eResearch is pleased to publish an Industry Report on “Scandium – A Metal for a Green Future; Your Guide to Understanding and Investing in Scandium Companies”.

You can download our 39-page Scandium Industry Report by clicking on the following link: eR-Scandium-Industry-Report-2023-10-18-FINAL

Scandium (Sc) is an important metal with many applications in various industries, particularly in the production of aluminum-scandium (Al-Sc) alloys and solid oxide fuel cells (SOFCs).

Scandium (Sc) is an important metal with many applications in various industries, particularly in the production of aluminum-scandium (Al-Sc) alloys and solid oxide fuel cells (SOFCs).

Sc is also used in ceramics, electronics, lasers, lighting, and radioactive isotopes.

Sc is on the Critical Minerals list for Australia, Canada, the European Union (EU), and the United States (US), but not the United Kingdom (UK).

REPORT HIGHLIGHTS:

- Scandium Uses

- Scandium is a lightweight, soft metal with a high melting point and good electrical and heat conductivity.

- Scandium is alloyed with aluminum (Al-Sc) similar to how niobium is alloyed with steel.

- Scandium increases the strength of aluminum but reduces its weight and provides it with increased flexibility, heat resistance, and corrosion resistance, making it ideal for applications in aerospace, aviation, automotive, defense, and energy transmission.

- Sc-Al alloy powders offer the potential for 3D printing of complex metal structures that are difficult or expensive to produce using traditional fabrication methods.

- Scandium in Solid Oxide Fuel Cells

- Scandium plays an important role in enhancing the performance and efficiency of SOFCs, which are devices that convert chemical energy into electrical energy.

- SOFCs use hydrogen or hydrocarbon fuels and oxygen to produce electricity, making them suitable for various applications, such as power generation and industrial processes.

- Scandium improves SOFC performance by stabilizing zirconia-based electrolyte materials.

- Scandium also lowers SOFC operating temperatures, thus reducing thermal stress, improving start-up times, and extending lifespan.

- Current Supply and Demand

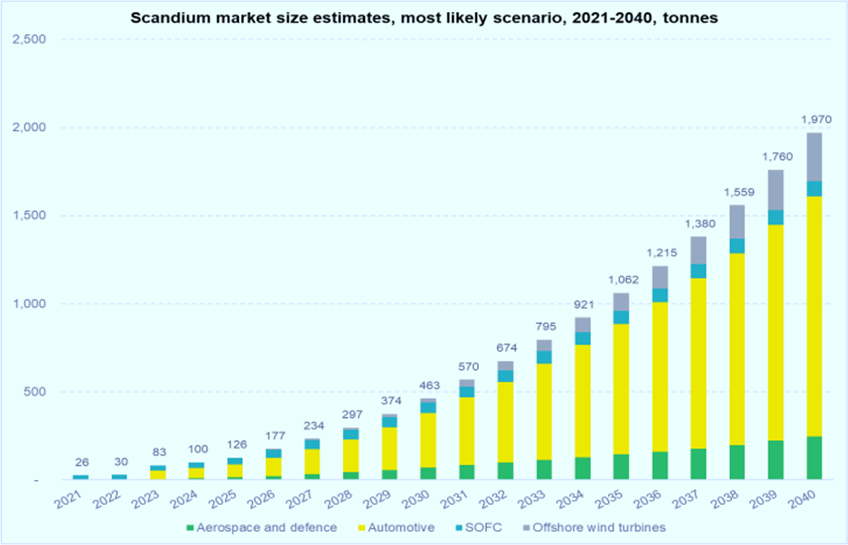

- The current scandium market indicates that demand is being met by supply, with approximately 20 to 30 tonnes in demand for 2022.

- However, if 0.1% of the annual global aluminum production was alloyed with 0.5% scandium, it would result in an annual global scandium demand of 345 tonnes, which is 11x the current demand.

- Current demand forecasts from the Aerospace, Automotive, Defence, SOFC, and Wind Turbine industries could reach almost 500 tonnes by 2030.

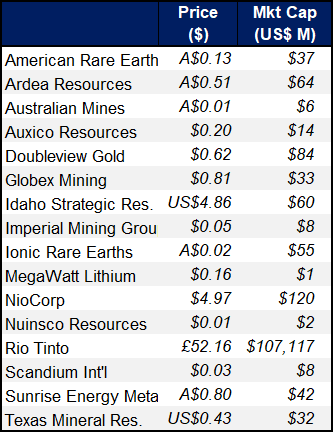

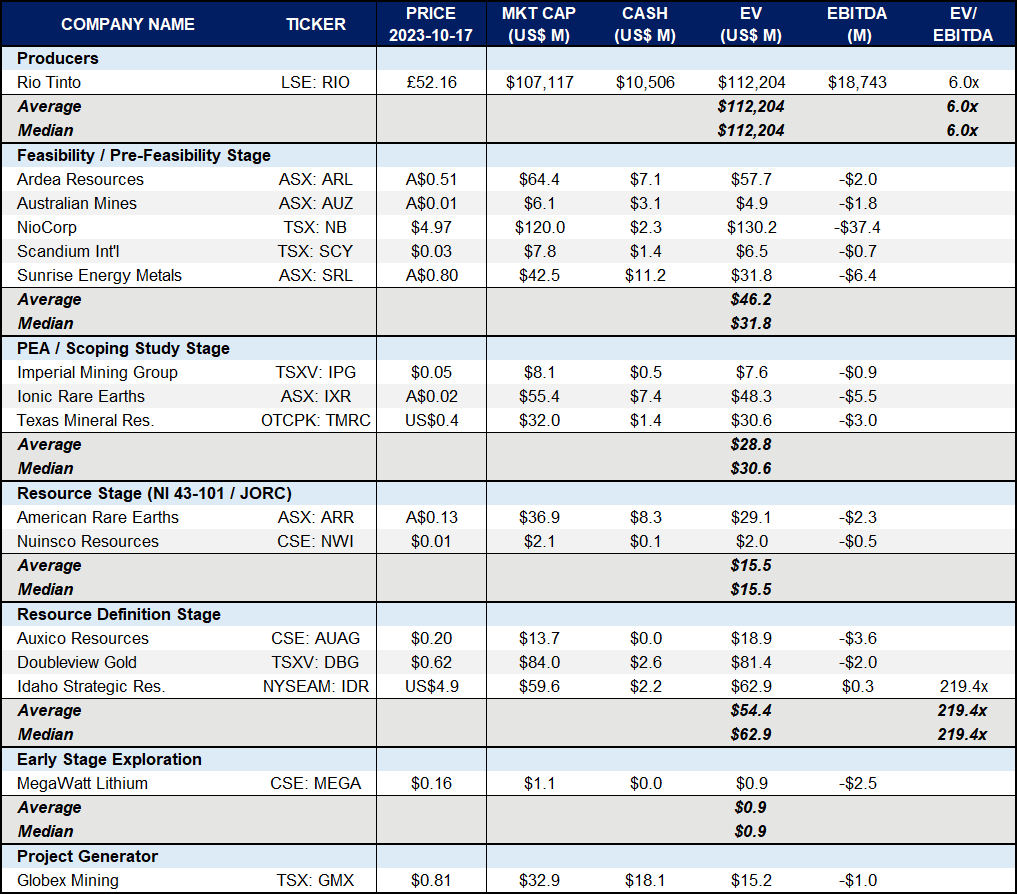

- Companies Reviewed in the Scandium Industry Report

- American Rare Earths, Ardea Resources, Australian Mines, Auxico Resources, Doubleview Gold, Globex Mining, Imperial Mining, Idaho Strategic Resources, Ionic Rare Earths, MegaWatt Lithium, NioCorp, Nuinsco Resources, Platina Resources, Scandium International Mining, Sunrise Energy Metals, and Texas Mineral Resources.

- Company Spotlight – Imperial Mining Group (TSXV: IPG) [Editor’s Note: Now known as Scandium Canada Ltd. (TSXV: SCD)]

- Imperial Mining’s flagship project is the Crater Lake scandium-rare earths property in Quebec, Canada, with the potential to become a low-cost producer of high-purity scandium oxide.

- The Preliminary Economic Assessment (PEA) for Crater Lake estimates a post-tax NPV10% of $1.72 billion and an after-tax IRR of 32.8% over a 25-year mine life.

- Recent optimization efforts have increased Sc recovery to 96% and rare earths recovery to 94% at the leaching stage, with a mine-to-precipitate recovery of 76% for Sc and 60% for rare earths.

- A recent NI 43-101 compliant resource update pegged the total resource at 27.7 million tonnes at an average grade of 271 ppm scandium oxide. Work continues on a Feasibility Study (FS), permitting, design and engineering studies, and offtake agreements.

FIGURE 1: Scandium Comp Table

FIGURE 2: Scandium Demand Scenarios

You can download our 39-page Scandium Industry Report by clicking on the following link: eR-Scandium-Industry-Report-2023-10-18-FINAL

Other eResearch Industry Mining Reports:

- Atlantic Gold Industry Report – The Ultimate Guide to Gold Mining Companies in the Appalachian Gold Belt (2021)

- Cobalt Industry Report(2019)

- Invest Like Eric Sprott (2020)

- Niobium Industry Report – Strategic Metal Beginning to Shine (2020)

- Project Generator Industry Report (2019)

- Vanadium: Powering the Renewable Energy Revolution – Update Report (2023)

Notes: All numbers in CAD unless otherwise stated. The author of this report, and employees, consultants, and family of eResearch may own stock positions in companies mentioned in this article and may have been paid by a company mentioned in the article or research report. eResearch offers no representations or warranties that any of the information contained in this article is accurate or complete. Articles on eresearch.com are provided for general informational purposes only and do not constitute financial, investment, tax, legal, or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this information should consult with a financial advisor. The article may contain “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements are based on the opinions and assumptions of the Company’s management as of the date made. They are inherently susceptible to uncertainty and other factors that could cause actual events/results to differ materially from these forward-looking statements. Additional risks and uncertainties, including those that the Company does not know about now or that it currently deems immaterial, may also adversely affect the Company’s business or any investment therein. Any projections given are principally intended for use as objectives and are not intended, and should not be taken, as assurances that the projected results will be obtained by the Company. The assumptions used may not prove to be accurate and a potential decline in the Company’s financial condition or results of operations may negatively impact the value of its securities. Please read eResearch’s full disclaimer.