eResearch | The eResearch Recession Barometer for the USA fell last week to 8.0x from the previous week’s 9.0x. With key yield curve ratios rising off near-Inversion levels, the lower Recession Barometer reading means that the prospect of an Economic Recession occurring in the USA lessened considerably last week.

Our Barometer Reading is composed of three metrics: (1) the 10-year/2-year yield curve ratio; (2) an equal-weight average of 3 yield curve ratios, comprising the 20-year/10-year, the 10-year/3-month, and the 5-year/2-year maturity comparisons; and (3) an equal-weight average of 12 yield curve ratios.

In order to trigger the eResearch Count-Down to an Economic Recession in the USA, the 10-year/2-year ratio MUST be inverted, and 2 of 3 metrics (10/2, 3-ratio, and 12-ratio) MUST be inverted, and the Combined Reading MUST be inverted.

Barometer Reading of 8.0x

The 10/2 ratio last week rose slightly from 0.12x to 0.13x. However, the 3-ratio reading rose from 0.01x to 0.11x, and the 12-ratio reading rose from 0.02x to 0.11x. As a result, the Combined Reading rose last week from 0.05x to the current 0.12x, which translates into a Barometer Reading of 8.0x.

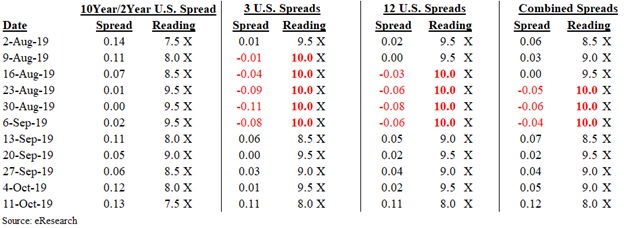

The following table shows the three metrics, with their respective Spreads and Readings, since the beginning of August. The table shows that there was a three-week period when the 3-ratio Spread, the 12-ratio Spread, and the Combined ratio Spread were all negative.

However, in order to trigger our Count-Down initiative, the metric that was missing an inverted ratio was the key 10-year/2-year yield curve ratio. Unless this metric is negative, our Count-Down does not start.

USA-China Trade Negotiations

The progress in the USA-China trade negotiations seems to have been the catalyst for rising yields (falling bond prices) in the final two trading days last week. There needs to be some follow-through with other positive economic and/or political announcements to keep the ratio readings from falling back down again.

In the meantime, the increased Spreads across almost all of the interest rate maturities have taken a lot of pressure off the near-term possibility of the USA going on Recession Watch.

You can read our comprehensive report by clicking the following link: Recession Barometer 2019-10-11