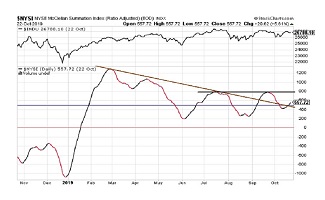

On Tuesday, August 20, 2019, the RASI came in at 280, which continues to be well below “500”, which indicates Negative market expectations.

The Ratio-Adjusted Summation Index, RASI, is a market indicator developed by Tom McClellan of McClellan Financial Publications. A RASI reading that rises to and reaches a specified level (500 and above) can be a signal that a new market up-trend is starting. Conversely, a move from well above 500 down to and below 500 is a signal that the market is weakening and that it should move lower. This is the case now.