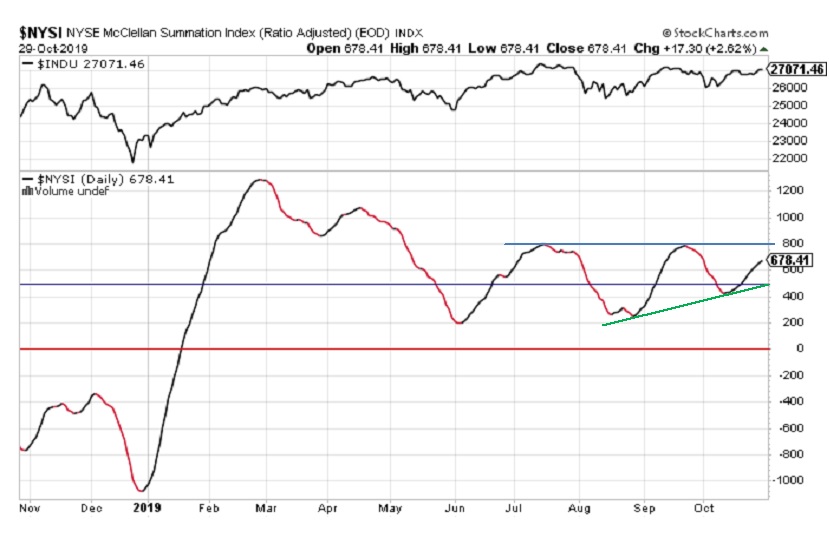

eResearch | The RASI at the close on Tuesday, October 29 is at 678. This is up from 557 a week ago. The Index continues to push higher with the possibility of testing resistance at 800, as shown by the BLUE line on the accompanying chart.

Double Top/Triple Top?

This overhead resistance at 800 is still 18% above its current level. That 800 level also represents a Double Top. If the Index rises to the 800 resistance level and fails to penetrate it and move higher, then this would complete a very bearish Triple Top and the Index would then be expected to move lower, maybe much lower.

Ascending Triangle

Currently, as the Chart shows, the Index is now trending within an ascending triangle, bounded by the Green up-trend line and the Red resistance line. This is a bullish formation usually, so a move in the near future will show if the Index can break through that resistance and continue higher.

Significance of RASI Index for the Market

The significance of the RASI Index is that it has proven to be a good predictor of the future direction of the DJIA. The upper section of the chart depicts the closing prices of the DJIA and, clearly, there is a good correlation between the two indexes. Since the lows of mid to late August, the RASI and the DJIA both moved higher in unison and, since mid-September, they both moved lower together. Now, both Indexes are moving higher, practically in unison.

RASI and DJIA Moving Higher

The DJIA is getting close to testing its Double Top at 27,300-27,400. Currently, it is at 27,071, having started its recent move higher on October 3. RASI bottomed around 440, below the benchmark 500 level, but it charged through 500 in mid-October and has been moving strongly upwards ever since.

//

What is the Ratio-Adjusted Summation Index (RASI)?

- The Ratio-Adjusted Summation Index, RASI, is a market indicator developed by Tom McClellan of McClellan Financial Publications.

- A RASI reading that rises to and reaches a specified level (500 and above) can be a signal that a new market up-trend is starting.

- The +500 level is an important dividing line for the RASI, in terms of giving a go/no-go signal about the new up-trend.

- When a rebound in the RASI occurs, but it falls short of getting up to the 500 level, historically that has meant trouble lies ahead.

- But zooming well above 500 is a sign that there is a lot of strength behind the move, and the higher it goes above 500, the more emphatic the message of strength.

- Conversely, a move from well above 500 down to and below 500 is a signal that the market is weakening and that it should move lower.

//