eResearch | We have created a portfolio of quality dividend-paying stocks with the focus being on providing an attractive income return.

The Dividend-Income Portfolio has a long-term perspective. It comprises essentially a Buy-and-Hold strategy, with minimal trading.

The initial investment will be a total of $500,000. It is intended that each of the stocks in the Portfolio will have an equal weighting.

The initial Portfolio is presented below. We will provide our first report in two weeks time.

| DIVIDEND INCOME PORTFOLIO | As at: | 01-Dec-19 | |||||

| Share Price Information | Inception: | 01-Dec-19 | |||||

| (Nov 30/19 closing prices) | |||||||

| Purchase | Current | First | Second | ||||

| Company | Symbol | Price | Price | Target | Target | ||

| 1 | ChemTrade Logistics Income Fund | CHE.UN | $11.11 | $11.11 | $11.72 | $12.10 | |

| 2 | Emera Inc. | EMA | $54.62 | $54.62 | $56.25 | $57.80 | |

| 3 | Fortis Inc. | FTS | $52.04 | $52.04 | $53.13 | $54.00 | |

| 4 | Inter Pipeline Ltd. | IPL | $22.00 | $22.00 | $22.65 | $23.45 | |

| 5 | Keyera Corp. | KEY | $32.41 | $32.41 | $33.60 | $34.40 | |

| 6 | Pason Systems Inc. | PSI | $12.90 | $12.90 | $14.00 | $14.85 | |

| 7 | Pembina Pipeline Corporation | PPL | $46.38 | $46.38 | $47.65 | $48.45 | |

| 8 | Polaris Infrastructure Inc. | PIF | $11.72 | $11.72 | $12.50 | $13.30 | |

| 9 | Superior Plus Inc. | SPB | $12.57 | $12.57 | $31.25 | $34.38 | |

| 10 | Vermilion Energy Inc. | VET | $19.10 | $19.10 | $20.30 | $21.87 | |

Comparable ETFs that will be used for tracking:

| Current | ||

| Comparable ETFs | Symbol | Price |

| Dividend Aristocrats ETF | CDZ | $28.31 |

| Dividend Growth Split Corp. | DGS | $5.26 |

| iShares Cdn. Dividend ETF | XDV | $25.89 |

| BMO Cdn, Dividend ETF | ZDV | $17.72 |

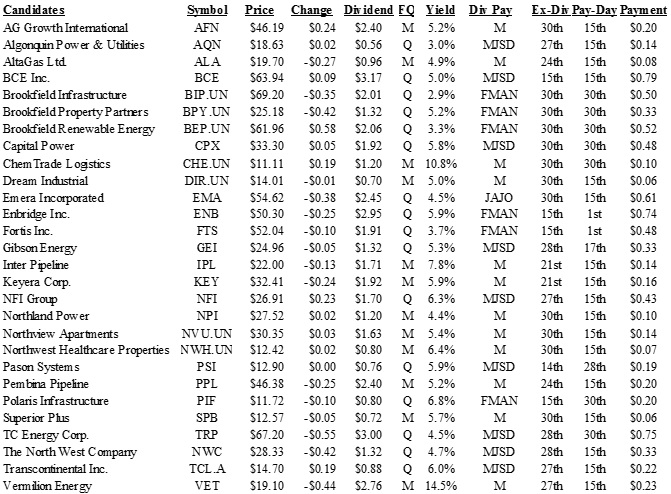

The stocks in the Portfolio were chosen from a broad list of quality income-bearing stocks, as set out in the following table.

You can access this week’s Dividend Portfolio by clicking here: Dividend Portfolio 12-01-2019

//