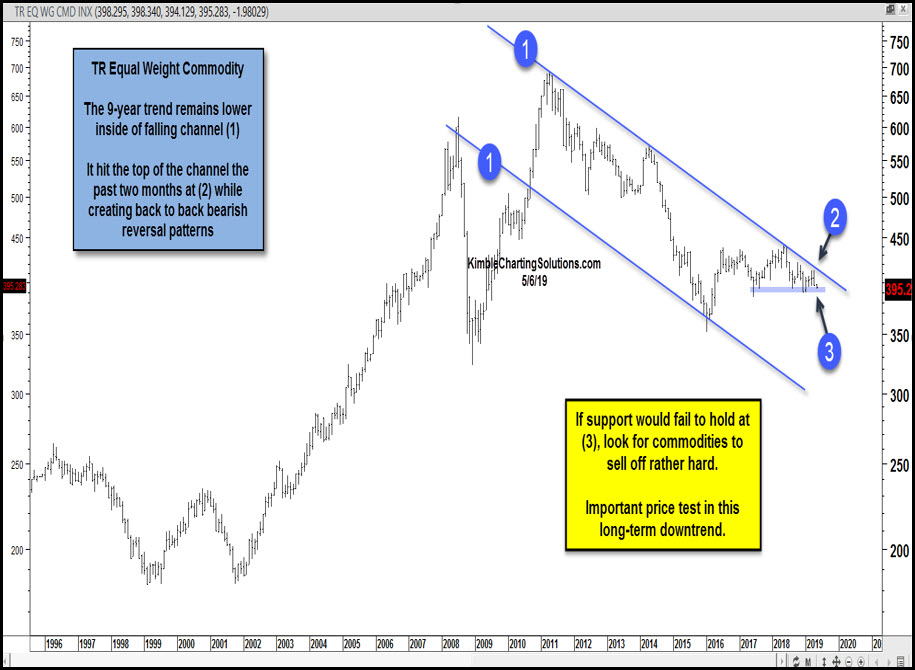

In today’s chart, we look at the state of the current downtrend (1) on the TR Equal Weight Commodity Index.

This broad commodities index is testing both support and resistance at the same time. Price is being squeezed by a wedge pattern made up of 2 year lateral support (3) and the downtrend resistance line (2). To break out of this 9-year falling channel, the commodities index would need to rally past (2). However, should support at (3) break, it would likely mean another sell off in the index (and commodities prices).

Here is the latest article: … … HERE