eResearch | Yesterday, Xpeng Motors (NYSE: XPEV), a China-based Electric Vehicle (“EV”) manufacturer, started trading on the New York Stock Exchange (“NYSE”) after announcing an increase in funding to its Initial Public Offering (“IPO”) by more than 33% to $1.5 billion in capital, providing a valuation of approximately $11 billion.

This IPO is the third major U.S. listing made by a Chinese EV company in the past two years, following Li Auto (NASDAQ: LI), who listed on the NASDAQ exchange last month, and NIO (NYSE: NIO), who listed on the NYSE in 2018.

The EV industry recently became a large focus for investors as manufacturers such as Tesla (NASDAQ: TSLA) experienced significant share price appreciation amid the pandemic.

Xpeng Motors

Xpeng, also known as Xiaopeng Motors, is an EV manufacturer focused on building “smart” EVs, which leverages XPILOT, its autonomous driving technology, and Xmart OS, its in-house intelligent operating system. Xpeng’s EVs are also competitively priced at a base starting price of around $30,000.

Xpeng, also known as Xiaopeng Motors, is an EV manufacturer focused on building “smart” EVs, which leverages XPILOT, its autonomous driving technology, and Xmart OS, its in-house intelligent operating system. Xpeng’s EVs are also competitively priced at a base starting price of around $30,000.

Chinese e-commerce leaders, Alibaba Group Holding (HKG:9988) and Xiaomi (HKG: 1910), are among Xpeng’s largest backers in China. Joint bookrunners for the IPO on the NYSE including Bank of America Securities, Credit Suisse Group (SWX: CSGN), and J.P. Morgan Chase (NYSE: JPM).

Xpeng is expected to use the $1.5 billion from the IPO mainly towards R&D, which last year reached $300 million in spending, a third of which was used on intelligent functions such as autonomous driving. In addition, Xpeng plans to use funds towards expanding its sales operations.

The IPO also includes a greenshoe option, which allows Xpeng to issue an additional 15 million shares for a further $224 million in funding, if exercised in the next 30 days from the listing date.

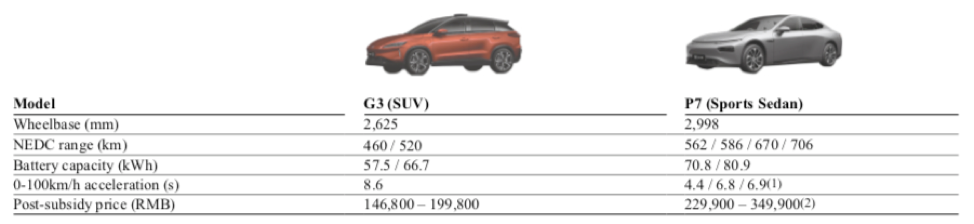

Xpeng currently operates two manufacturing facilities in China for its two EV models, the P7 Sedan (launched last year) and the G3 SUV (launched this year), which in the most recent quarter sold 325 and 2,903 units, respectively. Last month, Xpeng experienced a surge in demand, selling 1,641 P7 Sedans and 810 G3 SUVs.

In comparison, during the month of July, Tesla produced over 12,500 Model 3 vehicles in China and sold over 11,000.

PHOTO 1: Xpeng’s G3 and P7 EV Models

Last year, Xpeng reported Revenue of $329 million, with a Net loss of $522 million. Xpeng currently has Cash and Cash Equivalents of $150 million, Restricted Cash of $118 million, and Long-term Debt of $239 million.

Xpeng’s stock price is currently trading at $22.79 per share, a 52% increase from its listing price of $15 per share.

Li Auto

At the end of last month, Li Auto launched its IPO, raising $1.1 billion and providing an approximate valuation of $10 billion.

At the end of last month, Li Auto launched its IPO, raising $1.1 billion and providing an approximate valuation of $10 billion.

Li Auto, also known as Li Xiang, is a China-based EV manufacturer backed by Meituan Dianping (HKG: 3690) and ByteDance. Li Auto focuses on hybrid Extended Range Electric Vehicles (“EREV”), which include an auxiliary power unit that increases the EVs maximum range.

Li Auto’s stock is currently trading at $17.95 per share, a 56% increase from its listing price of $11.50 per share.

NIO

Last year, NIO was the first major China-based EV manufacturer to list on a U.S. stock exchange, raising $1 billion and providing an approximate valuation of $6.4 billion.

Last year, NIO was the first major China-based EV manufacturer to list on a U.S. stock exchange, raising $1 billion and providing an approximate valuation of $6.4 billion.

NIO is a China-based EV manufacturer backed by Tencent Holdings (HKG;0700), focused on leveraging its NIO Pilot technology to build semi-autonomous EVs.

This year, NIO launched a Battery as a Service (“BaaS”) offering, which allows for users to pay a 25% lower cost for its EVs without the battery, and instead paying a monthly subscription fee for chargeable, swappable, and upgradable batteries.

NIO’s stock price is currently trading at $18.50 per share, a 195% increase from its listing price of $6.26 per share.

China EV Industry

China’s government is driving EV demand by offering subsidies to consumers, which were expected to be phased out by this year. However, China extended the EV subsidies to 2022, with tax exemptions on purchases for up to two years.

According to ReportLinker’s report called “Global Electric and Hybrid Vehicles Driveline Industry”, China’s EV market is expected to reach $68 billion by 2027, a CAGR of 16% from 2020.

Other recent eResearch articles related to the EV industry:

- July 25th: Tesla’s Quarterly Call – EVs, Self-Driving, Insurance, Solar, and a Call Out to Nickel Miners – the call had it all

- July 24th: Electric Motor Optimization Company Exro Technologies Announces New Partnership after Raising C$8M

- July 16th: Amazon-backed Electric Vehicle Manufacturer Rivian Announces $2.5B Investment

- July 6th: Tesla Becomes Most Valuable Auto Company in the World after Impressive Deliveries and Rollout of Tesla Energy’s Autobidder Platform