eResearch | As businesses become more digital and data driven, especially due to the COVID-19 self-isolation enforcements, cloud offerings such as Infrastructure as a Service (IaaS) and Platform as a Service (PaaS) are becoming a necessity for all businesses of all sizes to grow and scale.

According to Synergy Research, in Q1/2020, the cloud industry reported US$29 billion in spending, a 37% increase year-over-year, due to numerous companies competing to scale cloud infrastructures and operations.

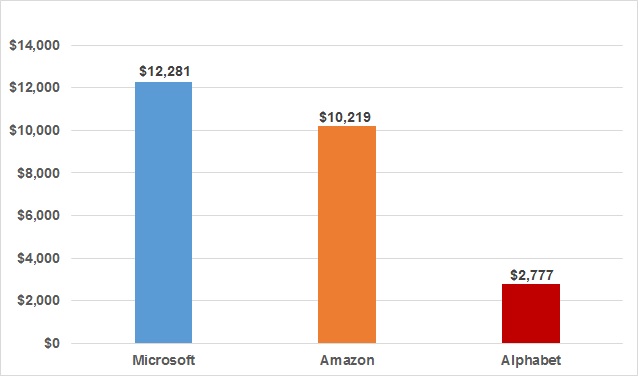

Microsoft Corp. (NASDAQ: MSFT) currently leads the cloud market in revenue as it was a first mover in the cloud race, but Amazon.com, Inc. (NASDAQ: AMZN) is almost neck and neck as the two competitors reported a 33% and a 27% growth in cloud revenues for calendar Q1/2020, respectively.

Microsoft rapidly grew its cloud business through leveraging its pre-existing ecosystem of services and products (Office, SharePoint, Windows/SQL server, etc.) to seamlessly integrate cloud offerings with its Azure web platform.

However, Alphabet Inc. (NASDAQ: GOOGL), who was late to the race with less than half the revenues of Amazon and Microsoft, is accelerating growth at a much faster pace of 52%.

GRAPH 1: Cloud Revenue – Most Recent Quarter (US$M)

According to Gartner, the cloud infrastructure market is expected to grow 17% to US$266 billion in 2020, with its two main segments SaaS and IaaS forecasted to increase 17% to US$116 billion and 24% to $50 billion, respectively.

See below updates on Amazon, Microsoft and Alphabet’s cloud segments in Q1/2020.

Amazon

In Q1/2020, Amazon’s cloud platform, Amazon Web Services (“AWS”), reported US$10.2 billion in revenue, a 33% increase year-over-year, attributed to increased customer usage and cost structure productivity. AWS accounts for 13% of Amazon’s total revenue but 77% of its operating income, illustrating the importance of the AWS on Amazon’s bottom-line.

This past quarter was AWS’s weakest growth in revenue since Amazon started disclosing AWS operations separately in 2015, however, Amazon currently has US$34.1 billion in expected revenue from long-term contracts.

This past quarter was AWS’s weakest growth in revenue since Amazon started disclosing AWS operations separately in 2015, however, Amazon currently has US$34.1 billion in expected revenue from long-term contracts.

This week, Amazon announced a partnership with OpenText, Canada’s largest enterprise software company, to allow AWS clients access to OpenText’s portfolio of Information Management Solutions, which will accelerate customers’ transition to cloud networks.

To support the COVID-19 pandemic, Amazon launched the AWS COVID-19 Data Lake, a platform which consolidates datasets from research institutes such as Johns Hopkins University, and makes it available to anyone combating the pandemic.

Amazon Cloud Financial Highlights Q1/2020

- Revenue of US$10.2 billion, a 33% increase year-over-year, which include US$3.4 billion in unearned revenue with US$1.8 billion remaining.

- Operating Expenses of US$7.1 billion, a 31% increase year-over-year.

- Operating Income of US$3.1 billion, a 38% increase year-over-year.

- Cash Capital Expenditures for AWS of US$5.4 billion.

Microsoft

In FQ3/2020, Microsoft’s cloud platform, Intelligent Cloud, reported US$12.3 billion in revenue, a 27% increase year-over-year, mainly due to its Azure platform growing revenue by 59% through increased IaaS and PaaS sales. Intelligent Cloud accounts for 35% of Microsoft’s total revenue and operating income.

Microsoft’s growth rate for its Azure platform is much lower than the 67% average growth rate during the past five quarters, which may be due to the effects of increased competition and as the initial influx of Office 365 clients adopting Azure dissipates.

Last month, Microsoft announced a multi-year partnership with the National Basketball Association (“NBA”) to become its official cloud and artificial intelligence services provider, in which the NBA will use Microsoft Azure as its platform to broadcast games.

Microsoft reported minimal impacts to its cloud business from the COVID-19 pandemic, with cloud usage increasing for its Azure clients, especially for the Microsoft Teams conferencing platform, which was forced to lift restrictions on subscription limits due to high volumes of new customers. For more information about the video conferencing industry and Microsoft Teams, please read our article “Verizon Acquires Video Conferencing Platform BlueJeans Network”.

Microsoft Cloud Financial Highlights FQ3/2020

- Revenue of US$12.3 billion, a 27% increase year-over-year, with US$12.9 billion in unearned revenue currently held on the balance sheet.

- Operating Expenses of US$7.7 billion, a 20% increase year-over-year.

- Operating Income of US$4.6 billion, a 42% increase year-over-year.

- Capital Expenses of US$3.9 billion.

Alphabet

In Q1/2020, Alphabet’s cloud platform, Google Cloud, reported US$2.8 billion in revenue, a 52% increase year-over-year, driven by continued growth in its Google Cloud Platform and G Suite productivity tools. Intelligent Cloud accounts for 7% of Alphabet’s total revenue.

Last year, Thomas Kurian took the lead as Google Cloud’s CEO with plans to triple its salesforce, acquire synergistic companies, and build partnerships. Shortly after the change in leadership, Google Cloud announced a US$2.6 billion acquisition of Looker Data Sciences, a data analytics company which will allow Google Cloud’s customers to manage and visualize data.

Last year, Thomas Kurian took the lead as Google Cloud’s CEO with plans to triple its salesforce, acquire synergistic companies, and build partnerships. Shortly after the change in leadership, Google Cloud announced a US$2.6 billion acquisition of Looker Data Sciences, a data analytics company which will allow Google Cloud’s customers to manage and visualize data.

In April, Google Cloud announced a partnership with HCA Healthcare (NYSE: HCA), a leading healthcare provider in the U.S., to launch the COVID-19 Response Portal, an open data platform used to aggregate and disseminate data on ICU bed and ventilator utilization, testing results, and total number of patient visits to hospitals in the U.S.

Alphabet only started breaking out its cloud operations on its financial statements last quarter, resulting in limited data for its Google Cloud segment.

Alphabet Cloud Financial Highlights Q1/2020

- Revenue of US$2.8 billion, a 52% increase year-over-year, with US$12.8 billion in unearned revenue currently held on the balance sheet.

- Capital Expenses of US$6 billion.

//

Other companies in the Cloud industry include Alibaba, IBM and Oracle. For an overview of the Cloud industry, please read our previous article “Look to the Cloud to Add Tech to Diversify Your Portfolio”.

//