Written by: Jay Yi, MBA; Edited by: Chris Thompson, CFA, MBA, P.Eng

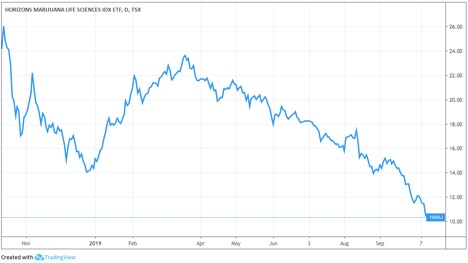

eResearch | Horizons Marijuana Life Sciences ETF (TSX: HMMJ), the first cannabis ETF, has fallen almost 60% in share price this past year due to several factors including (1) missed earnings from constituent companies, (2) vaping-related health concerns, and (3) miscarried government regulations. In addition to investors losing confidence, multiple cannabis deals in 2019 have broken apart as companies fail to execute in an uncertain market environment.

Horizons Marijuana Life Sciences ETF – 1 Year Stock Performance (CAD)

In the H1/2019, acquisitions, mergers, and partnerships saturated the cannabis market, but recently there has been failures in two deals and one IPO, which highlights the challenges the industry is currently facing.

MedMen and PharmaCann LLC Terminate Merger

Last year, Medmen Enterprises Inc. (CSE: MMEN; OTC: MMNFF) announced acquisition of PharmaCann LLC, a private Chicago-based cannabis producer with operations in eight states, for US$682 million.

Last year, Medmen Enterprises Inc. (CSE: MMEN; OTC: MMNFF) announced acquisition of PharmaCann LLC, a private Chicago-based cannabis producer with operations in eight states, for US$682 million.

On October 8, 2019, MedMen and PharmaCann LLC announced a mutual termination of the deal, which came as a surprise after they received approvals from two rounds of requests for information from the U.S. Department of Justice Antitrust Division.

The termination was followed by a statement from MedMen CEO Adam Bierman who said “The cannabis sector has evolved tremendously since we first announced the PharmaCann transaction and based on the current macro environment and future opportunities that exist for our business, we believe it is now in the best interest of our shareholders to deepen, rather than widen, our company’s reach”.

In return for forgiving a US$21 million line of credit to PharmaCann, MedMen received four licenses including production and retail sales licenses in Chicago, Illinois, and Virginia.

Medmen shares fell 9.6% after the announcement due to disappointed investors who were excited to see MedMen become a contender for the largest cannabis company in the world and the scale efficiencies that could have followed.

Aleafia ends 5-year supply agreement with Aphria

In September 2018, Aphria Inc. (TSX:APHA) agreed to supply 175,000kg of cannabis to Aleafia Health Inc.’s (TSX:ALEF) subsidiary, Emblem Corp., for five years starting May 2019, but Aprhia failed to deliver any cannabis for several months after that date.

In September 2018, Aphria Inc. (TSX:APHA) agreed to supply 175,000kg of cannabis to Aleafia Health Inc.’s (TSX:ALEF) subsidiary, Emblem Corp., for five years starting May 2019, but Aprhia failed to deliver any cannabis for several months after that date.

A statement from Aleafia which explained the terminated agreement said “Following Aphria’s failure to meet its supply obligations under the supply agreement, Emblem has exercised its contractual right to terminate the supply agreement in accordance with its terms.”

Aleafia can still claim for damages against Aphria as products that could have been sold for revenue was not delivered, but the two companies are first obligated to negotiate for 30 days’ post-reception of the termination notice, after which Aphria must prepare to defend itself if Aleafia decides to take legal action.

Breath of Life delays IPO

Breath of Life Pharma Ltd., an Israel-based medical cannabis producer who was expecting to list publicly and raise C$150 million on the Toronto Stock Exchange decided to hold off due to bearish market conditions.

Breath of Life Pharma Ltd., an Israel-based medical cannabis producer who was expecting to list publicly and raise C$150 million on the Toronto Stock Exchange decided to hold off due to bearish market conditions.

Various media sources reported that Breath of Life Pharma was concerned about the general market malaise for cannabis company financings and potential impact it could have on their valuation.

As markets have been constantly trending down through the beginning of H2/2019, if Breath of Life attempted to list publicly, it would be difficult selling shares to the public market while keeping its valuation stable.

This is also not good news for the Canadian stock exchanges as they expected more cannabis IPO’s in 2019 and 2020, even after all of the cannabis deals that launched in the past two years.

As uncertainty grows in the cannabis market, it will be interesting to see the impact as the Canadian market legalizes cannabis derivatives, such as edibles and vaporizer oils, next week.

The gloomy state of the stock market in the cannabis sector is making a major impact on capital-intensive deals as several cannabis companies turn strategies from scaling to focusing on organic growth and operations. It will be interesting to see if cannabis companies can move the market by improving bottom lines.

//

Aphria Inc. (TSX: APHA; NYSE: APHA; LSE: 0UI4; DB: 10E)

- Headquartered in Ontario, Canada, Aphria is a Canadian licensed cannabis company that owns Broken Coast Cannabis Inc., which is a globally known cannabis product brand that has won multiple competitions with its strains.

- It currently has two main production facilities, Aphria One and Aphria Diamond, which collectively produces 255,500 kilogram of cannabis per year.

- Aphria is currently trading at C$6.20 with a C$1.5 billion market capitalization.

Aleafia Health Inc. (TSX: ALEF; OTC: ALEAF; DB: ARAH)

- Headquartered in Toronto, Canada, Aleafia is a vertically integrated cannabis producer who owns three licenses for cannabis production and cultivation.

- Aleafia focuses on producing high margin products such as oils, capsules, and sprays, offered to a national network of medical patients which has seen over 60,000 patients to date.

- Aleafia is currently trading at C$0.79 per share with a market capitalization of C$214.8 million.

Medmen Enterprises Inc. (CSE: MMEN; OTC: MMNFF; DB: 0JS)

- Headquartered in California, U.S., MedMen is a multi-state cannabis operator with operations in Arizona, Illinois, California, Nevada, New York, and Florida.

- MedMen operates 19 licensed cannabis facilities and 70 retail locations with over 2 million retail transactions since 2018.

- Medmen is currently trading at C$1.58 per share with a market capitalization of C$805 million.

Breath of Life Pharma Ltd. (private)

- Headquartered in Israel, Breath of Life is a cannabis producer and cannabis product manufacturer focused on the medical market in the EU, Canada, and Australia.

- Breathe of Life was one of the first licensed cannabis producers in Israel and works with medical centers and research facilities to support clinical programs for over 30 indications.

PharmaCann LLC. (private)

- Headquartered in Illinois, U.S., PharmaCann is a multi-state cannabis operator with 13 dispensary locations and three production facilities in Illinois, Maryland, Massachusetts, and New York.

- PharmaCann is vertically integrated and focuses on the medical market with goals to increase sustainable access to cannabis by offering effective, affordable and trusted products.

//