eResearch is pleased to publish our initial report on Peak Positioning Technologies Inc. (CSE:PKK). You can download the full 42-page report by clicking here: eR-Peak_PKK-IR-2020_03_04_FINAL

We are Initiating Coverage on Peak Positioning with a Buy rating and one-year price target of C$0.20/share.

![]() //

//

COMPANY DESCRIPTION:

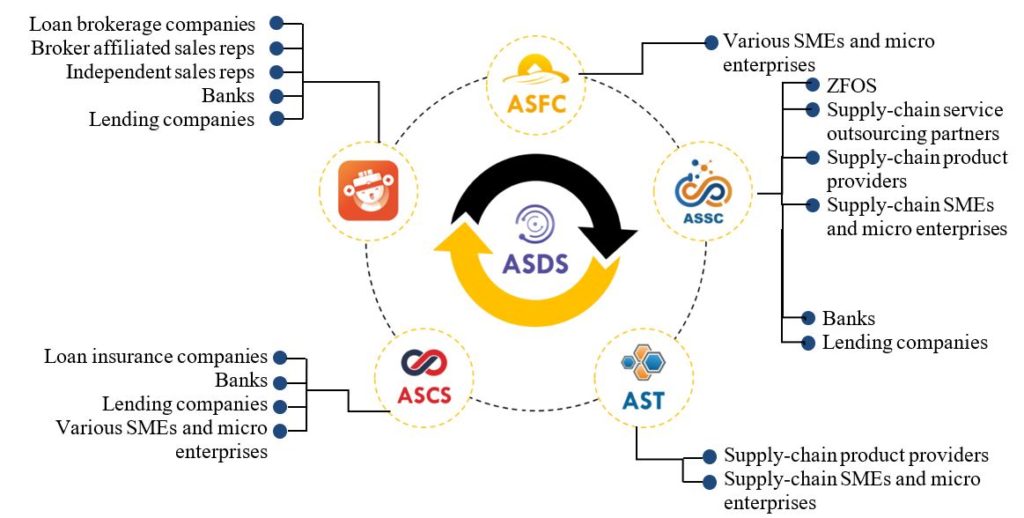

Peak Positioning Technologies Inc. (“Peak” or “the Company”) is the parent company of a group of financial technology (“FinTech”) subsidiaries operating in China’s commercial lending industry. Peak thereby provides an investment vehicle for North American investors looking to participate in China’s FinTech industry. In China, Peak’s subsidiaries use technology, analytics, and artificial intelligence (“AI”) to provide loans, help small and medium enterprises (“SMEs”) obtain loans, help lenders find clients, and also minimize lending risk. Peak accomplishes this through an ecosystem of lenders, borrowers, loan brokers, and other participants that have come together around its Cubeler Lending Hub platform to improve the efficiency and transparency of loan generation.

INVESTMENT HIGHLIGHTS:

- Over the past three years, Peak has created and acquired six operating subsidiaries in China focusing on FinTech solutions, primarily in the commercial credit industry. Peak licensed the Cubeler Lending Hub platform to offer credit-matching services between businesses (borrowers) and financial institutions (lenders) that automates various aspects of transactions, including financial due diligence and qualification for borrowers, making it faster and easier for a Chinese SME to obtain credit and reduces the risk for corporate lenders.

- In Q2/2019, Peak created a new joint venture (“JV”) subsidiary with Jiangsu Zhongpu Financial Outsourcing Service (“ZFOS”) to help address specific financial needs of supply-chain participants. In less than one month of service, the new subsidiary accounted for 20% of Peak’s revenue in Q2/2019.

- In Q4/2019, Peak acquired the Jinxiaoer loan brokerage platform, which had over 40,000 registered loan sales reps in 2018 who submitted loan requests totalling over $3 billion to the platform that year. Peak plans to integrate Jinxiaoer to its Cubeler Lending Hub platform, driving transactions to Cubeler while ensuring a higher probability that loan requests submitted through Jinxiaoer are quickly matched to lenders.

FINANCIAL ANALYSIS & VALUATION:

- We modelled Peak’s revenue for 2019-2021 as a sum of the revenue from the six operating subsidiaries and estimated:

- 2019: Revenue $12.1 million; EBITDA $0.3 million;

- 2020: Revenue $35.3 million; EBITDA $3.9 million;

- 2021: Revenue $53.1 million; EBITDA $18.8 million.

- Using a revenue multiple of 4x 2020 Revenue, an EBITDA multiple of 10x 2020 EBITDA, and a DCF at 10%, we estimate an equal-weighted price per share target of $0.19.

- We are Initiating Coverage on Peak with a Buy rating and one-year price target of $0.20.

//

You can download the full 42-page report by clicking here: eR-Peak_PKK-IR-2020_03_04_FINAL

//