eResearch | This week, Baylin Technologies Inc. (TSX: BYL), released its Q1/2020 results. Headquartered in Toronto, Baylin focuses on research, design, development, manufacturing and sales of passive and active radio frequency products and services.

Baylin has three divisions that focus on wireless technology:

- Galtronics Corporation, an antenna design and manufacturing company;

- Advantech Wireless Technologies Inc., a leading wireless broadband communications solution provider; and,

- Alga Microwave, a leading supplier of active and passive radio frequency and microwave components.

See eResearch’s article on Canadian 5G companies that includes a section on Baylin: https://eresearch.com/2020/06/13/eresearch-reports/canadian-5g-public-companies

Q1/2020 Financial Results

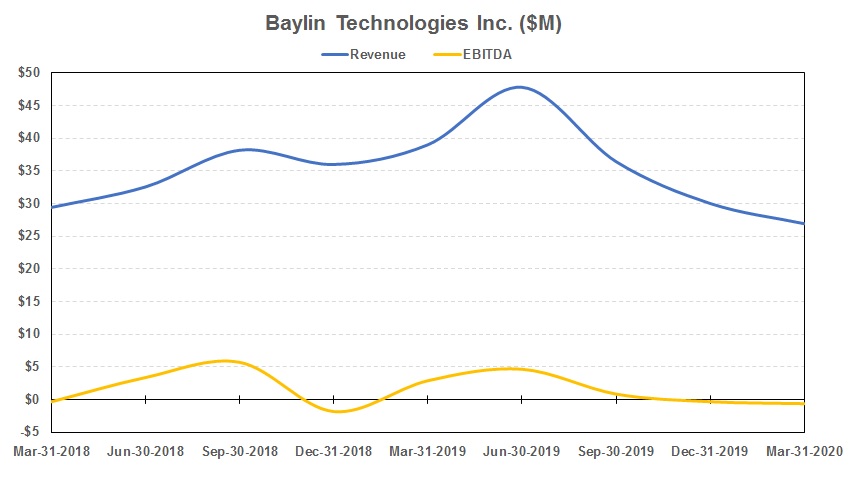

Baylin Technologies announced revenues of $26.9 million in the first quarter of 2020 versus $39.0 million reported in the same quarter of 2019 representing a 31% decrease.

Gross margins went down to 31.9% in Q1/2020 compared with 36.7% from Q1/2019. On the same trend, the Adjusted EBITDA was down to $0.6 million from $4.1 million in the first quarter of 2019.

According to the Company, the downward trend was explained by two main events: (1) several “one-off” projects from a major customer in the first quarter of 2019 that did not repeat in Q1/2020; (2) the COVID-19 outbreak that impacted operations.

Due to the pandemic, in February and March there was a shortage in the supply chain in China followed by commercial store lockdowns that lowered consumer demand in Europe and North America. Reduced demand was also a reason for Satcom (satellite communication) to post lower revenue, which was slightly offset by emergency services and military customers.

Additionally, delayed shipments in China caused by the extension of the Lunar New Year holiday, negatively hit revenue from wireless infrastructure and embedded antenna’s division.

Although operating expenses were a little lower, there was a ban on layoffs during the re-start period after the Lunar New Year holiday. This layoff ban caused a 4-week-labor-variance, which inflated labor expenses relative to sales volumes and negatively impacted EBITDA

Due to capital expenditures, debt servicing and cash taxes, net cash went down to $1.5 million from $3.1 million.

CHART 1: Baylin’s Revenue and EBITDA by Quarter

COVID-19 and 2020 Outlook

According to the Company, all its subsidiaries remained open throughout the entire period to date.

Baylin also stated there are no reported cases of COVID-19 among its employees. To attenuate the financial impact, the Company filed for financial relief programs from the governments of the United States, Canada, and China. The financial relief is already in place.

Moreover, since March 31, RBC and HSBC Bank Canada waived compliance relative to the financial covenants of a $20 million credit agreement. They gave the Company an option to defer the scheduled principal repayments on the term loan on June 30, 2020 and September 30, 2020.

“We appreciate the flexibility and support shown by our lenders”, stated Michael Wolfe, Baylin’s Chief Financial Officer. “This has been an unusual time, and their continued willingness to work with us cooperatively as we navigate our way through the uncertainty brought about by the COVID-19 pandemic demonstrates the strength of our relationship”, added Mr. Wolfe.

Baylin has seen an uptick in sales orders and expects a robust second half. Pent-up demand in the mobile business could support better revenues for the next quarters when compared to last year. Baylin recently announced it secured purchase orders and supply agreements totaling $11 million. Additionally, expense reductions implemented last year and in March 2020 are expected to improve profitability.

“While we expect continued challenges in the months ahead, we are optimistic that our financial results in the second half of 2020 will positively reflect the actions we have taken and the significant efforts we have made over the last three quarters”, said Mr. Dewey, President and Chief Executive Officer.

//