eResearch is pleased to publish an update Equity Research Report on Peak Fintech Group Inc. (CSE: PKK; OTCQX: PKKFF) pertaining to Peak’s recent release of its Q3/2020 financial statements.

eResearch is pleased to publish an update Equity Research Report on Peak Fintech Group Inc. (CSE: PKK; OTCQX: PKKFF) pertaining to Peak’s recent release of its Q3/2020 financial statements.

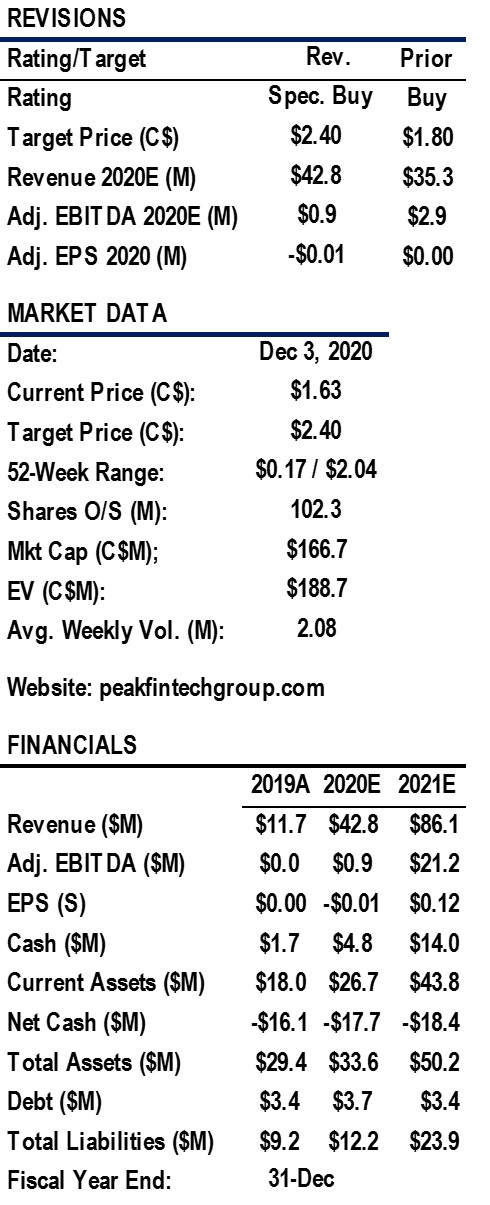

We are increasing our one-year target price to $2.40 from $1.80 and changing the rating to Speculative Buy from Buy.

You can download our 16-page Update Report by clicking on the following link: eR-Peak_PKK-UR-2020_12_04_FINAL

//

Peak Fintech Group is the parent company of a group of financial technology (“FinTech”) subsidiaries operating in China’s commercial lending industry. Peak thereby provides an investment vehicle for North American investors looking to participate in China’s FinTech industry. In China, Peak’s subsidiaries use technology, analytics, and artificial intelligence (“AI”) to provide loans, help small and medium enterprises (“SMEs”) obtain loans, help lenders find clients, and also minimize lending risk. Peak accomplishes this through an ecosystem of lenders, borrowers, loan brokers, and other participants that have come together around its Cubeler Lending Hub platform.

Peak Fintech Group is the parent company of a group of financial technology (“FinTech”) subsidiaries operating in China’s commercial lending industry. Peak thereby provides an investment vehicle for North American investors looking to participate in China’s FinTech industry. In China, Peak’s subsidiaries use technology, analytics, and artificial intelligence (“AI”) to provide loans, help small and medium enterprises (“SMEs”) obtain loans, help lenders find clients, and also minimize lending risk. Peak accomplishes this through an ecosystem of lenders, borrowers, loan brokers, and other participants that have come together around its Cubeler Lending Hub platform.

QUARTERLY HIGHLIGHTS:

QUARTERLY HIGHLIGHTS:

Peak’s revenue in Q3/2020 doubles to $15.1 million compared to $7.3 million in Q2/2020.

- Revenue for the quarter was 35% higher than our estimate of $11.2 million and illustrates the adoption of Peak’s solutions in the marketplace.

- The Company continued to benefit from its lending platforms being used to help distribute government relief funds in China to SMEs that were affected by the coronavirus.

In Q3/2020, 94% of revenue was generated by Peak’s Fintech Platform.

- The Company’s FinTech platform’s revenue was $14.2 million compared with $0.9 million from Financial Services.

Large increase in Outsourcing Services expense hampers positive EBITDA.

- Currently representing almost 89% of sales in Q3/2020, up from 75% in Q2/2020, Peak believes that some of the Outsourcing Services will be brought in-house and Outsourcing Services should reduce to 40-50% of the Sales by the end of 2021.

Model Impacts:

- Due to higher revenue in Q3/2020 than we modeled, we have increased our Q4/2020 and 2021 revenue estimates.

- In addition, we have increased revenue estimates in 2021 and beyond to reflect the new client announcements.

FINANCIAL ANALYSIS & VALUATION:

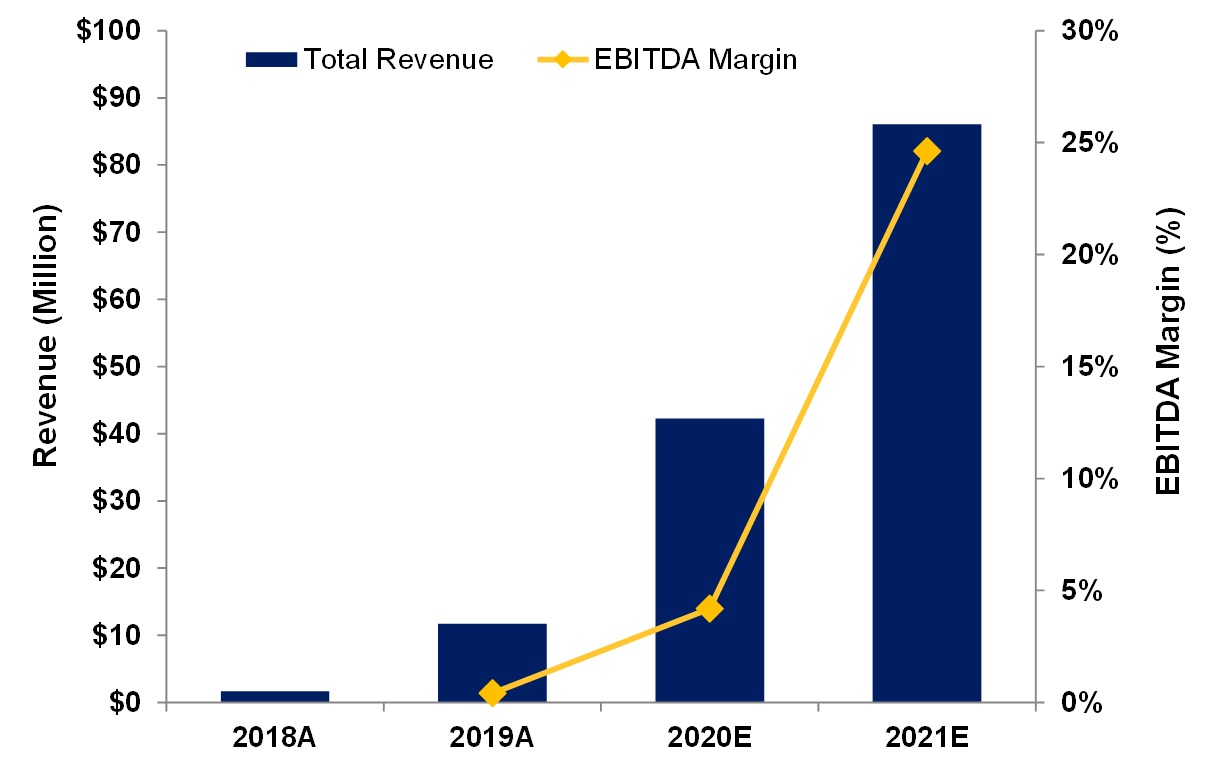

We modelled Peak’s revenue for 2020-2022 as a sum of the revenue from the six operating subsidiaries and estimated:

- 2020: Revenue $42.8 million; EBITDA $0.9 million;

- 2021: Revenue $86.1 million; EBITDA $21.2 million;

- 2022: Revenue $103.6 million; EBITDA $40.3 million.

Using a revenue multiple of 4x Revenue, an EBITDA multiple of 10x EBITDA, and a DCF at 10%, we estimate an equal-weighted price per share target of $2.38.

We are increasing our one-year target price to $2.40 from $1.80 and changing the rating to Speculative Buy from Buy.

//

You can download our 16-page Update Report by clicking on the following link: eR-Peak_PKK-UR-2020_12_04_FINAL

//

CHART 1: Revenue and EBITDA Margins

QUARTERLY HIGHLIGHTS:

QUARTERLY HIGHLIGHTS: