 163% increase year-over-year, driven by multiple acquisitions.

CloudMD leverages its proprietary platform for SaaS-based health technology offerings, which provides services to an ecosystem of 376 clinics, 3,000 licensed practitioners, and 3 million patients.

This past quarter, CloudMD drove growth through multiple acquisitions, including:

- Snapclarity (www.snapclarity.com), a digital healthcare platform focused on mental healthcare: C$3.4 million acquisition.

- South Surrey Medical (www.southsurreymedicalclinic.com), a clinic based in British Columbia: C$0.7 million acquisition.

- West Mississauga Medical Clinic (www.missisaugaclinic.com), a family health clinic based in Ontario: C$0.2 million acquisition for a 51% stake.

In addition, CloudMD expanded into the U.S. with the acquisition of a medical clinic focused on chronic care patients, managed by Dr. Fred Roh and Curtis Gibson. Dr. Roh has over 30 years of experience in the U.S. healthcare market and is a founder of the Healthcare Networks of America (www.hna-net.com), a physician network with over 15,000 members.

Last month, CloudMD signed a binding term sheet for an C$8 million acquisition of Re:Function Health Group (www.refunction.ca), a leading integrated clinic network and rehabilitation center in British Columbia with 7 clinics and 35 healthcare specialists.

This week, CloudMD announced an increase to its previously announced bought deal public offering to C$18 million, a 28% increase from its initial offering of C$13 million.

WELL Health Technologies

In Q2/2020, for the three months ended June 30, 2020, WELL Health Technologies (TSX: WELL), an omni-channel digital health company focused on Electronic Medical Records (“EMR”), reported Revenue of C$10.6 million, a 43% increase year-over-year, driven by a shift to telehealth.

In Q2/2020, for the three months ended June 30, 2020, WELL Health Technologies (TSX: WELL), an omni-channel digital health company focused on Electronic Medical Records (“EMR”), reported Revenue of C$10.6 million, a 43% increase year-over-year, driven by a shift to telehealth.

This past quarter, WELL Health closed a series of acquisitions focused on networks with EMR services, including:

- MedBASE Software (www.medbase.ca), a healthcare company with EMR services across a network of 61 clinics in Ontario: C$0.65 million acquisition

- Indivica (www.indivica.ca), a healthcare company who provides EMR software and services to approximately 390 clinics in Ontario: C$6.2 million acquisition.

So far, WELL Health has acquired seven EMR-focused companies, expanding its EMR network to approximately 10,000 physicians serving over 18 million patients.

WELL Health also expanded its portfolio of products as it recently announced a C$0.25 million investment in Phelix.ai (www.phelix.ai), receiving the rights to license Phelix.ai’s clinical assistant product, which is driven by artificial intelligence (“AI”).

In an effort to support security measures, WELL Health announced a C$2.6 million acquisition of the Services Division of Cycura (www.cycura.com), which provides various cybersecurity offerings such as penetration and vulnerability testing, code reviews, incident response services, and training services.

This week, WELL Health announced expansions into the U.S. healthcare market through a $14 million majority ownership investment in Circle Medical (www.circlemedical.ca), a U.S. health technology company who is connected with most U.S. insurers, enabling its services to be accessed by approximately 200 million Americans.

WELL Health’s U.S. expansion and investment in Circle Medical was supported by a C$23 million non-brokered private placement led by returning investor Li Ka-shing, a Hong Kong business leader. The private placement offered 4.8 million common shares at a price of C$4.77 per share.

Nova Leap Health

In Q2/2020, for the three months ended June 30, 2020, Nova Leap Health (TSXV: NLH), a home healthcare services company, reported Revenue of $3.9 million, a 6.3% decrease year-over-year, due to the pandemic reducing client service hours.

In Q2/2020, for the three months ended June 30, 2020, Nova Leap Health (TSXV: NLH), a home healthcare services company, reported Revenue of $3.9 million, a 6.3% decrease year-over-year, due to the pandemic reducing client service hours.

However, as the pandemic takes an unfortunate toll on senior facilities, Nova Leap expects more families to opt for in-home care services.

Nova Leap is focused on growing through acquisitions, with diversified operations currently across six U.S. states, including Vermont, New Hampshire, Massachusetts, Rhode Island, Oklahoma, and Ohio. Nova Leap also has operations in the province of Nova Scotia in Canada.

This week, Nova Leap announced a US$0.66 million acquisition of a home care services company located in the New England region, who reported annual Revenue of US$1.7 million for the year ended September 30, 2019.

Newtopia

In Q2/2020, for the three months ended June 30, 2020, Newtopia (TSXV: NEWU), a telehealth enabled habit-change platform focused on disease prevention, reported Revenue of C$2.7 million, a 67% increase year-over-year, driven by high engagement levels on its platform.

In Q2/2020, for the three months ended June 30, 2020, Newtopia (TSXV: NEWU), a telehealth enabled habit-change platform focused on disease prevention, reported Revenue of C$2.7 million, a 67% increase year-over-year, driven by high engagement levels on its platform.

Earlier this year, Newtopia received final approval from the TSX Venture Exchange (“TSXV”) for the listing of its common shares, which commenced trading on the TSXV in May.

Last month, Newtopia announced a new multi-year agreement with a Fortune 50 company in the U.S. to support employees who are at the most risk of developing chronic diseases.

To this date, Newtopia’s platform has been adopted by more than five Fortune 500 companies across various industries.

Assure Holdings

In Q2/2020, for the three months ended June 30, 2020, Assure Holdings (TSXV: IOM; OTC: ARHH), a company focused on providing surgeons with intraoperative neuromonitoring services, reported Revenue of negative $10.8 million, attributed to significant write-downs on receivables due to COVID-19 impacts.

In Q2/2020, for the three months ended June 30, 2020, Assure Holdings (TSXV: IOM; OTC: ARHH), a company focused on providing surgeons with intraoperative neuromonitoring services, reported Revenue of negative $10.8 million, attributed to significant write-downs on receivables due to COVID-19 impacts.

At the beginning of this past quarter, Assure Holdings experienced a 70% decline in the number of procedures performed as most elective procedures were postponed due to the pandemic, with expectations for rescheduling of procedures by the end of this year.

Last month, Assure Holdings announced a partnership with the largest commercial health insurer in the state of Michigan, which will allow Assure Holdings to provide services as an in-network healthcare provider in Michigan.

HealthTech Industry

As the pandemic facilitates the adoption of technology across various healthcare services, the HealthTech industry is growing rapidly with new companies, products, and innovations.

According to VynZ Research, the global digital health market was valued at $111 billion last year and is expected to reach $510 billion by 2025, growing at a CAGR of 29% between 2020 and 2025.

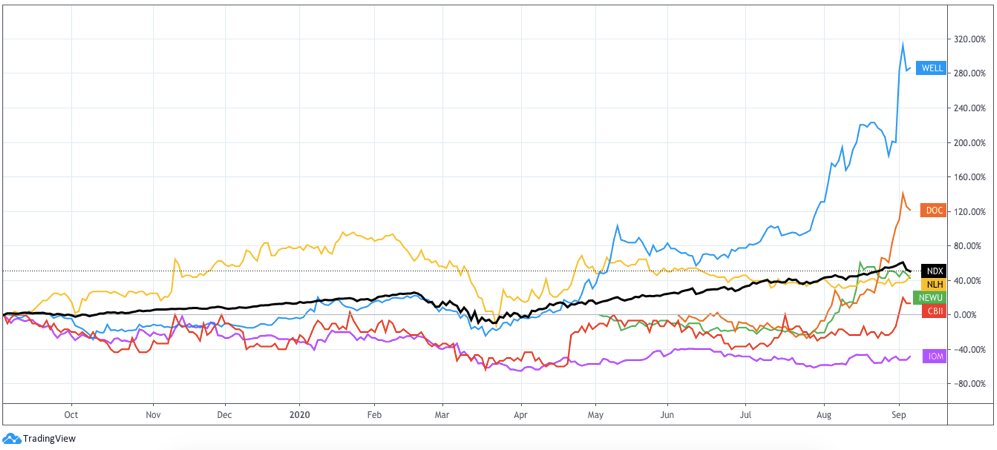

CHART 1: NASDAQ 100 (black) vs CBII (red), DOC (orange), NEWU (green), NLH (yellow), IOM (purple), and WELL (blue) – Past Year Stock Performance

Last quarter’s eResearch HealthTech update article: