eResearch is pleased to publish an update Equity Research Report on Peak Positioning Technologies Inc. (CNSX:PKK) pertaining to PKK’s recent release of its Q1/2020 financial statements.

You can download our 14-page Update Report by clicking on the following link: Peak Positioning’s Q1/2020 Update Report

//

Peak Positioning (“Peak”) is the parent company of a group of FinTech subsidiaries operating in China’s commercial lending industry.

Peak thereby provides an investment vehicle for North American investors looking to participate in China’s FinTech industry.

Peak’s subsidiaries use technology, analytics, and artificial intelligence to provide loans, help small and medium enterprises obtain loans, help lenders find clients, and also minimize lending risk.

Q1/2020 Financial Highlights

- Peak’s revenue in Q1/2020 was $3.9M compared to $0.9M in Q1/2019. Revenue for Q1 was higher than our estimate of $2.6M, even with the COVID-19 pandemic impacting operations in China. Peak’s revenue benefited late in Q1/2020 from the Company’s lending platforms being used to help distribute government relief funds to SME’s that were affected by the coronavirus.

- In Q1/2020, 70% of the revenue was generated by Peak’s ASDS & ASSC subsidiaries with 30% coming from ASCS and ASFC. Acquired in later 2019, the Jinxiaoer Platform integration was completed in May and we expect the Jinxiaoer subsidiary to start contributing revenue in the second half of Q2/2020 with the full impact to be felt in Q3/2020 and subsequent quarters.

- On June 14, 2020, Peak announced that it has begun the process to have its shares listed for trading on the OTCQB stock exchange in the U.S. Peak believes by upgrading the listing to the OTCQB from the OTC Market’s Pink exchange, the Company will gain access to a new pool of U.S. Investors.

- Model Impact: We expect Peak’s revenue growth to continue now that the health crisis has subsided in China. With the higher revenue in Q1/2020, we have slightly decreased our Q2, Q3 & Q4/2020 revenue estimates to maintain our 2020 revenue estimate of $35.3M.

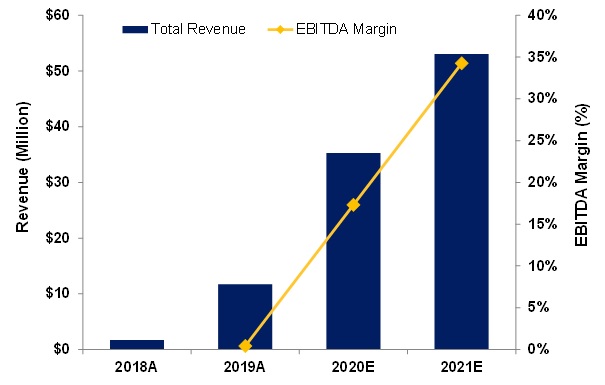

FINANCIAL ANALYSIS & VALUATION:

- We modelled Peak’s revenue for 2020-2022 as a sum of the revenue from the six operating subsidiaries and estimated:

- 2020: Revenue $35.3 million; EBITDA $5.6 million;

- 2021: Revenue $53.1 million; EBITDA $18.1 million;

- 2022: Revenue $58.4 million; EBITDA $22.9 million.

- Using a revenue multiple of 4x 2020 Revenue, an EBITDA multiple of 10x 2020 EBITDA, and a DCF at 10%, we estimate an equal-weighted price per share target of $0.20.

- We are maintaining a Buy rating and one-year price target of $0.20.

//

CHART 1: Revenue and EBITDA Margins – Actuals & Estimates – 2019-2021

You can download our 14-page Q1/2020 Update Report by clicking on the following link: Peak Positioning’s Q1/2020 Update Report

//