eResearch | On July 8, Goodfood Market Corp. (TSX: FOOD) released FQ3/2020 results that came in strong with Revenue of C$86.6 million, C$4.8 million higher than the Analysts’ consensus estimate of C$81.8 million, and C$0.05 of Earnings, C$0.10 higher than the Analysts’ consensus estimate of a loss of C$0.05. The stock price reacted positively and was up almost 6% on the day and closed over C$6.00.

$35 Million Bought Deal Financing

$35 Million Bought Deal Financing

Buoyed by the financial results, on July 15, Goodfood announced a C$35 million bought deal financing at a price of C$6.05 per share. A syndicate of underwriters agreed to purchase 4.135 million shares from the Company and 1.653 million shares from existing shareholders including Jonathan Ferrari, Chairman and Chief Executive Officer, and Neil Cuggy, President and Chief Operating Officer. The total deal size, with the potential over-allotment, will be over C$40 million. After the announcement, during the next trading day, the stock price fell by 4.5%.

Goodfood is a meal kit provider and online grocery company based in Montreal, Quebec. The Company’s main production facilities are in Quebec, Ontario, Alberta and British Colombia and delivers fresh meal solutions and grocery items to its 272,000 members across Canada.

Founded in 2014 by Neil Cuggy, Jonathan Ferrari and Raffi Krikorian, the Company went public on the TSX in 2017 and was recently added into the S&P/TSX Smallcap Index.

“We are pleased to be included among this select group of Canadian companies as our addition to the S&P/TSX Smallcap Index is a significant milestone. The Index is a key benchmark measure for the Canadian small cap equity markets and our inclusion among its constituents is a testament to the track record of strong capital markets and financial performance we have delivered,” said Jonathan Ferrari, Chief Executive Officer of Goodfood.

FQ3/2020: A Quarter of Exceptional Results

Goodfood surpassed Analysts’ revenue growth and profitability expectations. For the first time, since its inception in 2014, the Company reported positive Net Income and positive EBITDA.

Commenting on the Company’s Third Quarter results, CEO Jonathan Ferrari said, “This was the most challenging and most rewarding quarter in our history”.

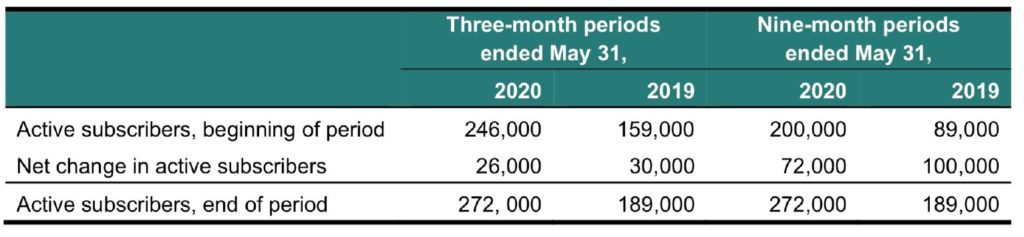

As of May 31, 2020, active subscribers totaled 272,000, up 26,000 in the quarter and an increase of 83,000 or 44% from FQ3/2019. In addition to having more clients, subscribers ordered larger baskets of goods, and this increase contributed to the strong financial performance of the Company during the quarter.

TABLE 1: Active Subscribers

Financial Performance Highlights in FQ3/2020 included:

- Revenues increased 74% to $86.6 million compared to $36.7 million in FQ3/2019.

- For the first time in the Company’s history, Goodfood reported positive net income and EBITDA in a quarter.

- Net income was $2.8 million, representing an increase of $6.4 million from FQ3/2019, and earnings per share of $0.05.

- Adjusted EBITDA reached $6.0 million in the quarter and EBITDA Margin was 6.9%, an improvement of 11.7% from FQ3/2019.

- Gross Margin reached 28.8%, an improvement of 0.5% and Gross Profit reached $24.9 million, an increase of $10.8 million, or 77% from the same quarter last year.

- At the end of the quarter, the Cash, Cash Equivalents and Restricted Cash position of the Company was $80.5 million.

COVID-19

The COVID-19 pandemic has had an impact on Goodfood’s overall business and operations. As an essential service in Canada, the Company continued to operate throughout the pandemic and experienced an acceleration of growth in demand, increased subscriber growth, number of orders and average order values, which jointly positively impacted revenue.

The pandemic fueled a sharp growth in online shopping in Canada. Canadians embraced a new way of shopping for groceries, Goodfood presented as an alternative to traditional grocery supermarkets.

The demand for Goodfood items exploded, particularly for private label grocery products. The Company offers everyday grocery essentials with exclusive prices, including extra virgin olive oil, sea salt, a variety of premium proteins, peanut butter, tea, appetizers and more.

The global pandemic however brought operational and supply chain challenges that impacted margins: social distancing and sanitizing costs negatively impacted gross margin.

Going Forward

Jonathan Ferrari expects lower results for FQ4/2020 but remains very optimistic about the future of the company.

“With the loosening of social distancing, order rate and average order size are coming back to their normal size”, admitted Jonathan Ferrari on the Company’s conference call.

He also emphasized on Goodfood’s seasonality pattern as revenues typically decrease every fiscal fourth quarter, which includes the months of June, July and August. With summer months, Canadians spend more time outdoors and usually order fewer groceries and meal kits online.

The main strategy is to further expand the private label grocery high margin products across Canada to increase online sales. The Company offers everyday grocery essentials with exclusive prices, including extra virgin olive oil, sea salt, a variety of premium proteins, peanut butter, tea, appetizers and more. Now with 300 exclusive private label grocery items, the offering has already doubled in the last 3 months.

In June, the Company signed a lease for its second fulfilment centre in the Greater Toronto Area. The new 200,000 square-foot facility will be an online grocery delivery centre and is expected to be operational in 2021, creating over 2,000 jobs once fully active.

The Retail Grocery Industry is going through a metamorphosis as customer preferences are moving towards buying groceries online and the demand will remain strong even after the pandemic eases. As Goodfood’s CEO expects most retailers to invest in their online presence, he emphasizes the importance of building on a differentiating strategy that will provide the Company a unique piece of the market.

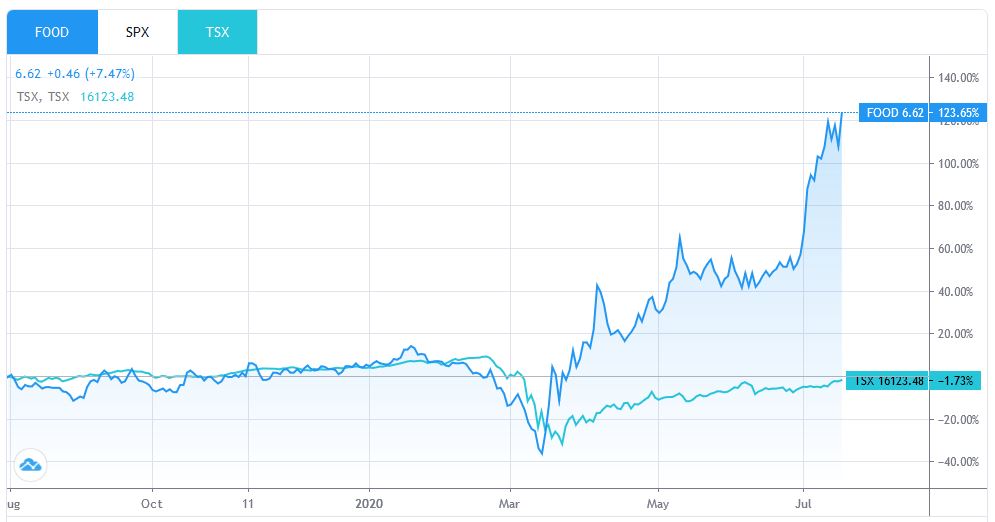

CHART 1: Goodfood (1 year stock chart) up 124% vs TSX down 2%