eResearch | Last week, A&W Revenue Royalties Income Fund (TSX:AW.UN; “the Fund”) reported financial results for a Covid-challenged second quarter of 2020, ending June 14, 2020. The Fund reported its lowest Revenue, Net Income and Earnings per Share (EPS) for the last 10 quarters.

The Fund owns the A&W trademarks used by A&W Food Services Inc. in the A&W restaurants in Canada. The Fund receives a 3% royalty of the gross sales reports by A&W restaurants in Canada. A&W is Canada’s fifth largest restaurant brand by sales and a good barometer of the current state of restaurants in Canada.

The Fund owns the A&W trademarks used by A&W Food Services Inc. in the A&W restaurants in Canada. The Fund receives a 3% royalty of the gross sales reports by A&W restaurants in Canada. A&W is Canada’s fifth largest restaurant brand by sales and a good barometer of the current state of restaurants in Canada.

Due to Covid-19 and health department recommendations, quarterly revenue was impacted as A&W Food Services voluntarily closed all its dining rooms across Canada, with some restaurants providing food services through Drive Thru’s, delivery or mobile orders.

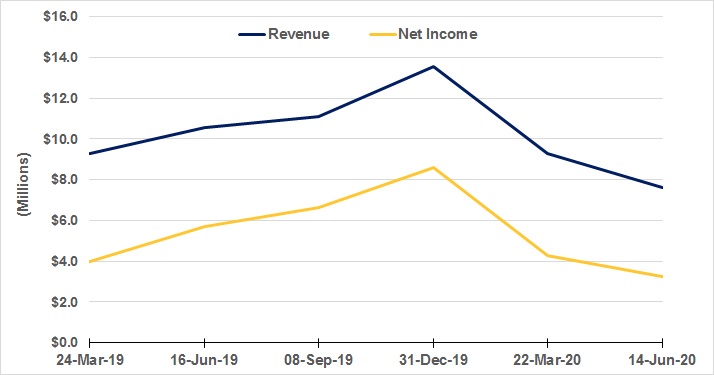

Second Quarter Financial Results

Compared to the previous year, all financial performance indicators were slashed. The Fund reported their lowest Revenue, Net Income and Earnings Per Share (EPS) for the last 10 quarters.

- A&W Food Services reported $253.2 million of gross sales in the royalty pool for the second quarter of 2020 versus $351.8 million in FQ2/2019, a 28% decrease.

- Royalty income was $7.6 million for FQ2/2020 versus $10.6 million in FQ2/2019.

- For FQ2/2020, same-store sales growth was down 31.6%.

- Net income for FQ2/2020 decreased 43.9% to $4.2 million from $7.6 million in FQ2/2019.

- Year-to-date sales in the royalty pool were $561.9 million, a 15% decrease from the sales of $660.7 million for the same period in 2019.

Distributions:

- Two monthly distributions totaling $0.318 were declared YTD in 2020 versus five monthly distribution totaling $0.745 in 2019 during the same period.

- There were no monthly distributions in FQ2/2020 due to COVID 19. The Fund decided to suspend its monthly distribution to preserve the liquidity until sales improved. The repayment of the deferred royalties plus interest will take place December 31, 2021 at latest.

CHART 1: A&W Revenue Royalties Income Fund – Quarterly Revenue

COVID-19

The Global Pandemic adversely impacted the hospitality industry. In order to slow the spread of the virus, the Canadian government ordered restaurants to close down mid-March 2020. The recommendations of health authorities also put significant restrictions on food service operations as restaurant daily traffic significantly decreased compared to the previous year.

As a result, A&W Food Services voluntarily closed all its dining rooms across Canada. On March 1, 2020, a total of 230 A&W restaurants out of the royalty pool of 971 were closed.

As the crisis eased, restaurants began to re-open and by June 14 only 109 restaurants in the royalty pool were closed and by July 22, only 21 restaurants remained closed.

Although Drive Thru services, delivery and mobile orders for pick up remained open, the closing of restaurants and dining rooms is the main reason for the notable decline in the company’s financial performance.

As expressed by the Fund Chairman, John McLernon: “This is a difficult time for Canada, our communities, our guests, franchisees and the staff who work in the restaurants. We therefore believe it is appropriate, and in the long-term best interests of the Fund and its unitholders, to pause distributions until we have much greater clarity around the sales levels in the restaurants.”

Furthermore, to ensure the continuity of the businesses and support the entire A&W eco-system, additional liquidity was required and on April 14, A&W Food Services announced a $10 million equity investment by its shareholders.

Mitigate the impact of COVID-19

The Canadian authorities are now easing restrictions on restaurants operations. They also announced important programs to help support the restaurant industry.

Susan D. Senecal, President and CEO of A&W Food Services and CEO of the A&W Revenue Royalties Income Fund is very optimistic about A&W’s ability to rebound from the impact of COVID 19.

“The A&W brand is one of the strongest in Canada and is well positioned to both rebound strongly and return to its record pace of growth. All enterprises in Canada are navigating very difficult challenges as they seek to ensure the long-term health and success of those businesses, for all stakeholders (…) A&W has consistently been one of the fastest growing and best performing restaurant chains in Canada. A&W Food Services and our franchisees are working collaboratively to position the business for this kind of growth once the current pandemic crisis is resolved, whether in 3 months, 6 months or 24 months”

Strategic initiatives such as repositioning and differentiating, delivering great food and a better customer experience will help the Company build customer loyalty, enhance their long-term financial performance and ultimately serve as a launching pad for strong results and improved market share in a very competitive Quick Service Restaurant sector.

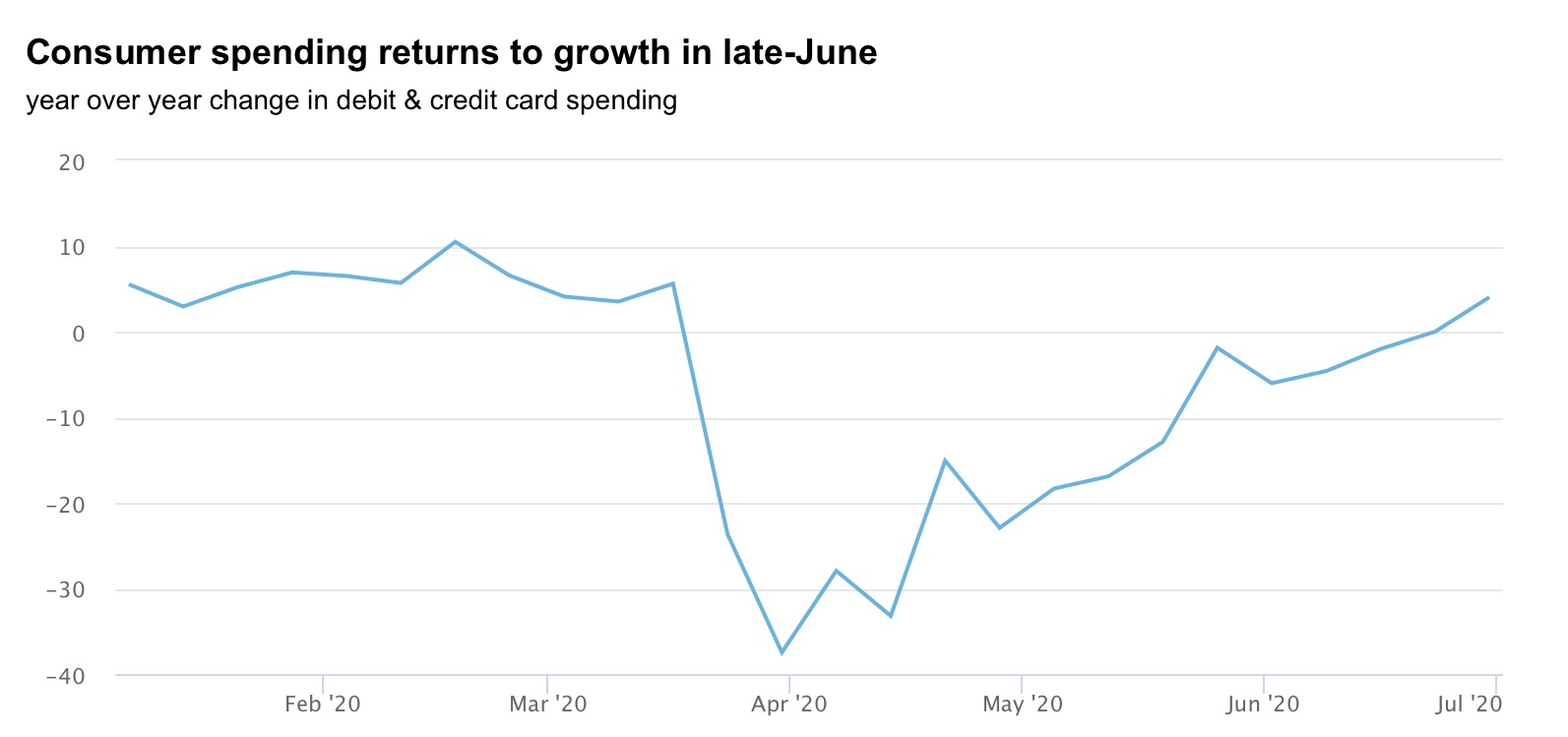

CHART 2: RBC’s COVID Consumer Spending Tracker

Consumer Spending

Since late June, consumer spending never ceased to climb and has been on an upward trend since April. According to RBC’s COVID Consumer Spending Tracker published on July 13, 2020 – and for the first time since the lockdown – consumer spending turned positive compared to levels during the last week of June 2019. Discretionary spending – on dining, shopping, household goods and more – saw the largest boost.

If the current trend continues, the A&W Revenue Royalties Income Fund is on the path to achieve growth (higher same store sales) and an improved third quarter.

Growth in the Fund is achieved two ways:

- Increasing the same store sales of the restaurants in the royalty pool

- Adding new restaurants to the Pool

To further its growth strategy, A&W Food Services had already opened 6 new restaurants in 2020 and has another 23 new restaurants under construction.

A&W Revenue Royalties Income Fund

A&W Revenue Royalties Income Fund (TSX:AW.UN) is a closed investment fund. Founded in 2001, the Fund is a limited purpose trust that invests in A&W Trademarks Inc. and owns the A&W trademarks used in the A&W Quick Service Restaurant business in Canada, licensed by A&W Food Services.

The Fund earns income through its ownership interests in A&W Trademarks. A&W Food Services pays a royalty equivalent to 3% of the gross sales reported by A&W restaurants in the royalty pool.

A&W Food Services is a privately-owned firm that franchises A&W Quick Service Restaurants across Canada. Headquartered in North Vancouver, BC, and mostly famous for its Root Beer, A&W is the second largest Fast Food Restaurant in Canada, after McDonalds.

//