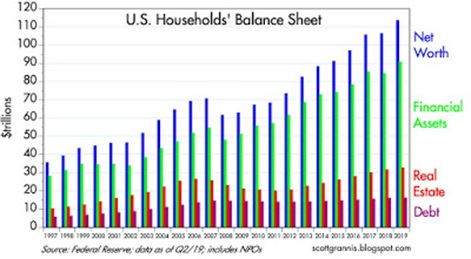

eResearch | The net worth of U.S. households continues to increase while, at the same time, households’ leverage continues to decline. What this means is that U.S. households’ asset values are rising at the same time that risk aversion continues strong. This is a relatively healthy situation.

The amount of U.S. households’ net worth has reached about $113 trillion, as shown in the chart below. Every asset class has shown increases, including savings accounts, stock and bond holdings, real estate, and private businesses.

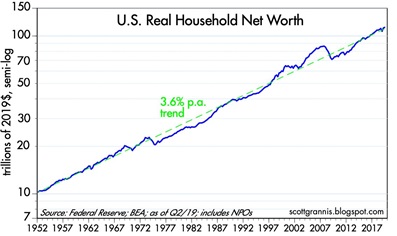

The next chart shows U.S. household net worth adjusted for inflation. The historical trend is about 3.6% per annum, and current annual increases are mirroring that rate.

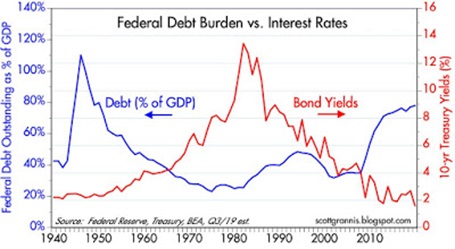

Our final chart shows the trend in U.S. federal debt, which has been rising dramatically. Although higher levels of federal debt are not a good thing, the fact that federal debt interest payments reflect the persistently low level of interest rates means that federal payments are actually declining when considered as a percent of GDP.

Scott Grannis, the Calafia Beach Pundit, concludes his article with the statement that “In short, while federal debt looks bad on the surface, in reality we are far from facing a disastrous situation.”

You can read the entire Calafia Beach Pundit article by clicking: http://scottgrannis.blogspot.com/2019/10/net-worth-and-risk-aversion.html

//