Silver Bullet Mines Corp. (SBMI), a Canada-based silver and copper exploration and development company, owns the Black Diamond Property in Arizona as its principal asset, which contains five past-producing, high-grade silver mines. This includes the Buckeye Silver Mine, with operations currently paused pending the resolution of safety issues, and the operating Mill, which is being used to process third-party material. SBMI also has 100% ownership of the Washington Mine in Idaho which is currently under development.

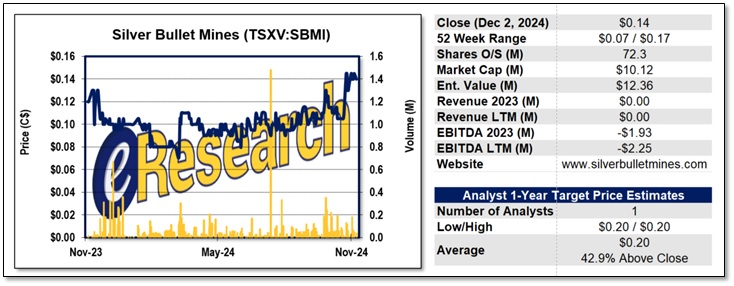

In our research report dated November 8, 2024, we revised our one-year target price on SBMI stock to $0.20 per share, representing a potential upside of about 43% from its current market value of $0.14. Since publishing our report, SBMI has issued three news releases that support our positive outlook for the company’s share price.

More information about SBMI can be found in our most recent research report here: eResearch-SBMI-UR-2024_11_08-FINAL

Update on the Super Champ Property in Arizona

On November 12, SBMI announced the receipt of multi-element assay results from samples taken from concentrate at the Super Champ property in Arizona, which is owned by a third party but is located near the Black Diamond Property. SBMI has an agreement with the Super Champ owner to process the mineralized material in stockpiles and waste dumps as well as possibly do some near-surface bulk samples.

The independent lab analysis showed a head grade of 28.0 ounces (877 grams) per ton of silver, as well as a concentrate grade of 339.6 ounces (10,563 grams) per ton of silver at a recovery rate of 88.2%, an improvement from the previous results released in early October. Included in the results were gold values that assayed 0.52 ounces (16.16 grams) per ton, which the company said has the potential to significantly increase the value of the concentrates. SBMI noted that based on the results from this analysis, it has entered into meaningful negotiations for the sale of the concentrate.

The concentrate was processed at SBMI’s mill in Globe, Arizona. Our model and valuation are based on the company processing 30,000 tons of third-party mineralized material at its mill over the next 12 months, producing about 240,000 ounces of silver with an average grade of 8 ounces per ton (oz/t), well below recent assays, at a 90% recovery rate. Depending on the silver price, production costs, and final grades, this could generate a net revenue of US$15 per ounce for SBMI.

FIGURE 1: Historical Adit at Super Champ in Arizona

Historic Workings Discovered at Super Champ

An additional development from the Super Champ property was announced on November 18, when the company reported the discovery of historic workings, including a shaft, tunnel, and waste piles, during the development of the Super Champ vein structure.

The discovery, which SBMI CEO John Carter called “spectacular,” has become known as the “Tunnel Zone.” Its historic adit, which measures approximately 4 feet wide by 8 feet high and is of unknown depth, was likely mined over a century ago, the company estimates.

SBMI said its field team reported visible silver in the Tunnel Zone and random samples taken from the region recently revealed assays as rich as 1,093.2 ounces (34,002.3 grams) per ton of silver. To gather data about the possible size and grade of the Tunnel Zone, the company continues to carry out a comprehensive sampling program that includes further exposing the vein and collecting grab, chip, and channel samples. Additionally, the Tunnel Zone is still being excavated to determine the possible strike length and vein width.

SBMI believes the Tunnel Zone has the potential to significantly increase the overall head grade of the Super Champ mineralized material or it could be a different high-grade zone that contains both silver and gold. The company further stated that material from this Zone is close to the surface and is expected to be relatively uncomplicated to extract. SBMI said the discovery of previous mining activities increases its confidence in high-grade silver and potential gold production at Super Champ.

FIGURE 2: Contract Miner at the Face of the Washington Mine in Idaho

Update on the Washington Mine in Idaho

On November 22, the company also announced that a contract had been awarded to complete the underground development and bulk sampling at the Washington Mine in Idaho. The Washington Mine is a historic high-grade gold mine, but its silver zones were blocked out and never mined, according to the company.

As SBMI takes the necessary steps to restart operations at the Washington Mine, the company is initially targeting a historic area known as the “Target Zone,” which was previously tested in the 1980s. Hecla Mining processed a bulk sample mined by the former owner from the Target Zone and it assayed 44 oz/t of silver and 0.1 oz/t of gold.

Additionally, SBMI thinks it has found the site of a potential extension of the Target Zone and an additional high-grade silver and gold zone that could be parallel to the Target Zone. Since no drilling has ever been done below the 150-foot level at the mine, the company aims to mine from that level to the surface. According to SBMI, historical testing and sampling suggest that the Target Zone may extend below that 150-foot level and include both high-grade silver and gold.

We expect the Washington Mine to provide a second revenue stream for the company once it is restarted.

Final Thoughts

Thus, these recent positive developments at the Super Champ property and Washington Mine support not only our one-year target price but also our two-year target price of $0.35 a share, which equates to a potential upside of more than 140% from current levels.

More information about SBMI can be found in our most recent research report here: eResearch-SBMI-UR-2024_11_08-FINAL

FIGURE 3: SBMI 1-Year Stock Chart

Notes: All numbers in CAD unless otherwise stated. The author of this report, and employees, consultants, and family of eResearch may own stock positions in companies mentioned in this article and may have been paid by a company mentioned in the article or research report. eResearch offers no representations or warranties that any of the information contained in this article is accurate or complete. Articles on eresearch.com are provided for general informational purposes only and do not constitute financial, investment, tax, legal, or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this information should consult with a financial advisor. The article may contain “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements are based on the opinions and assumptions of the Company’s management as of the date made. They are inherently susceptible to uncertainty and other factors that could cause actual events/results to differ materially from these forward-looking statements. Additional risks and uncertainties, including those that the Company does not know about now or that it currently deems immaterial, may also adversely affect the Company’s business or any investment therein. Any projections given are principally intended for use as objectives and are not intended, and should not be taken, as assurances that the projected results will be obtained by the Company. The assumptions used may not prove to be accurate and a potential decline in the Company’s financial condition or results of operations may negatively impact the value of its securities. Please read eResearch’s full disclaimer.